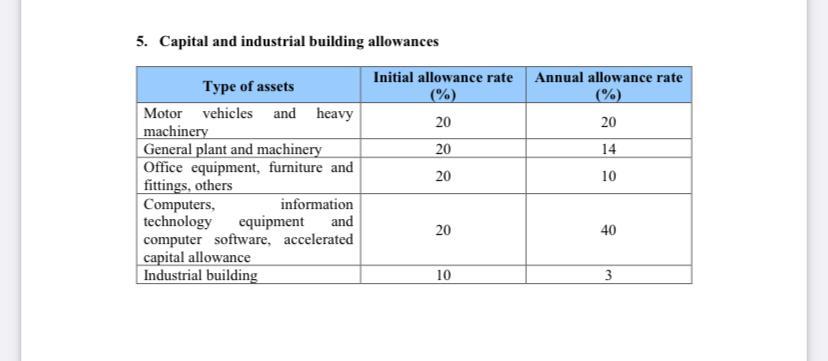

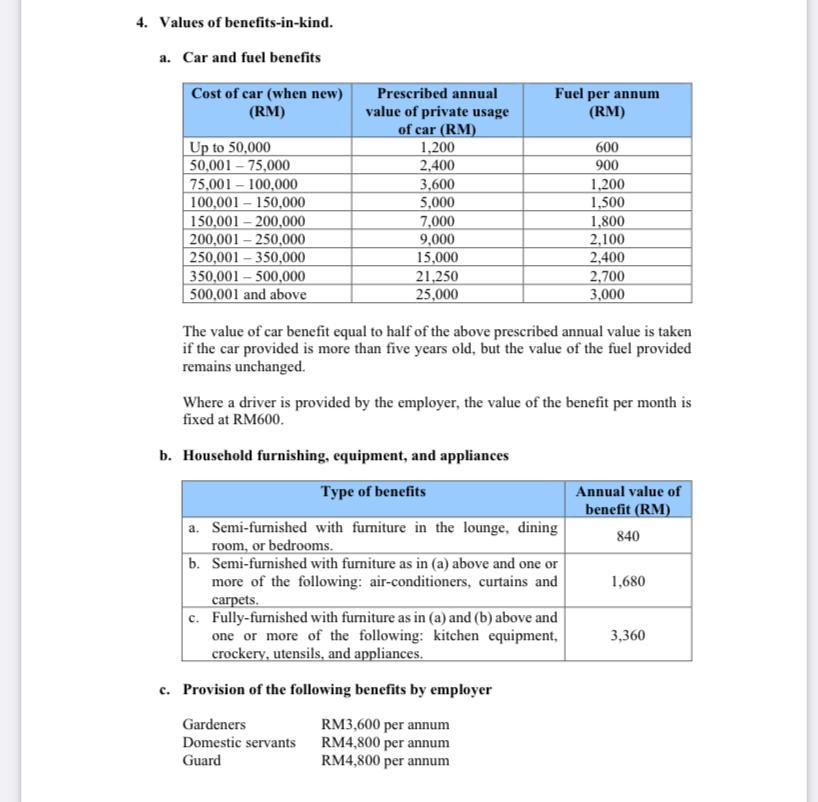

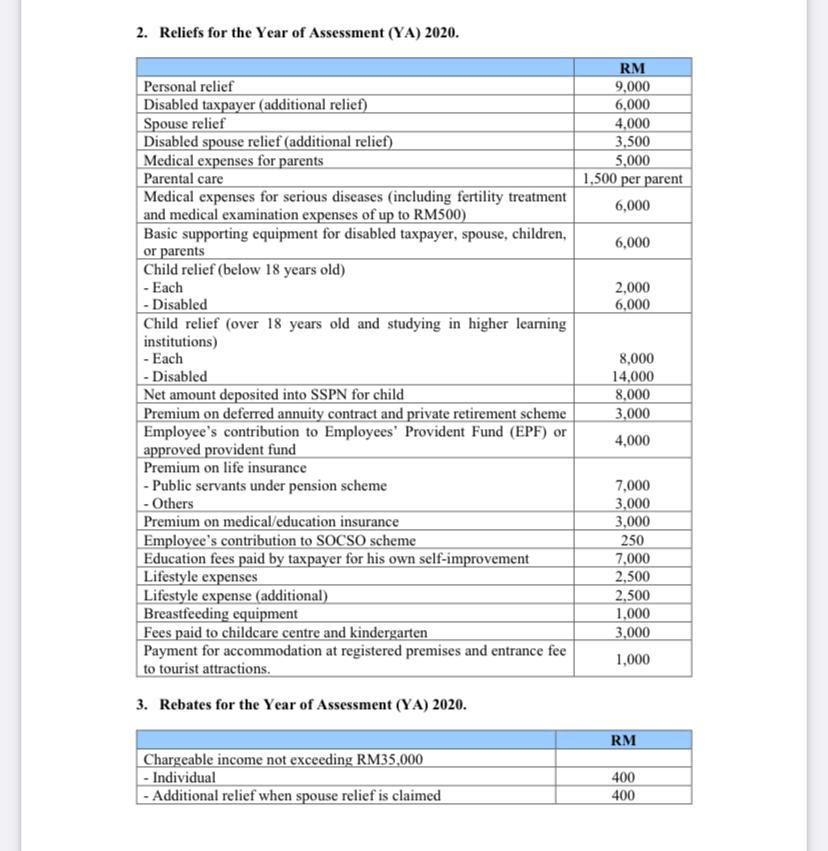

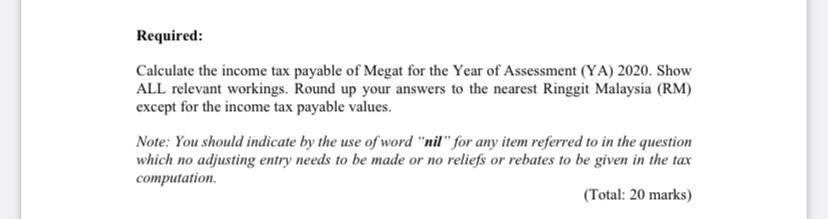

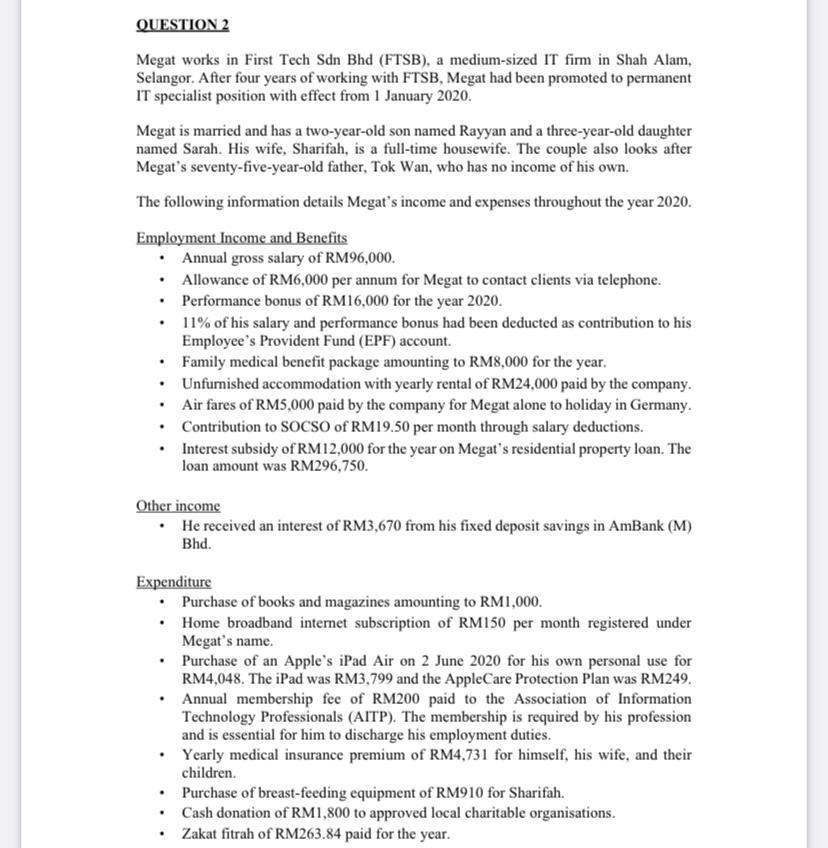

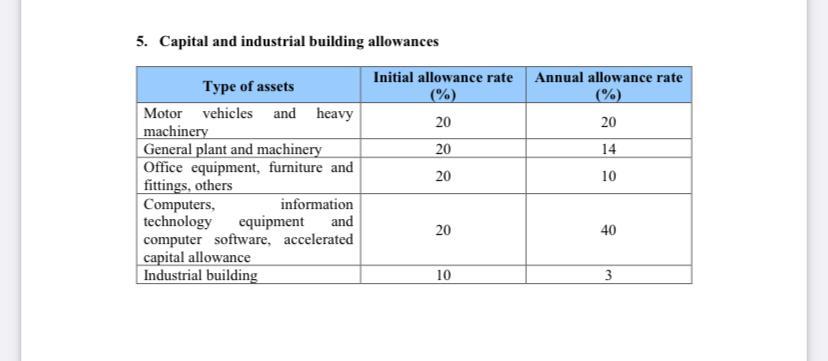

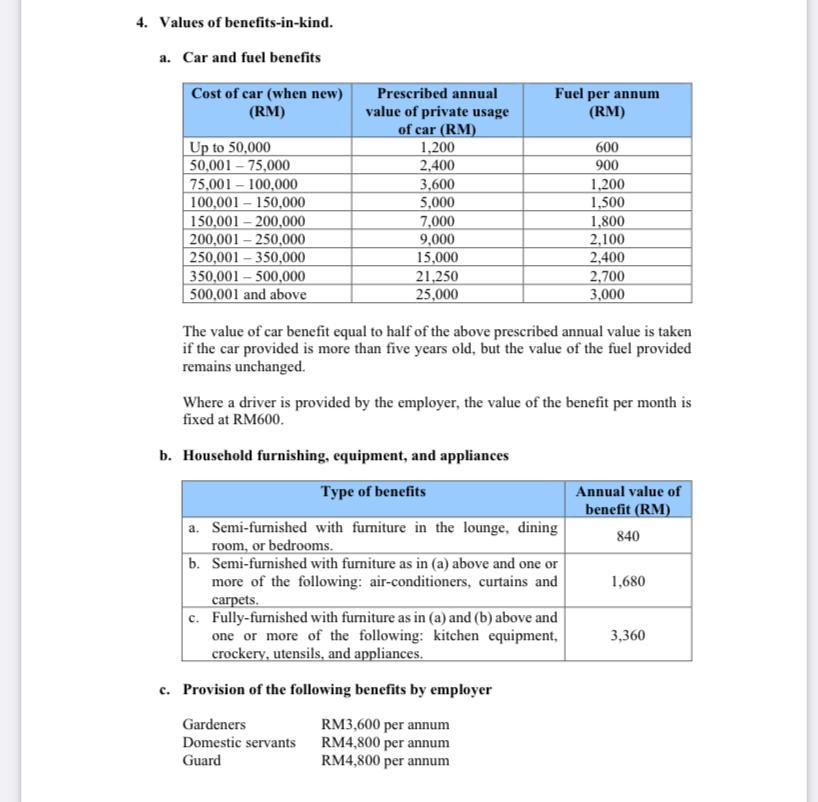

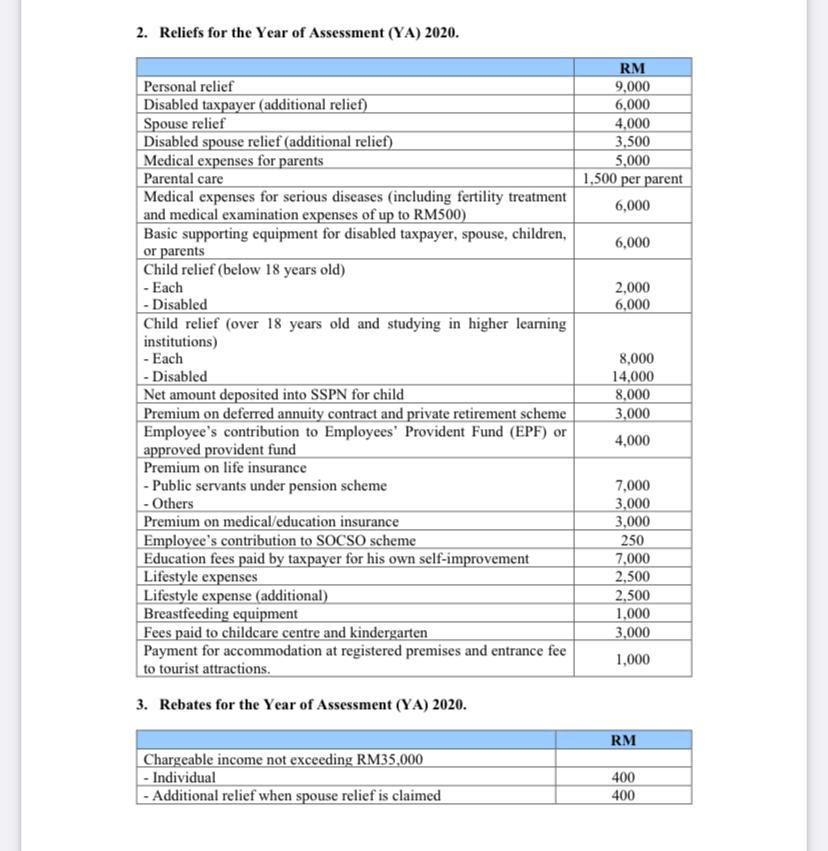

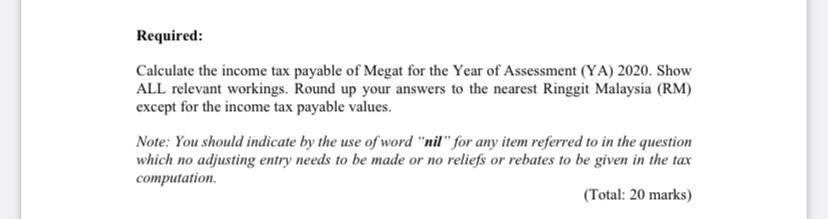

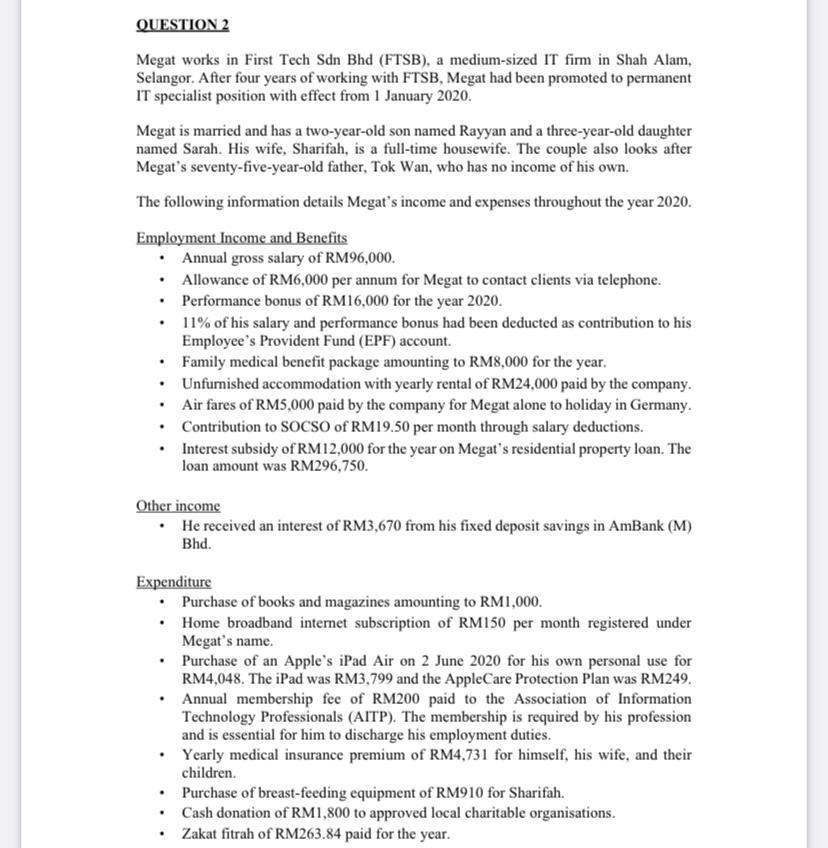

5. Capital and industrial building allowances Initial allowance rate (%) 20 20 Annual allowance rate (%) 20 14 Type of assets Motor vehicles and heavy machinery General plant and machinery Office equipment, furniture and fittings, others Computers, information technology equipment and computer software, accelerated capital allowance Industrial building 20 10 20 40 10 3 4. Values of benefits-in-kind. a. Car and fuel benefits Cost of car (when new) (RM) Fuel per annum (RM) Up to 50,000 50,001 - 75,000 75,001 - 100,000 100,001 - 150,000 150,001 - 200,000 200,001 - 250.000 250,001 - 350,000 350,001 - 500,000 500,001 and above Prescribed annual value of private usage of car (RM) 1,200 2,400 3,600 5,000 7,000 9,000 15,000 21,250 25,000 600 900 1.200 1,500 1,800 2,100 2,400 2,700 3,000 The value of car benefit equal to half of the above prescribed annual value is taken if the car provided is more than five years old, but the value of the fuel provided remains unchanged. Where a driver is provided by the employer, the value of the benefit per month is fixed at RM600. b. Household furnishing, equipment, and appliances Type of benefits Annual value of benefit (RM) 840 1,680 a. Semi-furnished with furniture in the lounge, dining room, or bedrooms. b. Semi-furnished with furniture as in (a) above and one or more of the following: air-conditioners, curtains and carpets. c. Fully-furnished with furniture as in (a) and (b) above and one or more of the following: kitchen equipment, crockery, utensils, and appliances. 