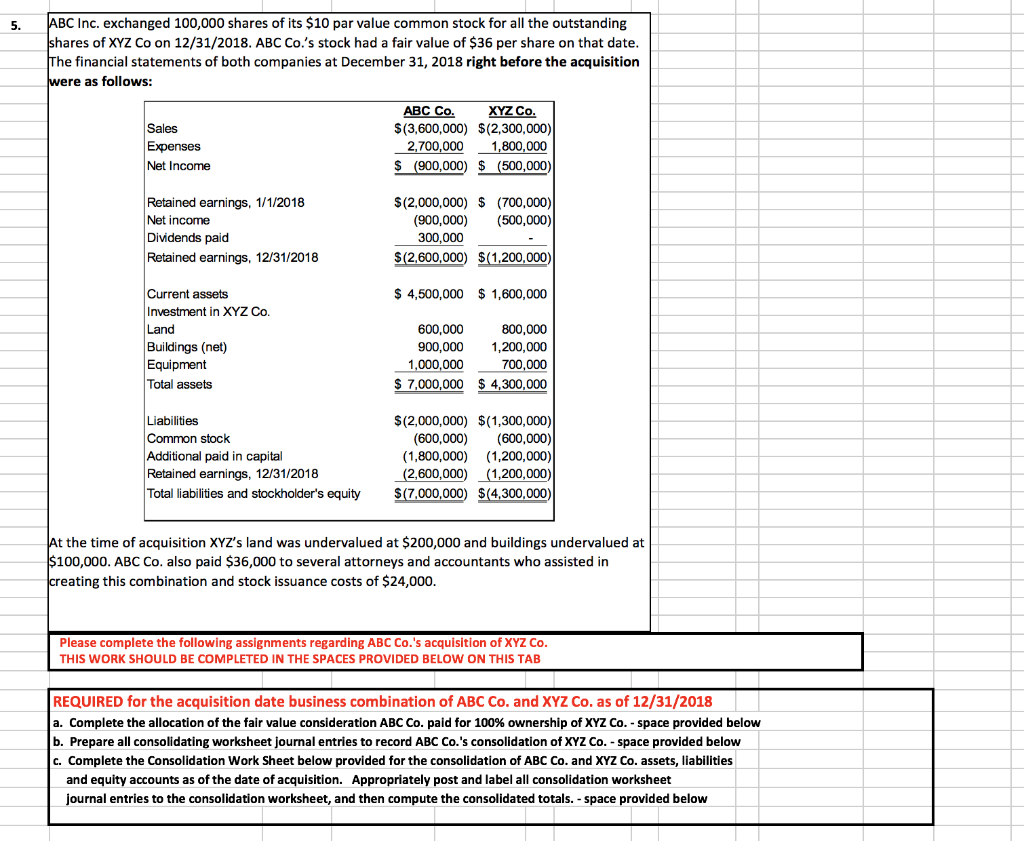

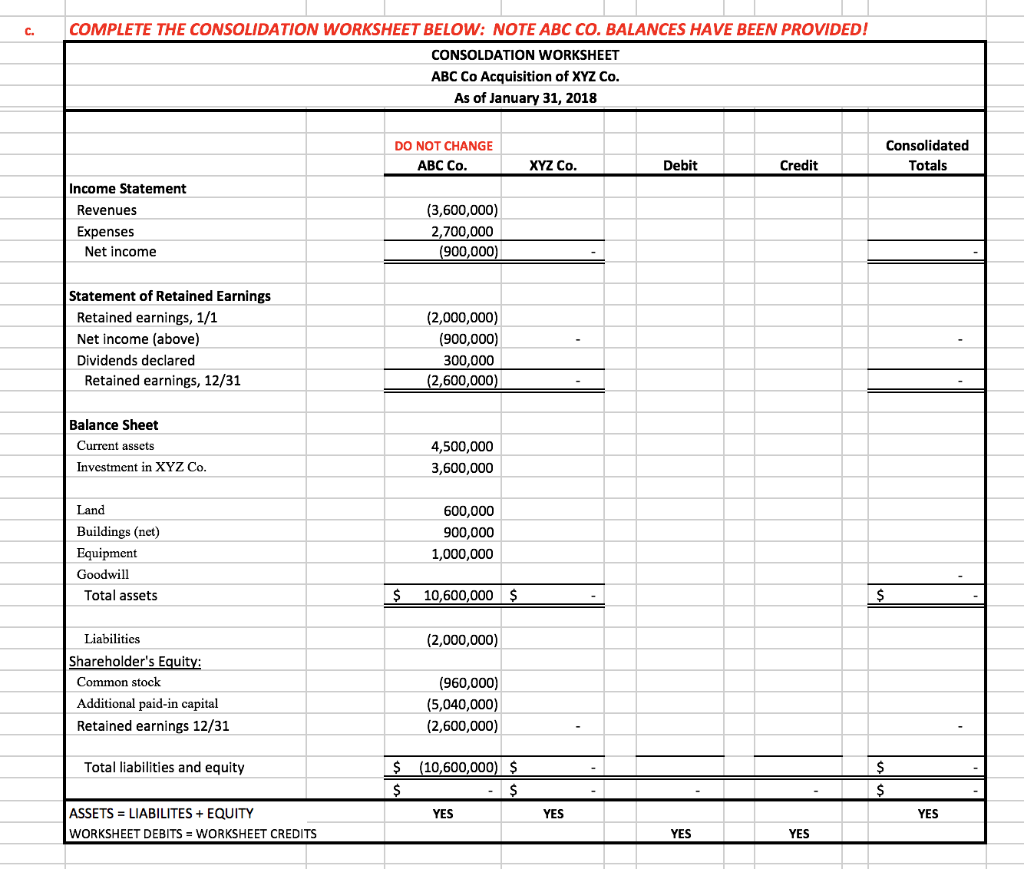

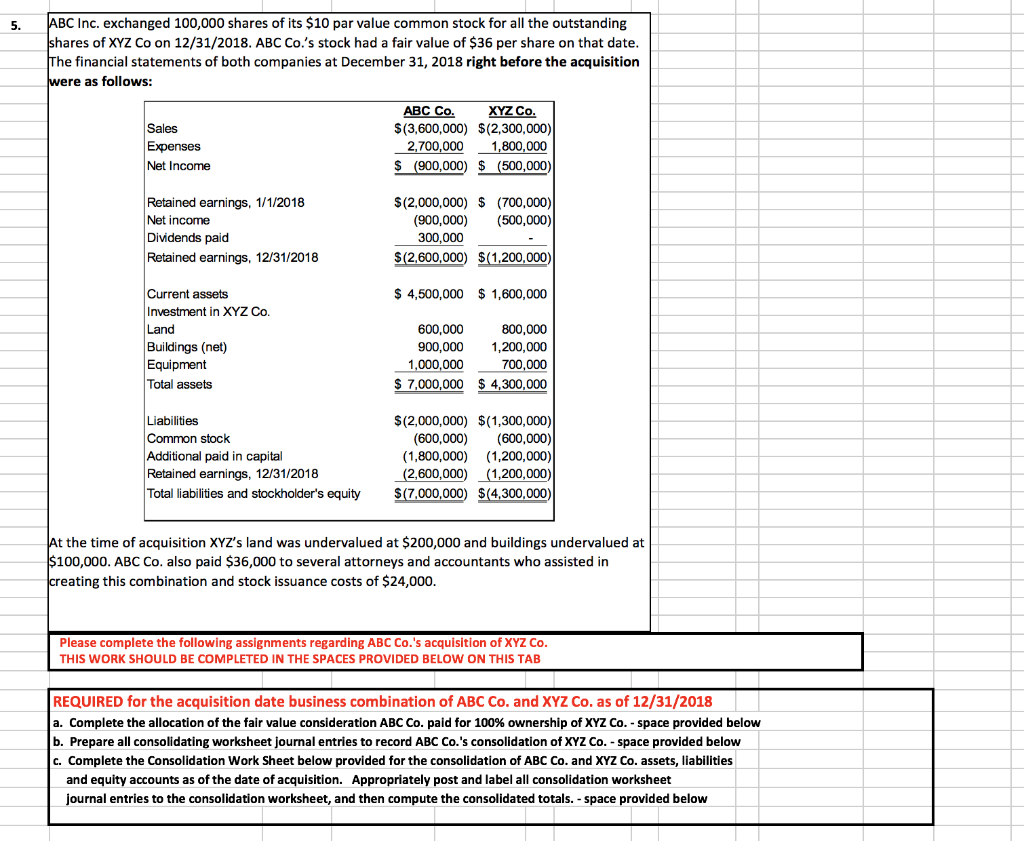

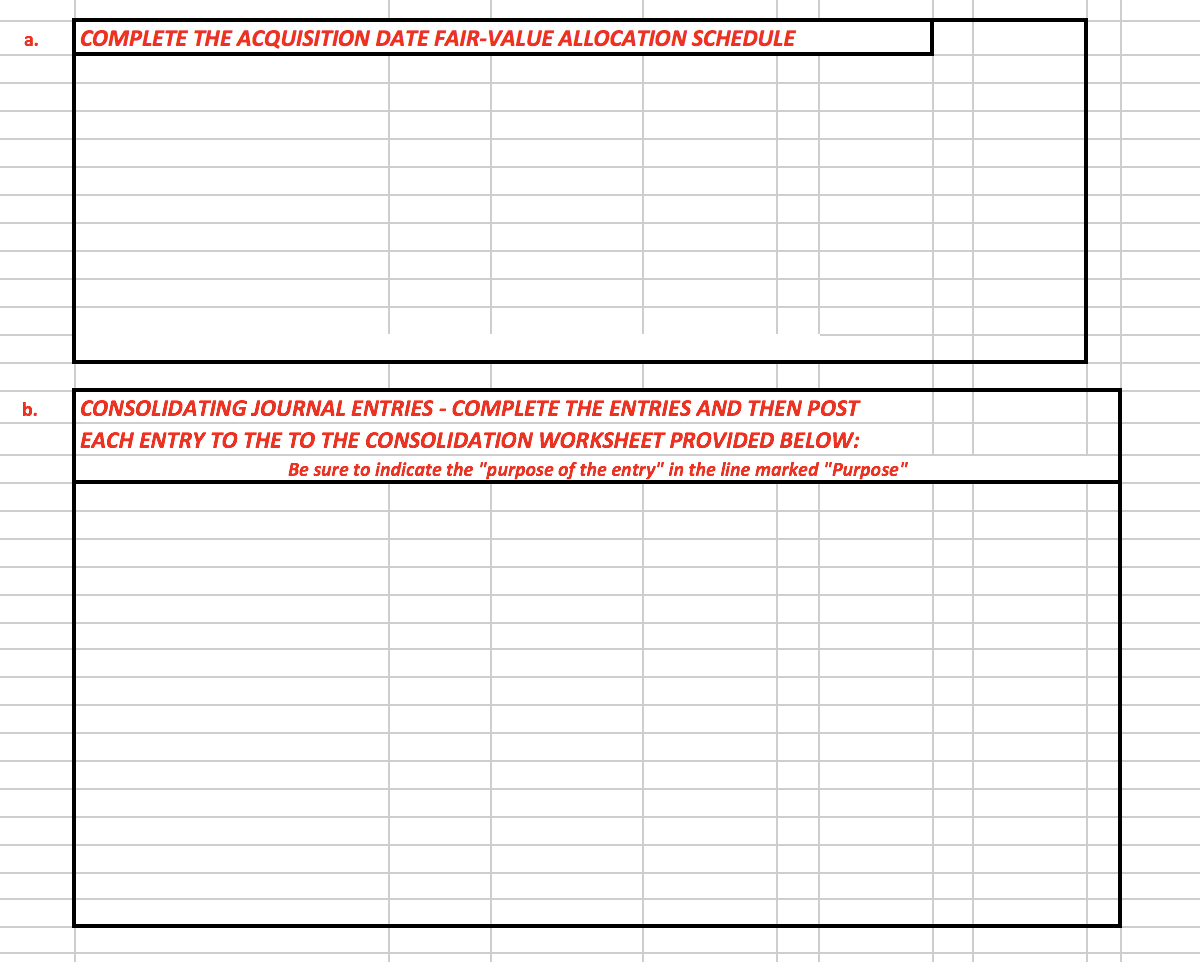

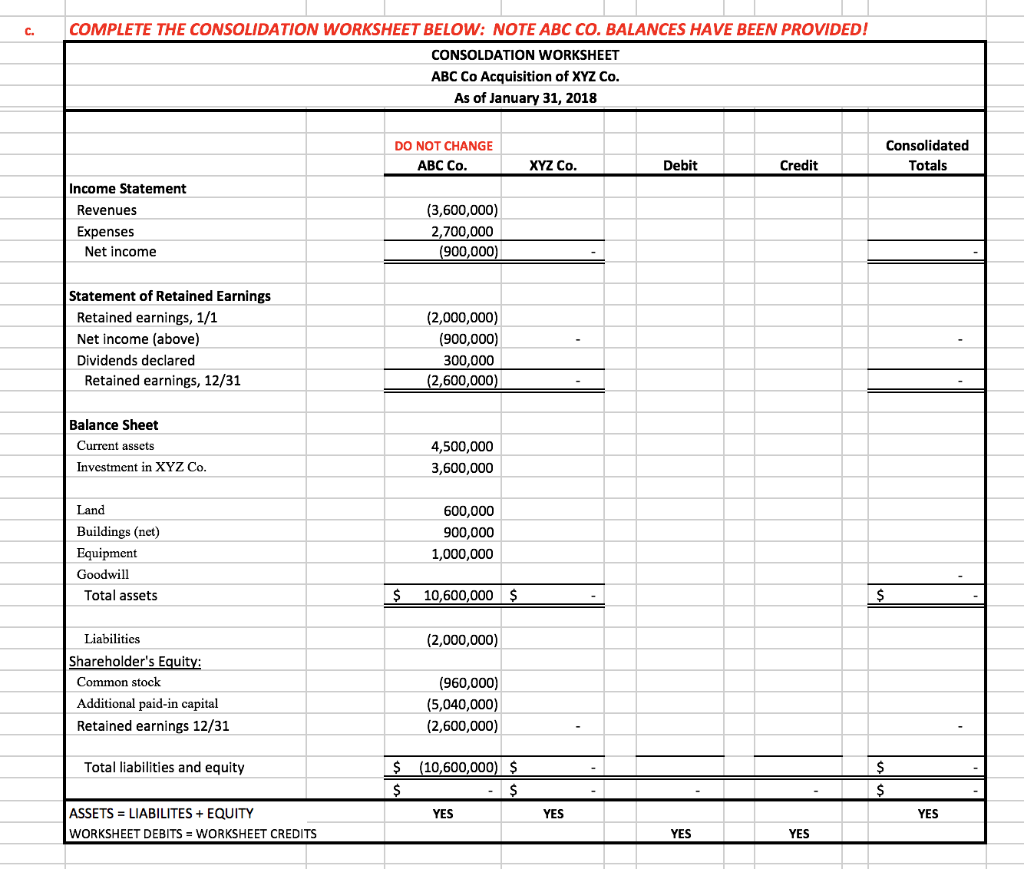

5. ABC Inc. exchanged 100,000 shares of its $10 par value common stock for all the outstanding shares of XYZ Co on 12/31/2018. ABC Co.'s stock had a fair value of $36 per share on that date. The financial statements of both companies at December 31, 2018 right before the acquisition were as follows: Sales Expenses Net Income ABC Co. XYZ Co. $(3,600,000) $(2,300,000) 2,700,000 1,800,000 $ (900,000) $ (500,000) Retained earnings, 1/1/2018 Net income Dividends paid Retained earnings, 12/31/2018 $(2,000,000) $ (700,000) (900,000) (500,000) 300,000 $(2,600,000) $(1,200,000) $ 4,500,000 $1,600,000 Current assets Investment in XYZ Co. Land Buildings (net) Equipment Total assets 600,000 800,000 900,000 1,200,000 1,000,000 700,000 $ 7,000,000 $ 4,300,000 Liabilities Common stock Additional paid in capital Retained earnings, 12/31/2018 Total liabilities and stockholder's equity $(2,000,000) $(1,300,000) (600,000) (600,000) (1,800,000) (1,200,000) (2,600,000) (1,200,000) S(7,000,000) $(4,300,000) At the time of acquisition XYZ's land was undervalued at $200,000 and buildings undervalued at $100,000. ABC Co. also paid $36,000 to several