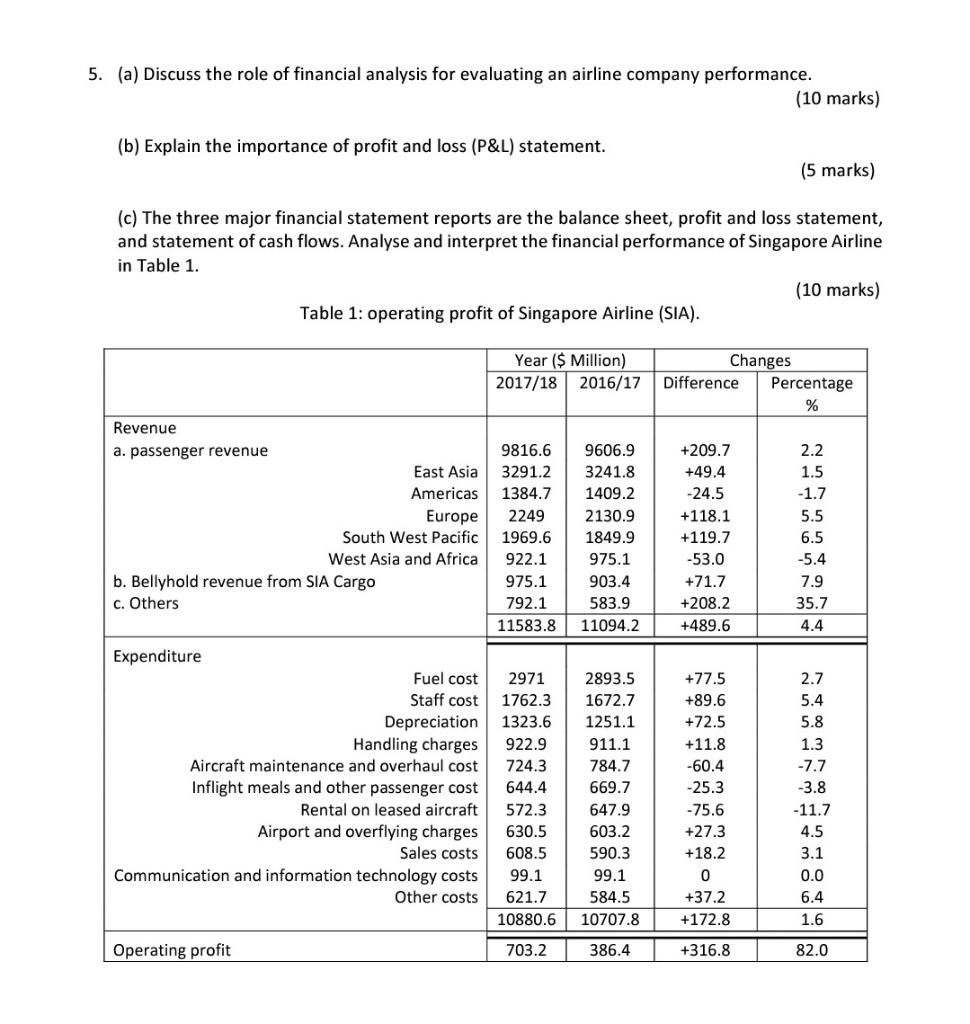

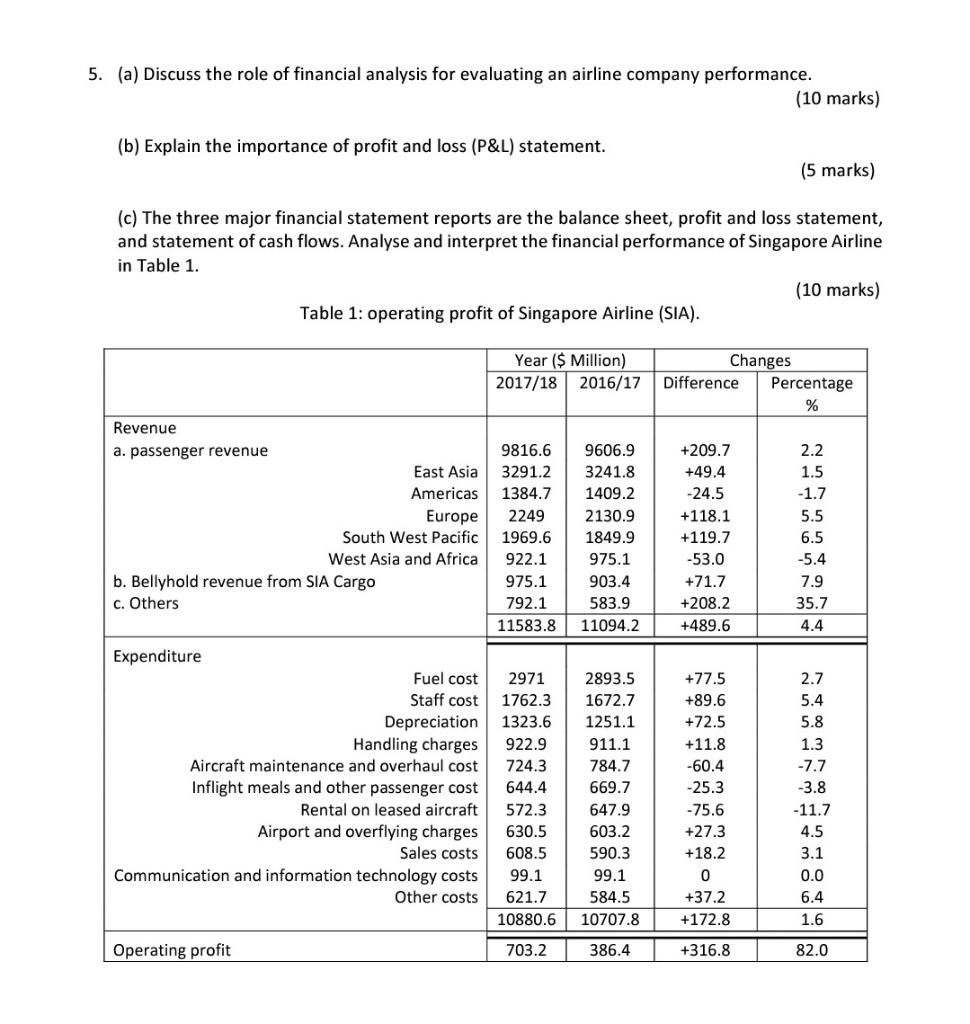

5. (a) Discuss the role of financial analysis for evaluating an airline company performance. (10 marks) (b) Explain the importance of profit and loss (P&L) statement. (5 marks) (c) The three major financial statement reports are the balance sheet, profit and loss statement, and statement of cash flows. Analyse and interpret the financial performance of Singapore Airline in Table 1. (10 marks) Table 1: operating profit of Singapore Airline (SIA). Year ($ Million) 2017/18 2016/17 Changes Difference Percentage % Revenue a. passenger revenue East Asia Americas Europe South West Pacific West Asia and Africa b. Bellyhold revenue from SIA Cargo c. Others 9816.6 3291.2 1384.7 2249 1969.6 922.1 975.1 792.1 11583.8 9606.9 3241.8 1409.2 2130.9 1849.9 975.1 903.4 583.9 11094.2 +209.7 +49.4 -24.5 +118.1 +119.7 -53.0 +71.7 +208.2 +489.6 2.2 1.5 -1.7 5.5 6.5 -5.4 7.9 35.7 4.4 Expenditure Fuel cost Staff cost Depreciation Handling charges Aircraft maintenance and overhaul cost Inflight meals and other passenger cost Rental on leased aircraft Airport and overflying charges Sales costs Communication and information technology costs Other costs 2971 1762.3 1323.6 922.9 724.3 644.4 572.3 630.5 608.5 99.1 621.7 10880.6 2893.5 1672.7 1251.1 911.1 784.7 669.7 647.9 603.2 590.3 99.1 584.5 10707.8 +77.5 +89.6 +72.5 +11.8 -60.4 -25.3 -75.6 +27.3 +18.2 0 +37.2 +172.8 2.7 5.4 5.8 1.3 -7.7 -3.8 -11.7 4.5 3.1 0.0 6.4 1.6 