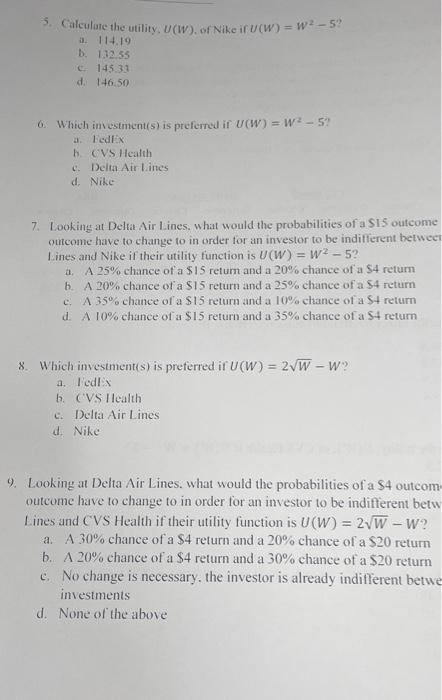

5. Calculate the utility. U(W) of Nike if (W) = W2 - 5% a. 114.19 b. 112.35 c.145 33 d. 146.50 6. Which investment(s) is preferred ir U(W) = W2 - 5? FedEx CVS Health c. Delta Air Lines d. Nike 7. Looking at Delta Air Lines, what would the probabilities of a S15 outcome outcome have to change to in order for an investor to be indifferent between Lines and Nike if their utility function is U (W) = W2 - 52 a. A 25% chance of a $15 return and a 20% chance of a $4 return 1. A 20% chance of a $15 return and a 25% chance of a $4 return A 35% chance of a $15 return and a 10% chance of a St return d. A 10% chance of a $15 return and a 35% chance of a S4 return c. 8. Which investment(s) is preferred ir (W) = 2VW-W? a. Fedex b. CVS Health c. Delta Air Lines d. Nike 9. Looking at Delta Air Lines, what would the probabilities of a $4 outcom outcome have to change to in order for an investor to be indifferent betw Lines and CVS Health if their utility function is U(W) = 2VW-W? a. A 30% chance of a $4 return and a 20% chance of a $20 return b. A 20% chance of a $4 return and a 30% chance of a $20 return c. No change is necessary, the investor is already indifferent betwe investments d. None of the above 5. Calculate the utility. U(W) of Nike if (W) = W2 - 5% a. 114.19 b. 112.35 c.145 33 d. 146.50 6. Which investment(s) is preferred ir U(W) = W2 - 5? FedEx CVS Health c. Delta Air Lines d. Nike 7. Looking at Delta Air Lines, what would the probabilities of a S15 outcome outcome have to change to in order for an investor to be indifferent between Lines and Nike if their utility function is U (W) = W2 - 52 a. A 25% chance of a $15 return and a 20% chance of a $4 return 1. A 20% chance of a $15 return and a 25% chance of a $4 return A 35% chance of a $15 return and a 10% chance of a St return d. A 10% chance of a $15 return and a 35% chance of a S4 return c. 8. Which investment(s) is preferred ir (W) = 2VW-W? a. Fedex b. CVS Health c. Delta Air Lines d. Nike 9. Looking at Delta Air Lines, what would the probabilities of a $4 outcom outcome have to change to in order for an investor to be indifferent betw Lines and CVS Health if their utility function is U(W) = 2VW-W? a. A 30% chance of a $4 return and a 20% chance of a $20 return b. A 20% chance of a $4 return and a 30% chance of a $20 return c. No change is necessary, the investor is already indifferent betwe investments d. None of the above