attorneys and accountants who assisted in creating this combination and stock issuance costs of $24,000. Please complete the following assignments regarding ABC Co.'s acquisition of XYZ Co. THIS WORK SHOULD BE COMPLETED IN THE SPACES PROVIDED BELOW ON THIS TAB REQUIRED for the acquisition date business combination of ABC Co. and XYZ Co, as of 12/31/2018 a. Complete the allocation of the fair value consideration ABC Co. paid for 100% ownership of XYZ Co. - space provided below b. Prepare all consolidating worksheet journal entries to record ABC Co.'s consolidation of XYZ Co. -space provided below c. Complete the Consolidation Work Sheet below provided for the consolidation of ABC Co. and XYZ Co. assets, liabilities and equity accounts as of the date of acquisition. Appropriately post and label all consolidation worksheet journal entries to the consolidation worksheet, and then compute the consolidated totals. -space provided below COMPLETE THE ACQUISITION DATE FAIR-VALUE ALLOCATION SCHEDULE CONSOLIDATING JOURNAL ENTRIES - COMPLETE THE ENTRIES AND THEN POST EACH ENTRY TO THE TO THE CONSOLIDATION WORKSHEET PROVIDED BELOW: Be sure to indicate the "purpose of the entry" in the line marked "Purpose" C. COMPLETE THE CONSOLIDATION WORKSHEET BELOW: NOTE ABC CO. BALANCES HAVE BEEN PROVIDED! CONSOLDATION WORKSHEET ABC Co Acquisition of