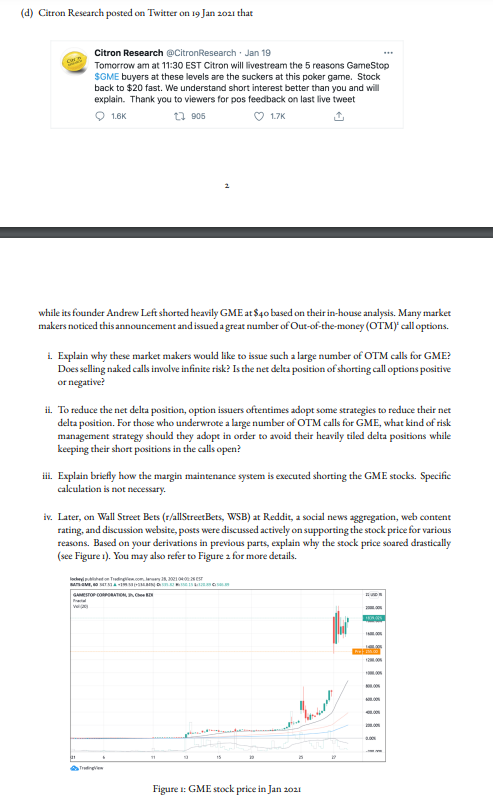

5. (a) Under a certain set of model assumptions, one can derive a closed form solution to the European call option price with the underlying asset S, with no dividend: Ct,T(St, K) = S(d) - Ke-(T-1)(d), (1) where (z) = Pr(Z z), with Z~ N(0, 1), d = (oT t)- [log (%) + (r + ) (T t)] and -1 d=d - oT - t. Derive the price formula for Pt.r (St, K), i.e. the European put option with the same underlying asset, same strike price and same maturity in terms of (-), d, d, St, K, r, t and T. (b) Define Ac(t, T, St, K) = OCt,T(St, K)/OS, as the sensitivity of a European call option with St as its underlying asset and maturity T. Evaluate Ap(t, T, 50, K) = OPtr (St, K)/OSt St-50 while you are given that Ac(t, T, 50, K) = 0.56. Interpret what Ac(t, T, St, K) = 0.5 means in laymen terms also. (c) i. Through direct calculation on (1), we can derive that Ap(t, T, S, K) = -(-d). Sketch graphs of the European call option deltas against the strike price K with different maturities. ii. Sketch graphs of the European call option gammas Ie(t,T) strike price K with different maturities. Ctr (St, K)/OS? against the (d) Citron Research posted on Twitter on 19 Jan 2021 that Citron Research @Citron Research Jan 19 SHER Tomorrow am at 11:30 EST Citron will livestream the 5 reasons GameStop $GME buyers at these levels are the suckers at this poker game. Stock back to $20 fast. We understand short interest better than you and will explain. Thank you to viewers for pos feedback on last live tweet 1.7K 1.6K 13 906 while its founder Andrew Left shorted heavily GME at $40 based on their in-house analysis. Many market makers noticed this announcement and issued a great number of Out-of-the-money (OTM)' call options. i. Explain why these market makers would like to issue such a large number of OTM calls for GME? Does selling naked calls involve infinite risk? Is the net delta position of shorting call options positive or negative? ii. To reduce the net delta position, option issuers oftentimes adopt some strategies to reduce their net delta position. For those who underwrote a large number of OTM calls for GME, what kind of risk management strategy should they adopt in order to avoid their heavily tiled delta positions while keeping their short positions in the calls open? iii. Explain briefly how the margin maintenance system is executed shorting the GME stocks. Specific calculation is not necessary. iv. Later, on Wall Street Bets (r/all StreetBets, WSB) at Reddit, a social news aggregation, web content rating, and discussion website, posts were discussed actively on supporting the stock price for various reasons. Based on your derivations in previous parts, explain why the stock price soared drastically (see Figure 1). You may also refer to Figure 2 for more details. lock Trading.comlenery 28, 202104:00:2 GAMESTOF COMPORT BUD HONORS 1 T 11 Figure 1: GME stock price in Jan 2021 P255.00 1200 40.00 5. (a) Under a certain set of model assumptions, one can derive a closed form solution to the European call option price with the underlying asset S, with no dividend: Ct,T(St, K) = S(d) - Ke-(T-1)(d), (1) where (z) = Pr(Z z), with Z~ N(0, 1), d = (oT t)- [log (%) + (r + ) (T t)] and -1 d=d - oT - t. Derive the price formula for Pt.r (St, K), i.e. the European put option with the same underlying asset, same strike price and same maturity in terms of (-), d, d, St, K, r, t and T. (b) Define Ac(t, T, St, K) = OCt,T(St, K)/OS, as the sensitivity of a European call option with St as its underlying asset and maturity T. Evaluate Ap(t, T, 50, K) = OPtr (St, K)/OSt St-50 while you are given that Ac(t, T, 50, K) = 0.56. Interpret what Ac(t, T, St, K) = 0.5 means in laymen terms also. (c) i. Through direct calculation on (1), we can derive that Ap(t, T, S, K) = -(-d). Sketch graphs of the European call option deltas against the strike price K with different maturities. ii. Sketch graphs of the European call option gammas Ie(t,T) strike price K with different maturities. Ctr (St, K)/OS? against the (d) Citron Research posted on Twitter on 19 Jan 2021 that Citron Research @Citron Research Jan 19 SHER Tomorrow am at 11:30 EST Citron will livestream the 5 reasons GameStop $GME buyers at these levels are the suckers at this poker game. Stock back to $20 fast. We understand short interest better than you and will explain. Thank you to viewers for pos feedback on last live tweet 1.7K 1.6K 13 906 while its founder Andrew Left shorted heavily GME at $40 based on their in-house analysis. Many market makers noticed this announcement and issued a great number of Out-of-the-money (OTM)' call options. i. Explain why these market makers would like to issue such a large number of OTM calls for GME? Does selling naked calls involve infinite risk? Is the net delta position of shorting call options positive or negative? ii. To reduce the net delta position, option issuers oftentimes adopt some strategies to reduce their net delta position. For those who underwrote a large number of OTM calls for GME, what kind of risk management strategy should they adopt in order to avoid their heavily tiled delta positions while keeping their short positions in the calls open? iii. Explain briefly how the margin maintenance system is executed shorting the GME stocks. Specific calculation is not necessary. iv. Later, on Wall Street Bets (r/all StreetBets, WSB) at Reddit, a social news aggregation, web content rating, and discussion website, posts were discussed actively on supporting the stock price for various reasons. Based on your derivations in previous parts, explain why the stock price soared drastically (see Figure 1). You may also refer to Figure 2 for more details. lock Trading.comlenery 28, 202104:00:2 GAMESTOF COMPORT BUD HONORS 1 T 11 Figure 1: GME stock price in Jan 2021 P255.00 1200 40.00