Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. A single taxpayer has a Schedule C income of $50,000 as their only source of income, and no employees and no assets. The taxpayer

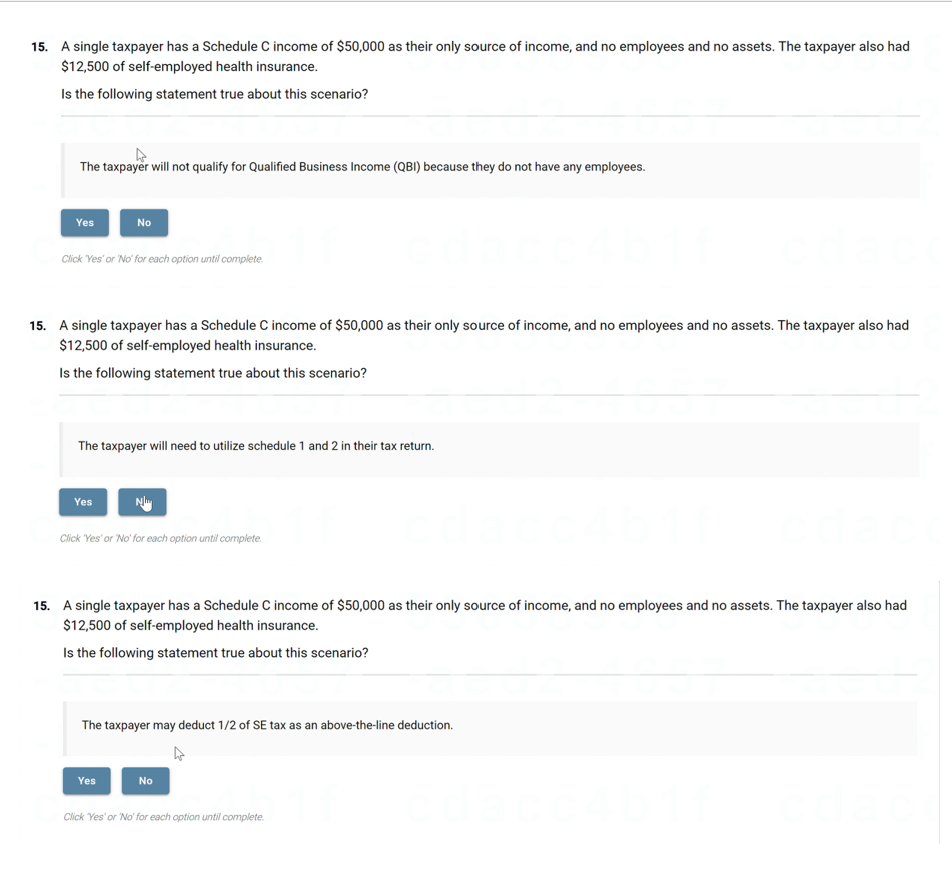

5. A single taxpayer has a Schedule C income of $50,000 as their only source of income, and no employees and no assets. The taxpayer also had $12,500 of self-employed health insurance. Is the following statement true about this scenario? The taxpayer will not qualify for Qualified Business Income (QBI) because they do not have any employees. Click 'Yes' or 'No' for each option until complete. A single taxpayer has a Schedule C income of $50,000 as their only source of income, and no employees and no assets. The taxpayer also had $12,500 of self-employed health insurance. Is the following statement true about this scenario? The taxpayer will need to utilize schedule 1 and 2 in their tax return. Click 'Yes' or No' for each option untili complete. 5. A single taxpayer has a Schedule C income of $50,000 as their only source of income, and no employees and no assets. The taxpayer also had $12,500 of self-employed health insurance. Is the following statement true about this scenario? The taxpayer may deduct 1/2 of SE tax as an above-the-line deduction. Click Yes' or 'No' for each option until complete

5. A single taxpayer has a Schedule C income of $50,000 as their only source of income, and no employees and no assets. The taxpayer also had $12,500 of self-employed health insurance. Is the following statement true about this scenario? The taxpayer will not qualify for Qualified Business Income (QBI) because they do not have any employees. Click 'Yes' or 'No' for each option until complete. A single taxpayer has a Schedule C income of $50,000 as their only source of income, and no employees and no assets. The taxpayer also had $12,500 of self-employed health insurance. Is the following statement true about this scenario? The taxpayer will need to utilize schedule 1 and 2 in their tax return. Click 'Yes' or No' for each option untili complete. 5. A single taxpayer has a Schedule C income of $50,000 as their only source of income, and no employees and no assets. The taxpayer also had $12,500 of self-employed health insurance. Is the following statement true about this scenario? The taxpayer may deduct 1/2 of SE tax as an above-the-line deduction. Click Yes' or 'No' for each option until complete Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started