Answered step by step

Verified Expert Solution

Question

1 Approved Answer

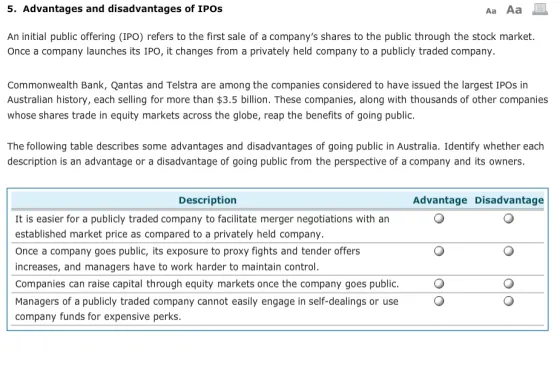

5. Advantages and disadvantages of IPOS Aa Aa An initial public offering (IPO) refers to the first sale of a company's shares to the

5. Advantages and disadvantages of IPOS Aa Aa An initial public offering (IPO) refers to the first sale of a company's shares to the public through the stock market. Once a company launches its IPO, it changes from a privately held company to a publicly traded company. Commonwealth Bank, Qantas and Telstra are among the companies considered to have issued the largest IPOs in Australian history, each selling for more than $3.5 billion. These companies, along with thousands of other companies whose shares trade in equity markets across the globe, reap the benefits of going public. The following table describes some advantages and disadvantages of going public in Australia. Identify whether each description is an advantage or a disadvantage of going public from the perspective of a company and its owners. Description It is easier for a publicly traded company to facilitate merger negotiations with an established market price as compared to a privately held company. Once a company goes public, its exposure to proxy fights and tender offers increases, and managers have to work harder to maintain control. Companies can raise capital through equity markets once the company goes public. Managers of a publicly traded company cannot easily engage in self-dealings or use company funds for expensive perks. Advantage Disadvantage O 00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Description Advantage Disadvantage It is easier for a publicly traded company to facilitate merger negotiations with an established market price Advan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started