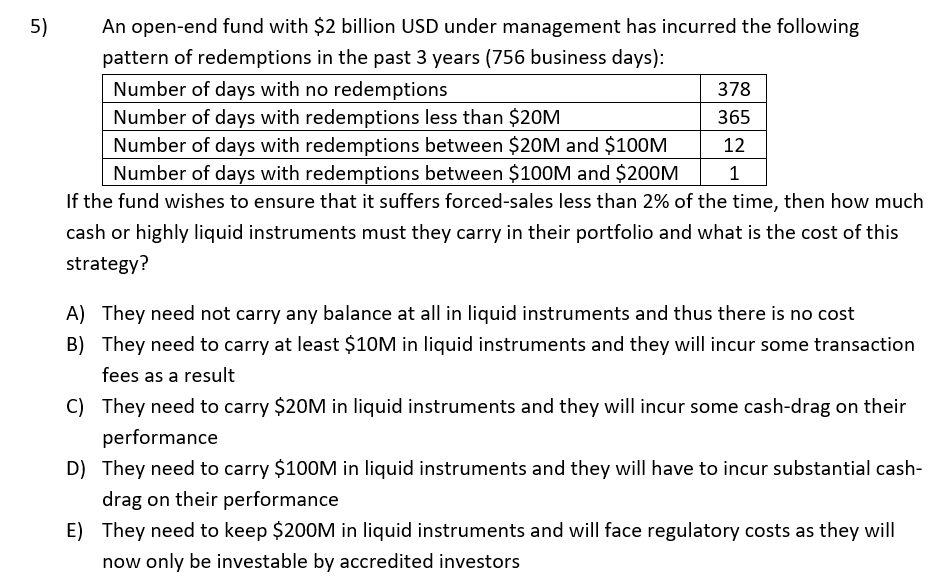

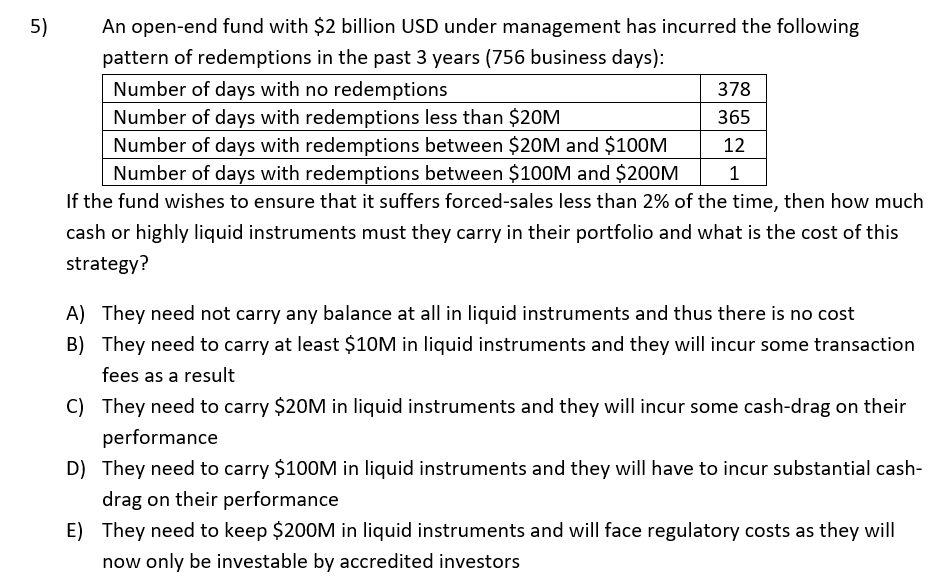

5) An open-end fund with $2 billion USD under management has incurred the following pattern of redemptions in the past 3 years (756 business days): Number of days with no redemptions 378 Number of days with redemptions less than $20M 365 12 Number of days with redemptions between $20M and $100M Number of days with redemptions between $100M and $200M 1 If the fund wishes to ensure that it suffers forced-sales less than 2% of the time, then how much cash or highly liquid instruments must they carry in their portfolio and what is the cost of this strategy? A) They need not carry any balance at all in liquid instruments and thus there is no cost B) They need to carry at least $10M in liquid instruments and they will incur some transaction fees as a result C) They need to carry $20M in liquid instruments and they will incur some cash-drag on their performance D) They need to carry $100M in liquid instruments and they will have to incur substantial cash- drag on their performance E) They need to keep $200M in liquid instruments and will face regulatory costs as they will now only be investable by accredited investors 5) An open-end fund with $2 billion USD under management has incurred the following pattern of redemptions in the past 3 years (756 business days): Number of days with no redemptions 378 Number of days with redemptions less than $20M 365 12 Number of days with redemptions between $20M and $100M Number of days with redemptions between $100M and $200M 1 If the fund wishes to ensure that it suffers forced-sales less than 2% of the time, then how much cash or highly liquid instruments must they carry in their portfolio and what is the cost of this strategy? A) They need not carry any balance at all in liquid instruments and thus there is no cost B) They need to carry at least $10M in liquid instruments and they will incur some transaction fees as a result C) They need to carry $20M in liquid instruments and they will incur some cash-drag on their performance D) They need to carry $100M in liquid instruments and they will have to incur substantial cash- drag on their performance E) They need to keep $200M in liquid instruments and will face regulatory costs as they will now only be investable by accredited investors