Answered step by step

Verified Expert Solution

Question

1 Approved Answer

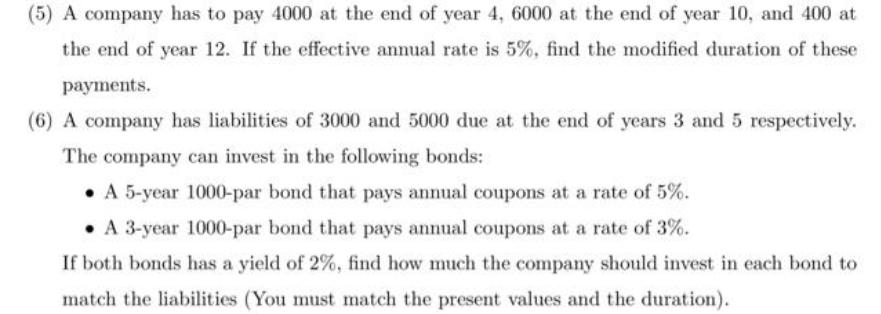

(5) A company has to pay 4000 at the end of year 4, 6000 at the end of year 10, and 400 at the

(5) A company has to pay 4000 at the end of year 4, 6000 at the end of year 10, and 400 at the end of year 12. If the effective annual rate is 5%, find the modified duration of these payments. (6) A company has liabilities of 3000 and 5000 due at the end of years 3 and 5 respectively. The company can invest in the following bonds: . A 5-year 1000-par bond that pays annual coupons at a rate of 5%. A 3-year 1000-par bond that pays annual coupons at a rate of 3%. If both bonds has a yield of 2%, find how much the company should invest in each bond to match the liabilities (You must match the present values and the duration).

Step by Step Solution

★★★★★

3.28 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

5To solve the problem we need to find the present value of each payment at the end of years 4 10 and 12 The present value is the value of a future payment or series of payments discounted at a given i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started