Answered step by step

Verified Expert Solution

Question

1 Approved Answer

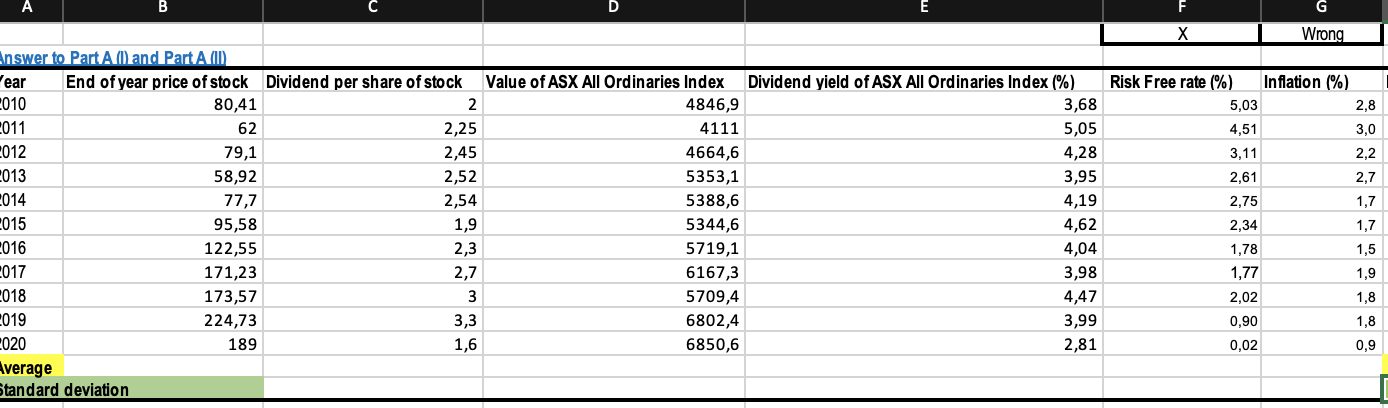

5. Calculate the exact annual real return (2010-2020) for the stock in column L (in decimals). 6. Calculate the exact annual real return (2010-2020) for

5. Calculate the exact annual real return (2010-2020) for the stock in column L (in decimals).

6. Calculate the exact annual real return (2010-2020) for the market in column M (in decimals).

7. Calculate the exact annual real return (2010-2020) for the risk-free asset in column N (in decimals).

A B C D E F G Wrong 2,8 2,25 Answer to Part Aland Part AM ear End of year price of stock Dividend per share of stock Value of ASX All Ordinaries Index 2010 80,41 2 4846,9 011 62 4111 2012 79,1 2,45 4664,6 2013 58,92 2,52 5353,1 2014 77,7 2,54 5388,6 015 95,58 1,9 5344,6 2016 122,55 2,3 5719,1 017 171,23 2,7 6167,3 2018 173,57 3 5709,4 2019 224,73 3,3 6802,4 C020 189 1,6 6850,6 Average Standard deviation Dividend yield of ASX All Ordinaries Index (%) 3,68 5,05 4,28 3,95 4,19 4,62 4,04 3,98 4,47 3,99 2,81 Risk Free rate (%) Inflation (%) 5,03 4,51 3,11 2,61 2,75 2,34 1,78 1,77 2,02 0,90 0,02 3,0 2,2 2,7 1,7 1,7 1,5 1,9 1,8 1,8 0,9 L M N Exact real return_stock Exact real return_market Exact real return_risk-free asset ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? . . . . ? A B C D E F G Wrong 2,8 2,25 Answer to Part Aland Part AM ear End of year price of stock Dividend per share of stock Value of ASX All Ordinaries Index 2010 80,41 2 4846,9 011 62 4111 2012 79,1 2,45 4664,6 2013 58,92 2,52 5353,1 2014 77,7 2,54 5388,6 015 95,58 1,9 5344,6 2016 122,55 2,3 5719,1 017 171,23 2,7 6167,3 2018 173,57 3 5709,4 2019 224,73 3,3 6802,4 C020 189 1,6 6850,6 Average Standard deviation Dividend yield of ASX All Ordinaries Index (%) 3,68 5,05 4,28 3,95 4,19 4,62 4,04 3,98 4,47 3,99 2,81 Risk Free rate (%) Inflation (%) 5,03 4,51 3,11 2,61 2,75 2,34 1,78 1,77 2,02 0,90 0,02 3,0 2,2 2,7 1,7 1,7 1,5 1,9 1,8 1,8 0,9 L M N Exact real return_stock Exact real return_market Exact real return_risk-free assetStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started