3,360 c. Provision of the following benefits by employer Gardeners Domestic servants Guard RM3,600 per annum RM4,800 per annum RM4,800 per annum 2. Reliefs for the Year of Assessment (YA) 2020. RM 9,000 6,000 4,000 3,500 5,000 1.500 per parent 6,000 6,000 2,000 6,000 Personal relief Disabled taxpayer (additional relief) Spouse relief Disabled spouse relief (additional relief) Medical expenses for parents Parental care Medical expenses for serious diseases (including fertility treatment and medical examination expenses of up to RM500) Basic supporting equipment for disabled taxpayer, spouse, children, or parents Child relief (below 18 years old) - Each - Disabled Child relief (over 18 years old and studying in higher learning institutions) - Each - Disabled Net amount deposited into SSPN for child Premium on deferred annuity contract and private retirement scheme Employee's contribution to Employees' Provident Fund (EPF) or approved provident fund Premium on life insurance - Public servants under pension scheme - Others Premium on medical education insurance Employee's contribution to SOCSO scheme Education fees paid by taxpayer for his own self-improvement Lifestyle expenses Lifestyle expense (additional) Breastfeeding equipment Fees paid to childcare centre and kindergarten Payment for accommodation at registered premises and entrance fee to tourist attractions. 3. Rebates for the Year of Assessment (YA) 2020. 