Question

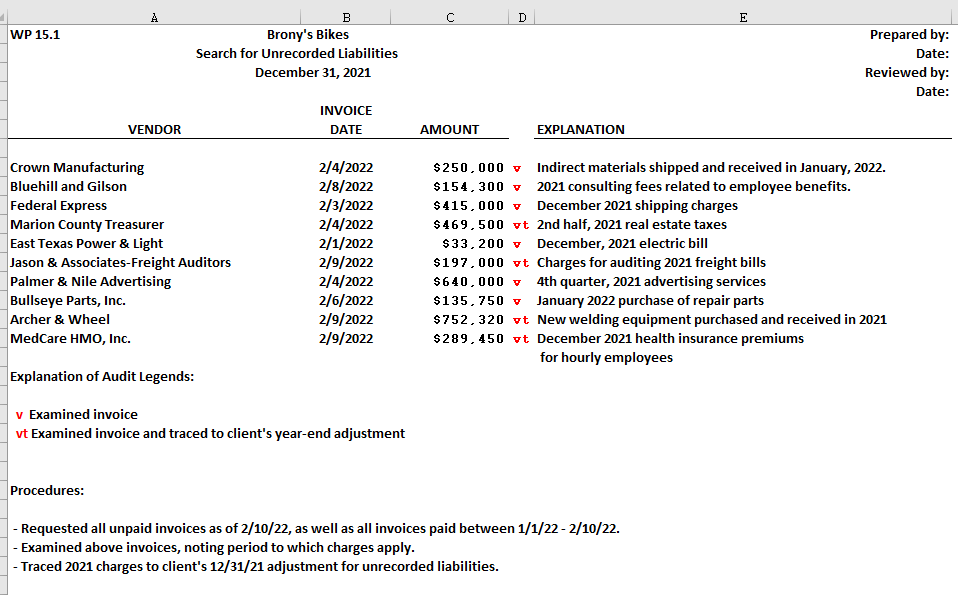

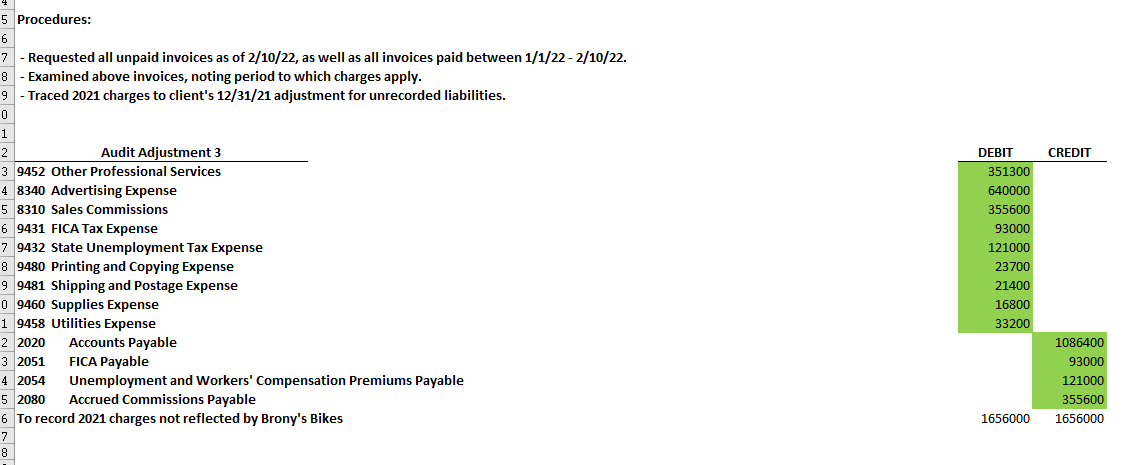

5. Assume that you found the following additional unrecorded charges pertaining to 2021. Add these unrecorded charges to Audit Adjustment 3 to record the appropriate

5. Assume that you found the following additional unrecorded charges pertaining to 2021. Add these unrecorded charges to Audit Adjustment 3 to record the appropriate expenses and liabilities at 12/31/21:

a. Sales commissions $355,600

b. Employers payroll taxes: FICA $93,000, state unemployment $121,000

c. Printing and copying $23,700

d. Postage $21,400

e. Office supplies $16,800

After adding these additional unrecorded charges to Audit Adjustment 3, what is the total dollar amount of the expenses/liabilities that you (as the auditor) have recorded?

The answer that I came up with is a total amount of expenses recorded is $1,656,000??

