Answered step by step

Verified Expert Solution

Question

1 Approved Answer

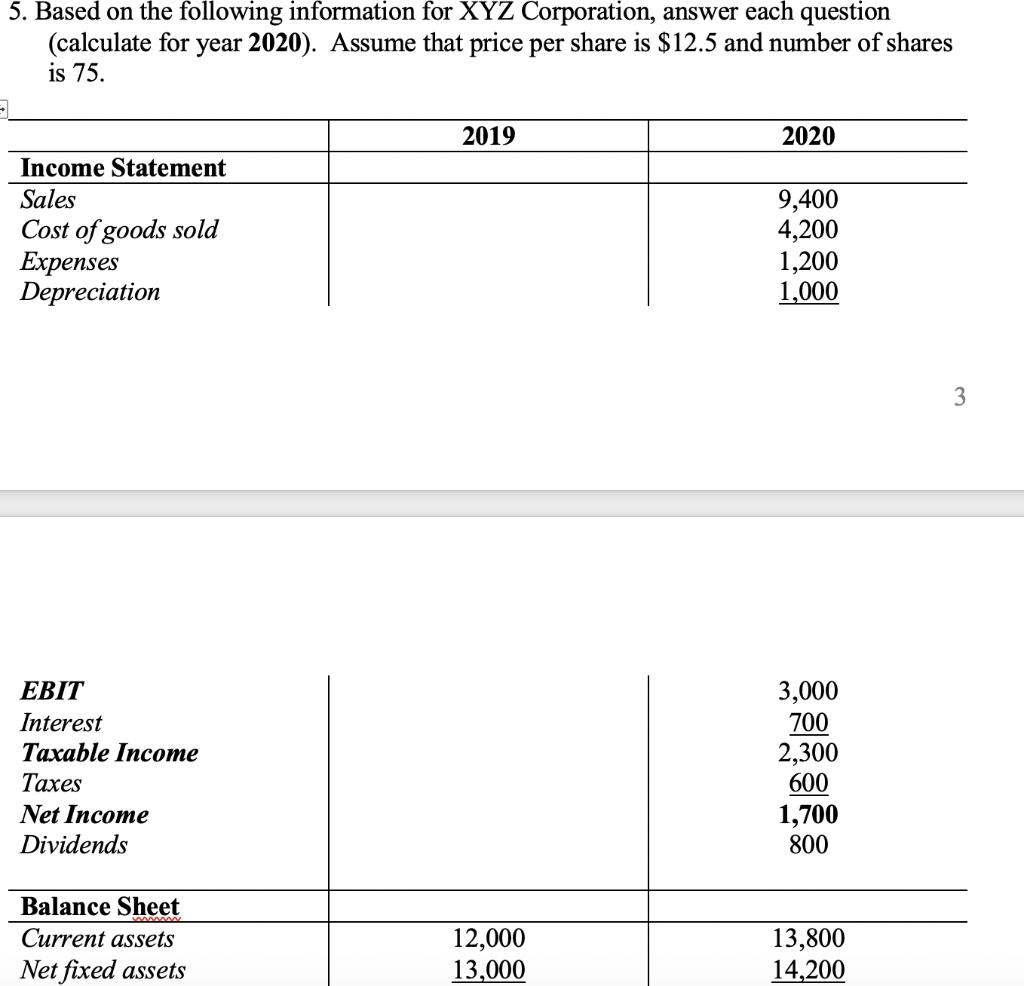

5. Based on the following information for XYZ Corporation, answer each question year 2020). Assume that price per share is $12.5 and number of

