Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5) Capital Market Expectations (15 Points - 25 Minutes) An investor is considering adding three new securities to his internationally focused fixed-income portfolio. The

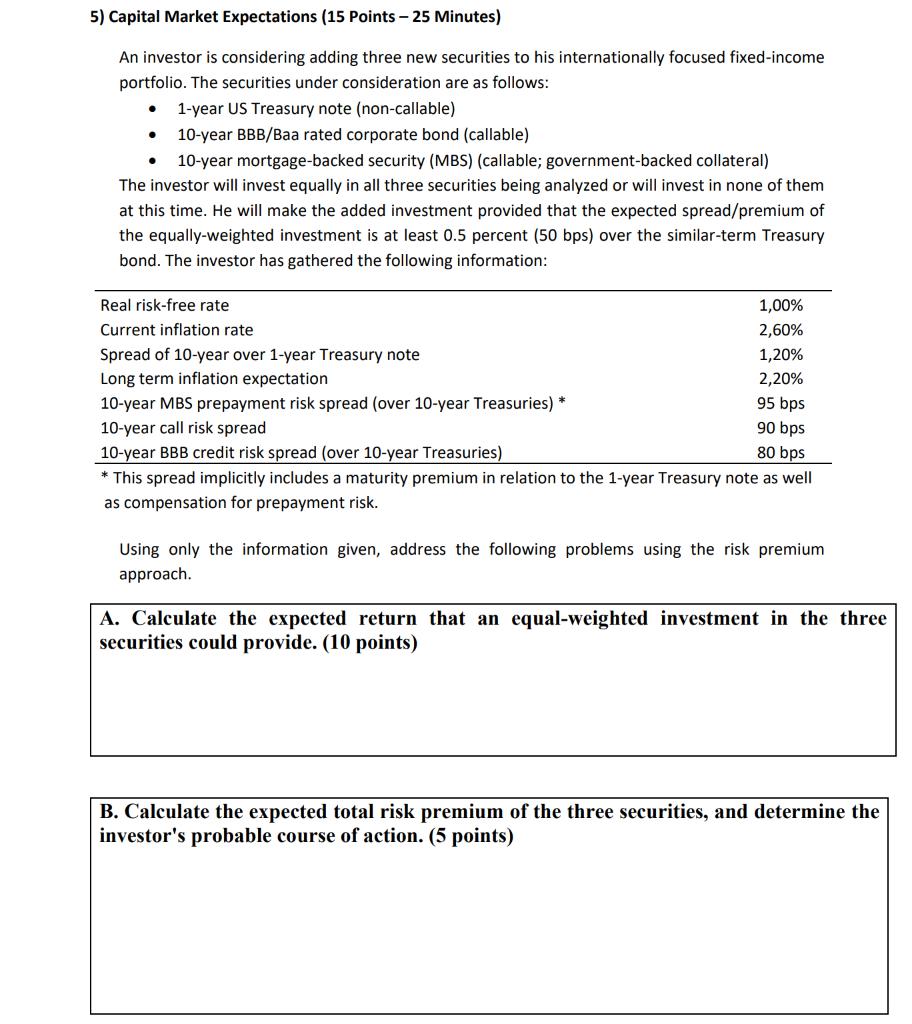

5) Capital Market Expectations (15 Points - 25 Minutes) An investor is considering adding three new securities to his internationally focused fixed-income portfolio. The securities under consideration are as follows: 1-year US Treasury note (non-callable) 10-year BBB/Baa rated corporate bond (callable) 10-year mortgage-backed security (MBS) (callable; government-backed collateral) The investor will invest equally in all three securities being analyzed or will invest in none of them at this time. He will make the added investment provided that the expected spread/premium of the equally-weighted investment is at least 0.5 percent (50 bps) over the similar-term Treasury bond. The investor has gathered the following information: Real risk-free rate Current inflation rate Spread of 10-year over 1-year Treasury note Long term inflation expectation 1,00% 2,60% 1,20% 2,20% 10-year MBS prepayment risk spread (over 10-year Treasuries) * 10-year call risk spread 95 bps 90 bps 80 bps 10-year BBB credit risk spread (over 10-year Treasuries) This spread implicitly includes a maturity premium in relation to the 1-year Treasury note as well as compensation for prepayment risk. Using only the information given, address the following problems using the risk premium approach. A. Calculate the expected return that an equal-weighted investment in the three securities could provide. (10 points) B. Calculate the expected total risk premium of the three securities, and determine the investor's probable course of action. (5 points)

Step by Step Solution

★★★★★

3.30 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started