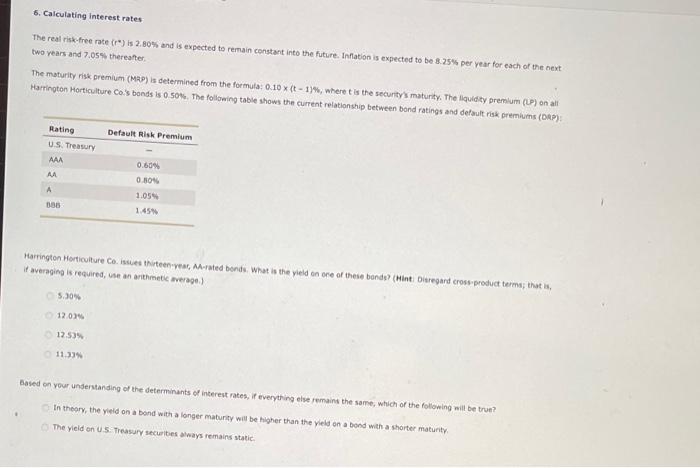

5. Calculating interest rates The real risk-free rate (r) is 2.80% and is expected to remain constant into the future. Inflation is expected to be 8.25 sh per year for each of the next two vears and 7.05% thereafer. The maturity risk premium (Map) is delermined from the formula: 0.10 it - 1 fw; where t is the security's maturity. The llquidity premium (uP) on all Harrington Horticulture cois bonds is 0 soth. The following table shows the current relationship between bond ratings and defarult risk oremluins (Oap): Harrington Horticulture Co. iscues thirteencyeac, MA-rated bends. What is the yield on ore of these bonds? (Hinti Ditregard cross.preduct termal that is, if ayeraging is required, use an arthmete merage.) 5.30%12.03%12.53%11.33% Based on your unjerstanding of the determinants of interest rates, if everything else femaint the same, which of the following mill be true? In theary, the vield on a bond with a longer maturity will be higher than the vield on a bond with a shorter maturity. The yield on 6.5 . Treasury securites always femains static. 5. Calculating interest rates The real risk-free rate (r) is 2.80% and is expected to remain constant into the future. Inflation is expected to be 8.25 sh per year for each of the next two vears and 7.05% thereafer. The maturity risk premium (Map) is delermined from the formula: 0.10 it - 1 fw; where t is the security's maturity. The llquidity premium (uP) on all Harrington Horticulture cois bonds is 0 soth. The following table shows the current relationship between bond ratings and defarult risk oremluins (Oap): Harrington Horticulture Co. iscues thirteencyeac, MA-rated bends. What is the yield on ore of these bonds? (Hinti Ditregard cross.preduct termal that is, if ayeraging is required, use an arthmete merage.) 5.30%12.03%12.53%11.33% Based on your unjerstanding of the determinants of interest rates, if everything else femaint the same, which of the following mill be true? In theary, the vield on a bond with a longer maturity will be higher than the vield on a bond with a shorter maturity. The yield on 6.5 . Treasury securites always femains static