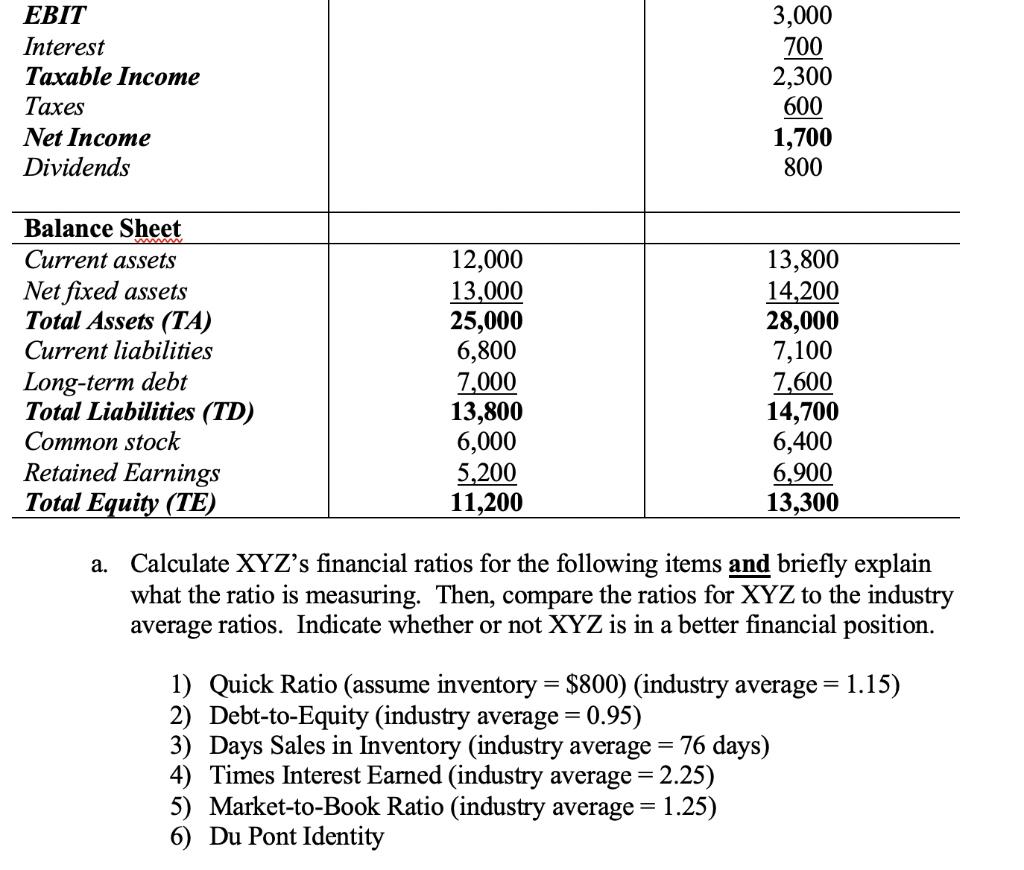

5. Based on the following information for XYZ Corporation, answer each question year 2020). Assume that price per share is $12.5 and number of shares (calculate for is 75. A Income Statement Sales Cost of goods sold Expenses Depreciation EBIT Interest Taxable Income Taxes Net Income Dividends Balance Sheet Current assets Net fixed assets 2019 12,000 13,000 2020 9,400 4,200 1,200 1,000 3,000 700 2,300 600 1,700 800 13,800 14,200 3 EBIT Interest Taxable Income Taxes Net Income Dividends Balance Sheet Current assets Net fixed assets Total Assets (TA) Current liabilities Long-term debt Total Liabilities (TD) Common stock Retained Earnings Total Equity (TE) a. 12,000 13,000 25,000 6,800 7,000 13,800 6,000 5,200 11,200 3,000 700 2,300 600 1,700 800 13,800 14,200 28,000 7,100 7,600 14,700 6,400 6,900 13,300 Calculate XYZ's financial ratios for the following items and briefly explain what the ratio is measuring. Then, compare the ratios for XYZ to the industry average ratios. Indicate whether or not XYZ is in a better financial position. 1) Quick Ratio (assume inventory = $800) (industry average = 1.15) 2) Debt-to-Equity (industry average = = 0.95) 3) Days Sales in Inventory (industry average = 76 days) 4) Times Interest Earned (industry average = 2.25) 5) Market-to-Book Ratio (industry average = 1.25) 6) Du Pont Identity

Step by Step Solution

★★★★★

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

1 Quick Ratio assume inventory 800 industry average 115 Quick Ratio Current Assets Inventory Current Liabilities Quick Ratio for XYZ 12000 800 6800 14...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started