8,000 14,000 8,000 3,000 4,000 7,000 3,000 3,000 250 7,000 2,500 2,500 1,000 3,000 1,000 RM Chargeable income not exceeding RM35,000 - Individual - Additional relief when spouse relief is claimed 400 400 Required: Calculate the income tax payable of Megat for the Year of Assessment (YA) 2020. Show ALL relevant workings. Round up your answers to the nearest Ringgit Malaysia (RM) except for the income tax payable values. Note: You should indicate by the use of word "nil" for any item referred to in the question which no adjusting entry needs to be made or no reliefs or rebates to be given in the tax computation. (Total: 20 marks) QUESTION 2 Megat works in First Tech Sdn Bhd (FTSB), a medium-sized IT firm in Shah Alam, Selangor. After four years of working with FTSB, Megat had been promoted to permanent IT specialist position with effect from 1 January 2020. Megat is married and has a two-year-old son named Rayyan and a three-year-old daughter named Sarah. His wife, Sharifah, is a full-time housewife. The couple also looks after Megat's seventy-five-year-old father, Tok Wan, who has no income of his own. The following information details Megat's income and expenses throughout the year 2020. Employment Income and Benefits Annual gross salary of RM96,000. Allowance of RM6,000 per annum for Megat to contact clients via telephone. Performance bonus of RM16,000 for the year 2020. 11% of his salary and performance bonus had been deducted as contribution to his Employee's Provident Fund (EPF) account. Family medical benefit package amounting to RM8,000 for the year. Unfurnished accommodation with yearly rental of RM24,000 paid by the company. Air fares of RM5,000 paid by the company for Megat alone to holiday in