Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. (a) Plantfood paid an annual dividend of $3 on its common stock and promises that the dividend will grow by 3% per year. If

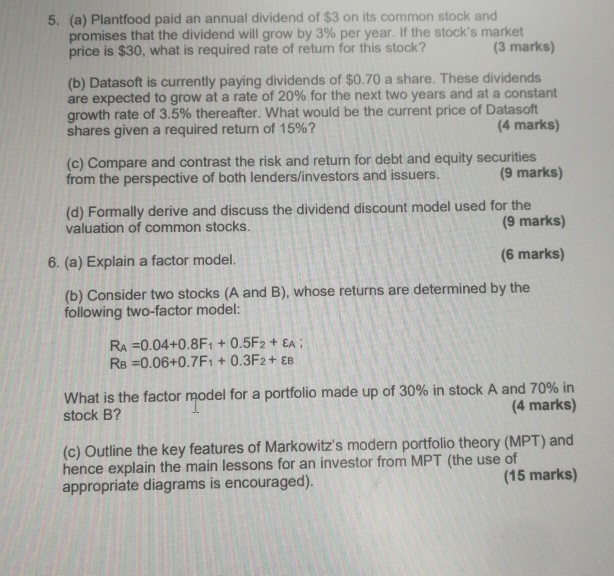

5. (a) Plantfood paid an annual dividend of $3 on its common stock and promises that the dividend will grow by 3% per year. If the stock's market price is $30, what is required rate of return for this stock? (3 marks) (b) Datasoft is currently paying dividends of $0.70 a share. These dividends are expected to grow at a rate of 20% for the next two years and at a constant growth rate of 3.5% thereafter. What would be the current price of Datasoft shares given a required return of 15%? (4 marks) (c) Compare and contrast the risk and return for debt and equity securities from the perspective of both lenders/investors and issuers. (9 marks) (d) Formally derive and discuss the dividend discount model used for the valuation of common stocks. (9 marks) 6. (a) Explain a factor model. (6 marks) (b) Consider two stocks (A and B), whose returns are determined by the following two-factor model: RA =0.04+0.8F1 + 0.5F2 + EA : Re =0.06+0.7F1 + 0.3F2 + EB What is the factor model for a portfolio made up of 30% in stock A and 70% in (4 marks) stock B? (c) Outline the key features of Markowitz's modern portfolio theory (MPT) and hence explain the main lessons for an investor from MPT (the use of appropriate diagrams is encouraged). (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started