Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. An insurance company classifies its auto insurance policyholders in the categories high, intermediate, or low risk. In any given year, a policyholder has

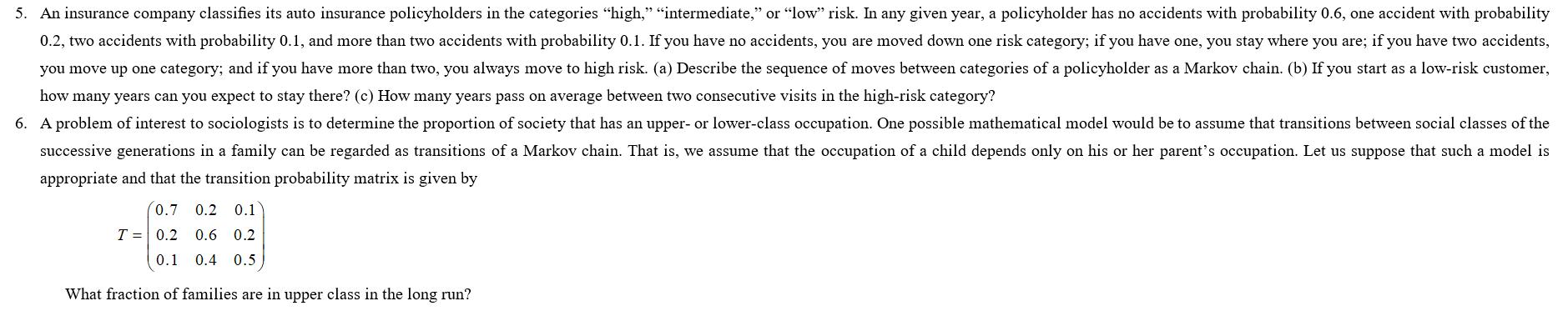

5. An insurance company classifies its auto insurance policyholders in the categories "high," "intermediate," or "low" risk. In any given year, a policyholder has no accidents with probability 0.6, one accident with probability 0.2, two accidents with probability 0.1, and more than two accidents with probability 0.1. If you have no accidents, you are moved down one risk category; if you have one, you stay where you are; if you have two accidents, you move up one category; and if you have more than two, you always move to high risk. (a) Describe the sequence of moves between categories of a policyholder as a Markov chain. (b) If you start as a low-risk customer, how many years can you expect to stay there? (c) How many years pass on average between two consecutive visits in the high-risk category? 6. A problem of interest to sociologists is to determine the proportion of society that has an upper- or lower-class occupation. One possible mathematical model would be to assume that transitions between social classes of the successive generations in a family can be regarded as transitions of a Markov chain. That is, we assume that the occupation of a child depends only on his or her parent's occupation. Let us suppose that such a model is appropriate and that the transition probability matrix is given by 0.7 0.2 0.1 T 0.2 0.6 0.2 0.1 0.4 0.5 What fraction of families are in upper class in the long run?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started