Germany. Contribution to SOCSO of RM19.50 per month through salary deductions. Interest subsidy of RM12,000 for the year on Megat's residential property loan. The loan amount was RM296,750. Other income He received an interest of RM3,670 from his fixed deposit savings in AmBank (M) Bhd. . Expenditure Purchase of books and magazines amounting to RM1,000. Home broadband internet subscription of RM150 per month registered under Megat's name. Purchase of an Apple's iPad Air on 2 June 2020 for his own personal use for RM4,048. The iPad was RM3,799 and the AppleCare Protection Plan was RM249. Annual membership fee of RM200 paid to the Association of Information Technology Professionals (AITP). The membership is required by his profession and is essential for him to discharge his employment duties. Yearly medical insurance premium of RM4,731 for himself, his wife, and their children. Purchase of breast-feeding equipment of RM910 for Sharifah. Cash donation of RM1,800 to approved local charitable organisations. Zakat fitrah of RM263.84 paid for the year. . . 5. Capital and industrial building allowances Initial allowance rate (%) 20 20 Annual allowance rate (%) 20 14 Type of assets Motor vehicles and heavy machinery General plant and machinery Office equipment, furniture and fittings, others Computers, information technology equipment and computer software, accelerated capital allowance Industrial building 20 10 20 40 10 3 4. Values of benefits-in-kind. a. Car and fuel benefits Cost of car (when new) (RM) Fuel per annum (RM) Up to 50,000 50,001 - 75,000 75,001 - 100,000 100,001 - 150,000 150,001 - 200,000 200,001 - 250.000 250,001 - 350,000 350,001 - 500,000 500,001 and above Prescribed