A c D E WP 15.1 B Brony's Bikes Search for Unrecorded Liabilities December 31, 2021 Prepared by: Date: Reviewed by: Date: INVOICE DATE VENDOR AMOUNT EXPLANATION Crown Manufacturing Bluehill and Gilson Federal Express Marion County Treasurer East Texas Power & Light Jason & Associates-Freight Auditors Palmer & Nile Advertising Bullseye Parts, Inc. Archer & Wheel MedCare HMO, Inc. 2/4/2022 2/8/2022 2/3/2022 2/4/2022 2/1/2022 2/9/2022 2/4/2022 2/6/2022 2/9/2022 2/9/2022 $250,000 , Indirect materials shipped and received in January, 2022. $154,300 2021 consulting fees related to employee benefits. $415,000 December 2021 shipping charges $469,500 vt 2nd half, 2021 real estate taxes $33,200 v December, 2021 electric bill $197,000 vt Charges for auditing 2021 freight bills $640,000 4th quarter, 2021 advertising services $135,750 v January 2022 purchase of repair parts $752,320 vt New welding equipment purchased and received in 2021 $289,450 vt December 2021 health insurance premiums for hourly employees Explanation of Audit Legends: v Examined invoice vt Examined invoice and traced to client's year-end adjustment Procedures: - Requested all unpaid invoices as of 2/10/22, as well as all invoices paid between 1/1/22-2/10/22. - Examined above invoices, noting period to which charges apply. - Traced 2021 charges to client's 12/31/21 adjustment for unrecorded liabilities. CREDIT 5 Procedures: 6 Requested all unpaid invoices as of 2/10/22, as well as all invoices paid between 1/1/22 - 2/10/22. 8 - Examined above invoices, noting period to which charges apply. 9 Traced 2021 charges to client's 12/31/21 adjustment for unrecorded liabilities. 0 1 2 Audit Adjustment 3 3 9452 Other Professional Services 4 8340 Advertising Expense 5 8310 Sales Commissions 6 9431 FICA Tax Expense 7 9432 State Unemployment Tax Expense 8 9480 Printing and Copying Expense 9 9481 Shipping and Postage Expense 0 9460 Supplies Expense 1 9458 Utilities Expense 2 2020 Accounts Payable 3 2051 FICA Payable 4 2054 Unemployment and Workers' Compensation Premiums Payable 5 2080 Accrued Commissions Payable 6 To record 2021 charges not reflected by Brony's Bikes 7 8 DEBIT 351300 640000 355600 93000 121000 23700 21400 16800 33200 1086400 93000 121000 355600 1656000 1656000 A c D E WP 15.1 B Brony's Bikes Search for Unrecorded Liabilities December 31, 2021 Prepared by: Date: Reviewed by: Date: INVOICE DATE VENDOR AMOUNT EXPLANATION Crown Manufacturing Bluehill and Gilson Federal Express Marion County Treasurer East Texas Power & Light Jason & Associates-Freight Auditors Palmer & Nile Advertising Bullseye Parts, Inc. Archer & Wheel MedCare HMO, Inc. 2/4/2022 2/8/2022 2/3/2022 2/4/2022 2/1/2022 2/9/2022 2/4/2022 2/6/2022 2/9/2022 2/9/2022 $250,000 , Indirect materials shipped and received in January, 2022. $154,300 2021 consulting fees related to employee benefits. $415,000 December 2021 shipping charges $469,500 vt 2nd half, 2021 real estate taxes $33,200 v December, 2021 electric bill $197,000 vt Charges for auditing 2021 freight bills $640,000 4th quarter, 2021 advertising services $135,750 v January 2022 purchase of repair parts $752,320 vt New welding equipment purchased and received in 2021 $289,450 vt December 2021 health insurance premiums for hourly employees Explanation of Audit Legends: v Examined invoice vt Examined invoice and traced to client's year-end adjustment Procedures: - Requested all unpaid invoices as of 2/10/22, as well as all invoices paid between 1/1/22-2/10/22. - Examined above invoices, noting period to which charges apply. - Traced 2021 charges to client's 12/31/21 adjustment for unrecorded liabilities. CREDIT 5 Procedures: 6 Requested all unpaid invoices as of 2/10/22, as well as all invoices paid between 1/1/22 - 2/10/22. 8 - Examined above invoices, noting period to which charges apply. 9 Traced 2021 charges to client's 12/31/21 adjustment for unrecorded liabilities. 0 1 2 Audit Adjustment 3 3 9452 Other Professional Services 4 8340 Advertising Expense 5 8310 Sales Commissions 6 9431 FICA Tax Expense 7 9432 State Unemployment Tax Expense 8 9480 Printing and Copying Expense 9 9481 Shipping and Postage Expense 0 9460 Supplies Expense 1 9458 Utilities Expense 2 2020 Accounts Payable 3 2051 FICA Payable 4 2054 Unemployment and Workers' Compensation Premiums Payable 5 2080 Accrued Commissions Payable 6 To record 2021 charges not reflected by Brony's Bikes 7 8 DEBIT 351300 640000 355600 93000 121000 23700 21400 16800 33200 1086400 93000 121000 355600 1656000 1656000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started