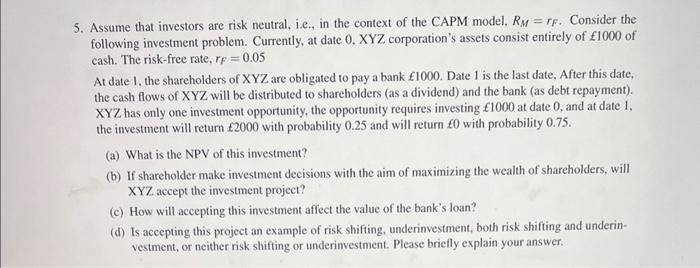

5. Assume that investors are risk neutral, i.e., in the context of the CAPM model, RM=rF. Consider the following investment problem. Currently, at date 0,XYZ corporation's assets consist entirely of 1000 of cash. The risk-free rate, rF=0.05 At date 1 , the shareholders of XYZ are obligated to pay a bank f1000. Date 1 is the last date, After this date, the cash flows of XYZ will be distributed to shareholders (as a dividend) and the bank (as debt repayment). XYZ has only one investment opportunity, the opportunity requires investing 1000 at date 0 , and at date 1 . the investment will return 2000 with probability 0.25 and will return 0 with probability 0.75. (a) What is the NPV of this investment? (b) If shareholder make investment decisions with the aim of maximizing the wealth of shareholders, will XYZ accept the investment project? (c) How will accepting this investment affect the value of the bank's loan? (d) Is accepting this project an example of risk shifting, underinvestment, both risk shifting and underinvestment, or neither risk shifting or underinvestment. Please briefly explain your answer. 5. Assume that investors are risk neutral, i.e., in the context of the CAPM model, RM=rF. Consider the following investment problem. Currently, at date 0,XYZ corporation's assets consist entirely of 1000 of cash. The risk-free rate, rF=0.05 At date 1 , the shareholders of XYZ are obligated to pay a bank f1000. Date 1 is the last date, After this date, the cash flows of XYZ will be distributed to shareholders (as a dividend) and the bank (as debt repayment). XYZ has only one investment opportunity, the opportunity requires investing 1000 at date 0 , and at date 1 . the investment will return 2000 with probability 0.25 and will return 0 with probability 0.75. (a) What is the NPV of this investment? (b) If shareholder make investment decisions with the aim of maximizing the wealth of shareholders, will XYZ accept the investment project? (c) How will accepting this investment affect the value of the bank's loan? (d) Is accepting this project an example of risk shifting, underinvestment, both risk shifting and underinvestment, or neither risk shifting or underinvestment. Please briefly explain your