annual value of private usage of car (RM) 1,200 2,400 3,600 5,000 7,000 9,000 15,000 21,250 25,000 600 900 1.200 1,500 1,800 2,100 2,400 2,700 3,000 The value of car benefit equal to half of the above prescribed annual value is taken if the car provided is more than five years old, but the value of the fuel provided remains unchanged. Where a driver is provided by the employer, the value of the benefit per month is fixed at RM600. b. Household furnishing, equipment, and appliances Type of benefits Annual value of benefit (RM) 840 1,680 a. Semi-furnished with furniture in the lounge, dining room, or bedrooms. b. Semi-furnished with furniture as in (a) above and one or more of the following: air-conditioners, curtains and carpets. c. Fully-furnished with furniture as in (a) and (b) above and one or more of the following: kitchen equipment, crockery, utensils, and appliances. 3,360 c. Provision of the following benefits by employer Gardeners Domestic servants Guard RM3,600 per annum RM4,800 per annum RM4,800 per annum 2. Reliefs for the Year of Assessment (YA) 2020. RM 9,000 6,000 4,000 3,500 5,000 1.500 per parent 6,000 6,000 2,000 6,000 Personal relief Disabled taxpayer (additional relief) Spouse relief Disabled spouse relief (additional relief) Medical expenses for parents Parental care Medical expenses for serious diseases (including fertility treatment and medical examination expenses of up to RM500) Basic supporting equipment for disabled taxpayer, spouse, children, or parents Child relief (below 18 years old) - Each - Disabled Child relief (over 18 years old and studying in higher learning institutions) - Each - Disabled Net amount deposited into SSPN for child Premium on