Answered step by step

Verified Expert Solution

Question

1 Approved Answer

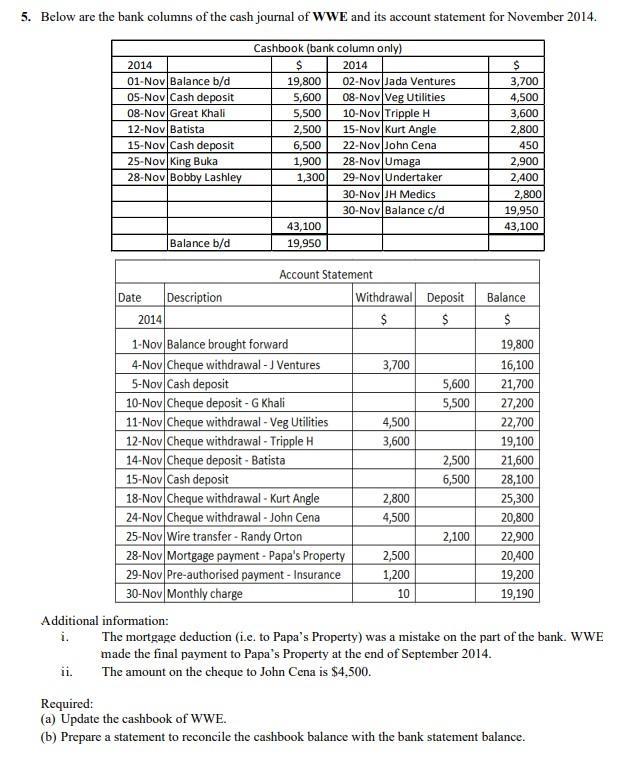

5. Below are the bank columns of the cash journal of WWE and its account statement for November 2014. Cashbook (bank column only) 2014

5. Below are the bank columns of the cash journal of WWE and its account statement for November 2014. Cashbook (bank column only) 2014 2014 01-Nov Balance b/d 05-Nov Cash deposit 08-Nov Great Khali 12-Nov Batista 15-Nov Cash deposit 25-Nov King Buka 28-Nov Bobby Lashley ii. Date Balance b/d Description $ 19,800 5,600 5,500 2,500 6,500 1,900 1,300 Additional information: 43,100 19,950 2014 1-Nov Balance brought forward. 4-Nov Cheque withdrawal - J Ventures 5-Nov Cash deposit Account Statement 10-Nov Cheque deposit - G Khali 11-Nov Cheque withdrawal - Veg Utilities 12-Nov Cheque withdrawal - Tripple H 14-Nov Cheque deposit - Batista 15-Nov Cash deposit 02-Nov Jada Ventures 08-Nov Veg Utilities 10-Nov Tripple H 15-Nov Kurt Angle 22-Nov John Cena 28-Nov Umaga 29-Nov Undertaker 30-Nov JH Medics 30-Nov Balance c/d 18-Nov Cheque withdrawal - Kurt Angle 24-Nov Cheque withdrawal - John Cena 25-Nov Wire transfer - Randy Orton 28-Nov Mortgage payment - Papa's Property 29-Nov Pre-authorised payment - Insurance 30-Nov Monthly charge Withdrawal Deposit $ $ 3,700 4,500 3,600 2,800 4,500 2,500 1,200 10 5,600 5,500 2,500 6,500 2,100 $ 3,700 4,500 3,600 2,800 450 2,900 2,400 2,800 19,950 43,100 Balance $ 19,800 16,100 21,700 27,200 22,700 19,100 21,600 28,100 25,300 20,800 22,900 20,400 19,200 19,190 The mortgage deduction (i.e. to Papa's Property) was a mistake on the part of the bank. WWE made the final payment to Papa's Property at the end of September 2014. The amount on the cheque to John Cena is $4,500. Required: (a) Update the cashbook of WWE. (b) Prepare a statement to reconcile the cashbook balance with the bank statement balance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer b ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started