Operating profit 703.2 386.4 +316.8 82.0 5. (a) Discuss the role of financial analysis for evaluating an airline company performance. (10 marks) (b) Explain the importance of profit and loss (P&L) statement. (5 marks) (c) The three major financial statement reports are the balance sheet, profit and loss statement, and statement of cash flows. Analyse and interpret the financial performance of Singapore Airline in Table 1. (10 marks) Table 1: operating profit of Singapore Airline (SIA). Year ($ Million) 2017/18 2016/17 Changes Difference Percentage % Revenue a. passenger revenue East Asia Americas Europe South West Pacific West Asia and Africa b. Bellyhold revenue from SIA Cargo c. Others 9816.6 3291.2 1384.7 2249 1969.6 922.1 975.1 792.1 11583.8 9606.9 3241.8 1409.2 2130.9 1849.9 975.1 903.4 583.9 11094.2 +209.7 +49.4 -24.5 +118.1 +119.7 -53.0 +71.7 +208.2 +489.6 2.2 1.5 -1.7 5.5 6.5 -5.4 7.9 35.7 4.4 Expenditure Fuel cost Staff cost Depreciation Handling charges Aircraft maintenance and overhaul cost Inflight meals and other passenger cost Rental on leased aircraft Airport and overflying charges Sales costs Communication and information technology costs Other costs 2971 1762.3 1323.6 922.9 724.3 644.4 572.3 630.5 608.5 99.1 621.7 10880.6 2893.5 1672.7 1251.1 911.1 784.7 669.7 647.9 603.2 590.3 99.1 584.5 10707.8 +77.5 +89.6 +72.5 +11.8 -60.4 -25.3 -75.6 +27.3 +18.2 0 +37.2 +172.8 2.7 5.4 5.8 1.3 -7.7 -3.8 -11.7 4.5 3.1 0.0 6.4 1.6 Operating profit 703.2 386.4 +316.8 82.0