deferred annuity contract and private retirement scheme Employee's contribution to Employees' Provident Fund (EPF) or approved provident fund Premium on life insurance - Public servants under pension scheme - Others Premium on medical education insurance Employee's contribution to SOCSO scheme Education fees paid by taxpayer for his own self-improvement Lifestyle expenses Lifestyle expense (additional) Breastfeeding equipment Fees paid to childcare centre and kindergarten Payment for accommodation at registered premises and entrance fee to tourist attractions. 3. Rebates for the Year of Assessment (YA) 2020. 8,000 14,000 8,000 3,000 4,000 7,000 3,000 3,000 250 7,000 2,500 2,500 1,000 3,000 1,000 RM Chargeable income not exceeding RM35,000 - Individual - Additional relief when spouse relief is claimed 400 400 Required: Calculate the income tax payable of Megat for the Year of Assessment (YA) 2020. Show ALL relevant workings. Round up your answers to the nearest Ringgit Malaysia (RM) except for the income tax payable values. Note: You should indicate by the use of word "nil" for any item referred to in the question which no adjusting entry needs to be made or no reliefs or rebates to be given in the tax computation. (Total: 20 marks) QUESTION 2 Megat works in First Tech Sdn Bhd (FTSB), a medium-sized IT firm in Shah Alam, Selangor. After four years of working with FTSB, Megat had been promoted to permanent IT specialist position with effect from 1 January 2020. Megat is married and has a two-year-old son named Rayyan and a three-year-old daughter named Sarah. His wife, Sharifah, is a full-time housewife. The couple also looks after Megat's seventy-five-year-old father, Tok