XYZ Co. As of January 31, 2018 DO NOT CHANGE ABC Co. Consolidated Totals XYZ Co. Debit Credit Income Statement Revenues Expenses Net income (3,600,000) 2,700,000 (900,000) Statement of Retained Earnings Retained earnings, 1/1 Net Income (above) Dividends declared Retained earnings, 12/31 (2,000,000) (900,000) 300,000 (2,600,000) Balance Sheet Current assets Investment in XYZ Co. 4,500,000 3,600,000 Land Buildings (net) Equipment Goodwill Total assets 600,000 900,000 1,000,000 $ 10,600,000 $ (2,000,000) Liabilities Shareholder's Equity: Common stock Additional paid-in capital Retained earnings 12/31 (960,000) (5,040,000) (2,600,000) Total liabilities and equity $ $ (10,600,000) $ . $ YES - $ YES YES ASSETS = LIABILITES + EQUITY WORKSHEET DEBITS = WORKSHEET CREDITS YES YES 5. ABC Inc. exchanged 100,000 shares of its $10 par value common stock for all the outstanding shares of XYZ Co on 12/31/2018. ABC Co.'s stock had a fair value of $36 per share on that date. The financial statements of both companies at December 31, 2018 right before the acquisition were as follows: Sales Expenses Net Income ABC Co. XYZ Co. $(3,600,000) $(2,300,000) 2,700,000 1,800,000 $ (900,000) $ (500,000) Retained earnings, 1/1/2018 Net income Dividends paid Retained earnings, 12/31/2018 $(2,000,000) $ (700,000) (900,000) (500,000) 300,000 $(2,600,000) $(1,200,000) $ 