Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. Business and financial risk The impact of financial leverage on return on equity and earnings per share Consider the following case of Green Rabbit

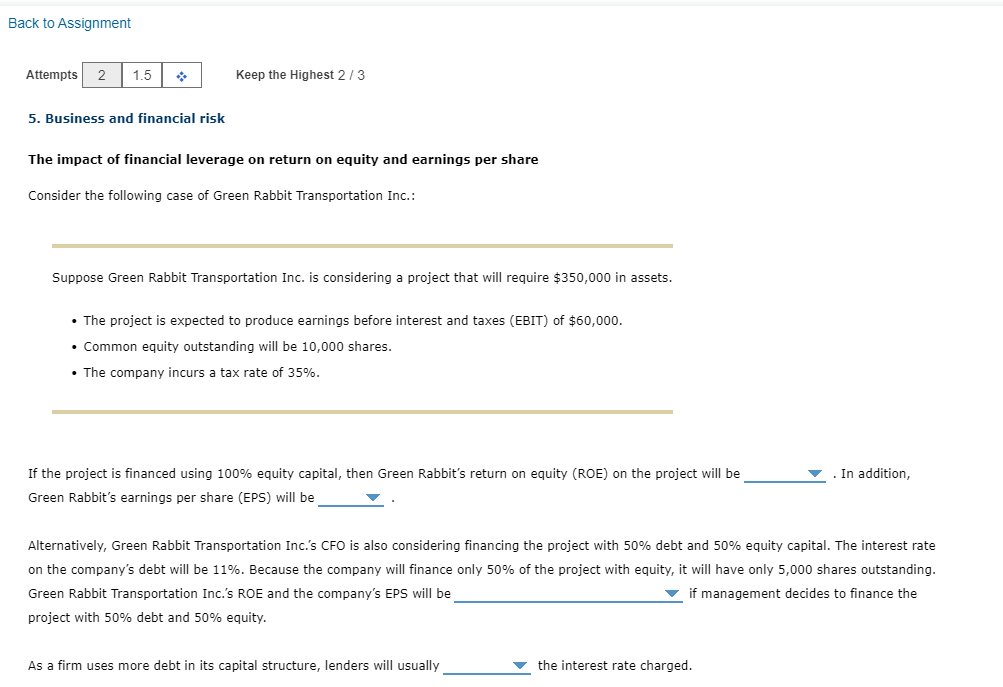

5. Business and financial risk The impact of financial leverage on return on equity and earnings per share Consider the following case of Green Rabbit Transportation Inc.: Suppose Green Rabbit Transportation Inc. is considering a project that will require $350,000 in assets. - The project is expected to produce earnings before interest and taxes (EBIT) of $60,000. - Common equity outstanding will be 10,000 shares. - The company incurs a tax rate of 35%. If the project is financed using 100% equity capital, then Green Rabbit's return on equity (ROE) on the project will be . In addition, Green Rabbit's earnings per share (EPS) will be Alternatively, Green Rabbit Transportation Inc.'s CFO is also considering financing the project with 50% debt and 50% equity capital. The interest rate on the company's debt will be 11%. Because the company will finance only 50% of the project with equity, it will have only 5,000 shares outstanding. Green Rabbit Transportation Inc.'s ROE and the company's EPS will be if management decides to finance the project with 50% debt and 50% equity. As a firm uses more debt in its capital structure, lenders will usually the interest rate charged

5. Business and financial risk The impact of financial leverage on return on equity and earnings per share Consider the following case of Green Rabbit Transportation Inc.: Suppose Green Rabbit Transportation Inc. is considering a project that will require $350,000 in assets. - The project is expected to produce earnings before interest and taxes (EBIT) of $60,000. - Common equity outstanding will be 10,000 shares. - The company incurs a tax rate of 35%. If the project is financed using 100% equity capital, then Green Rabbit's return on equity (ROE) on the project will be . In addition, Green Rabbit's earnings per share (EPS) will be Alternatively, Green Rabbit Transportation Inc.'s CFO is also considering financing the project with 50% debt and 50% equity capital. The interest rate on the company's debt will be 11%. Because the company will finance only 50% of the project with equity, it will have only 5,000 shares outstanding. Green Rabbit Transportation Inc.'s ROE and the company's EPS will be if management decides to finance the project with 50% debt and 50% equity. As a firm uses more debt in its capital structure, lenders will usually the interest rate charged Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started