Wan, who has no income of his own. The following information details Megat's income and expenses throughout the year 2020. Employment Income and Benefits Annual gross salary of RM96,000. Allowance of RM6,000 per annum for Megat to contact clients via telephone. Performance bonus of RM16,000 for the year 2020. 11% of his salary and performance bonus had been deducted as contribution to his Employee's Provident Fund (EPF) account. Family medical benefit package amounting to RM8,000 for the year. Unfurnished accommodation with yearly rental of RM24,000 paid by the company. Air fares of RM5,000 paid by the company for Megat alone to holiday in Germany. Contribution to SOCSO of RM19.50 per month through salary deductions. Interest subsidy of RM12,000 for the year on Megat's residential property loan. The loan amount was RM296,750. Other income He received an interest of RM3,670 from his fixed deposit savings in AmBank (M) Bhd. . Expenditure Purchase of books and magazines amounting to RM1,000. Home broadband internet subscription of RM150 per month registered under Megat's name. Purchase of an Apple's iPad Air on 2 June 2020 for his own personal use for RM4,048. The iPad was RM3,799 and the AppleCare Protection Plan was RM249. Annual membership fee of RM200 paid to the Association of Information Technology Professionals (AITP). The membership is required by his profession and is essential for him to discharge his employment duties. Yearly medical insurance premium of RM4,731 for himself, his wife, and their children. Purchase of breast-feeding equipment of RM910 for Sharifah. Cash donation of RM1,800 to approved local charitable organisations. Zakat fitrah of RM263.84 paid for the year