4,500,000 $1,600,000 Current assets Investment in XYZ Co. Land Buildings (net) Equipment Total assets 600,000 800,000 900,000 1,200,000 1,000,000 700,000 $ 7,000,000 $ 4,300,000 Liabilities Common stock Additional paid in capital Retained earnings, 12/31/2018 Total liabilities and stockholder's equity $(2,000,000) $(1,300,000) (600,000) (600,000) (1,800,000) (1,200,000) (2,600,000) (1,200,000) S(7,000,000) $(4,300,000) At the time of acquisition XYZ's land was undervalued at $200,000 and buildings undervalued at $100,000. ABC Co. also paid $36,000 to several attorneys and accountants who assisted in creating this combination and stock issuance costs of $24,000. Please complete the following assignments regarding ABC Co.'s acquisition of XYZ Co. THIS WORK SHOULD BE COMPLETED IN THE SPACES PROVIDED BELOW ON THIS TAB REQUIRED for the acquisition date business combination of ABC Co. and XYZ Co, as of 12/31/2018 a. Complete the allocation of the fair value consideration ABC Co. paid for 100% ownership of XYZ Co. - space provided below b. Prepare all consolidating worksheet journal entries to record ABC Co.'s consolidation of XYZ Co. -space provided below c. Complete the Consolidation Work Sheet below provided for the consolidation of ABC Co. and XYZ Co. assets, liabilities and equity accounts as of the date of acquisition. Appropriately