Question

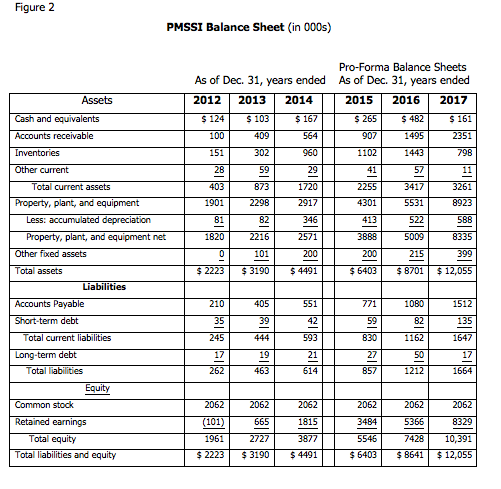

5. a. What is the average accounts receivable collection or 2014, 2015, 2016, and 2017? b. Is the time frame getting longer or shorter? What

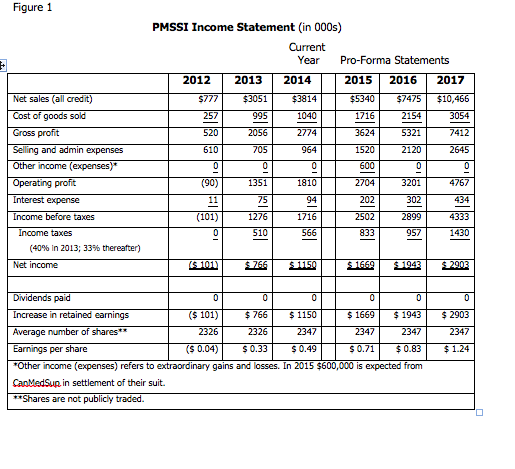

5. a. What is the average accounts receivable collection or 2014, 2015, 2016, and 2017?

b. Is the time frame getting longer or shorter? What are the consequences?

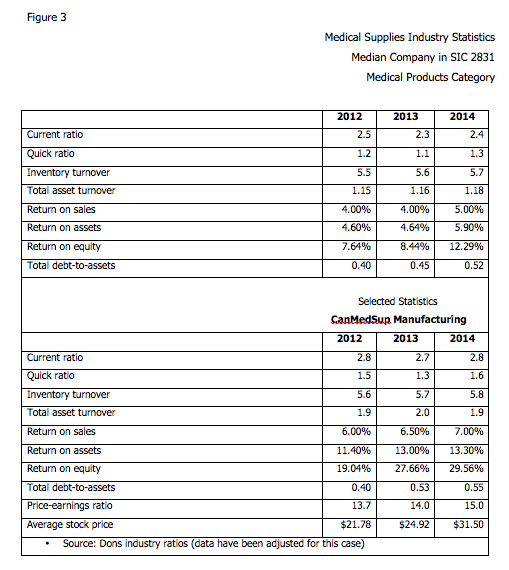

6. a. How does PMSSIs return-on-equity ratio (ROE) compared to CanMedSups and the

industry for 2014?

Using the Du Pont method, compare the positions of PMSSI and CanMedSup. Compare ROE for each company using the following formula:

ROE = profit margin x asset turnover/(1 - debt to assets)

Or

ROE = PM (Profit Margin x Total Asset Turnover (TATO) x EM (Equity Multiplier)

Compare the results to determine and explain the sources of ROE for each company.

Figure 1 PMSSI Income Statement 000s) Current Year Pro-Forma Statements 2012 2013 2014 2015 20162017 Net sales $3051$3814 040 74 $77 $7475 $1 goods sokd 2154 056 152 2645 and admin expenses income (expenses) ating 51 201 476 Interest expense 434 axes 899 axes 143 (40% in 2013; 33% thereafter) Net income vidends ncrease in retained Average number of shares* Earnings per share Other income (expenses) CanMedSup in settlement of their suit. earnings 1150 669 $0.04)$ s 0.49 fers to extraordinary gains and losses. I 5 $600,000 is expected Shares are not publicly trStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started