post and label all consolidation worksheet journal entries to the consolidation worksheet, and then compute the consolidated totals. -space provided below COMPLETE THE ACQUISITION DATE FAIR-VALUE ALLOCATION SCHEDULE CONSOLIDATING JOURNAL ENTRIES - COMPLETE THE ENTRIES AND THEN POST EACH ENTRY TO THE TO THE CONSOLIDATION WORKSHEET PROVIDED BELOW: Be sure to indicate the "purpose of the entry" in the line marked "Purpose" C. COMPLETE THE CONSOLIDATION WORKSHEET BELOW: NOTE ABC CO. BALANCES HAVE BEEN PROVIDED! CONSOLDATION WORKSHEET ABC Co Acquisition of XYZ Co. As of January 31, 2018 DO NOT CHANGE ABC Co. Consolidated Totals XYZ Co. Debit Credit Income Statement Revenues Expenses Net income (3,600,000) 2,700,000 (900,000) Statement of Retained Earnings Retained earnings, 1/1 Net Income (above) Dividends declared Retained earnings, 12/31 (2,000,000) (900,000) 300,000 (2,600,000) Balance Sheet Current assets Investment in XYZ Co. 4,500,000 3,600,000 Land Buildings (net) Equipment Goodwill Total assets 600,000 900,000 1,000,000 $ 10,600,000 $ (2,000,000) Liabilities Shareholder's Equity: Common stock Additional paid-in capital Retained earnings 12/31 (960,000) (5,040,000) (2,600,000) Total liabilities and equity $ $ (10,600,000) $ . $ YES - $ YES YES ASSETS = LIABILITES + EQUITY WORKSHEET DEBITS = WORKSHEET CREDITS YES YES