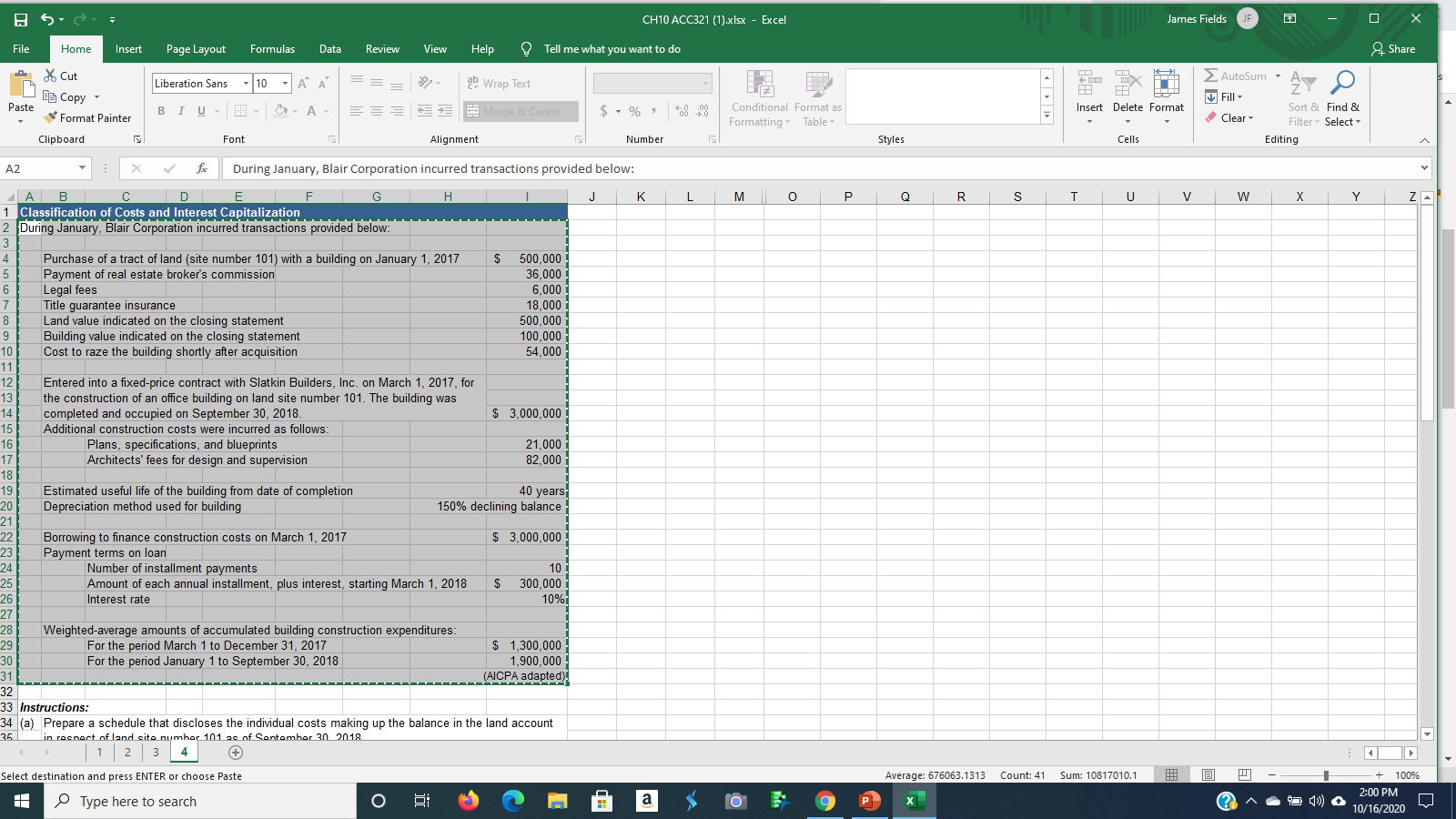

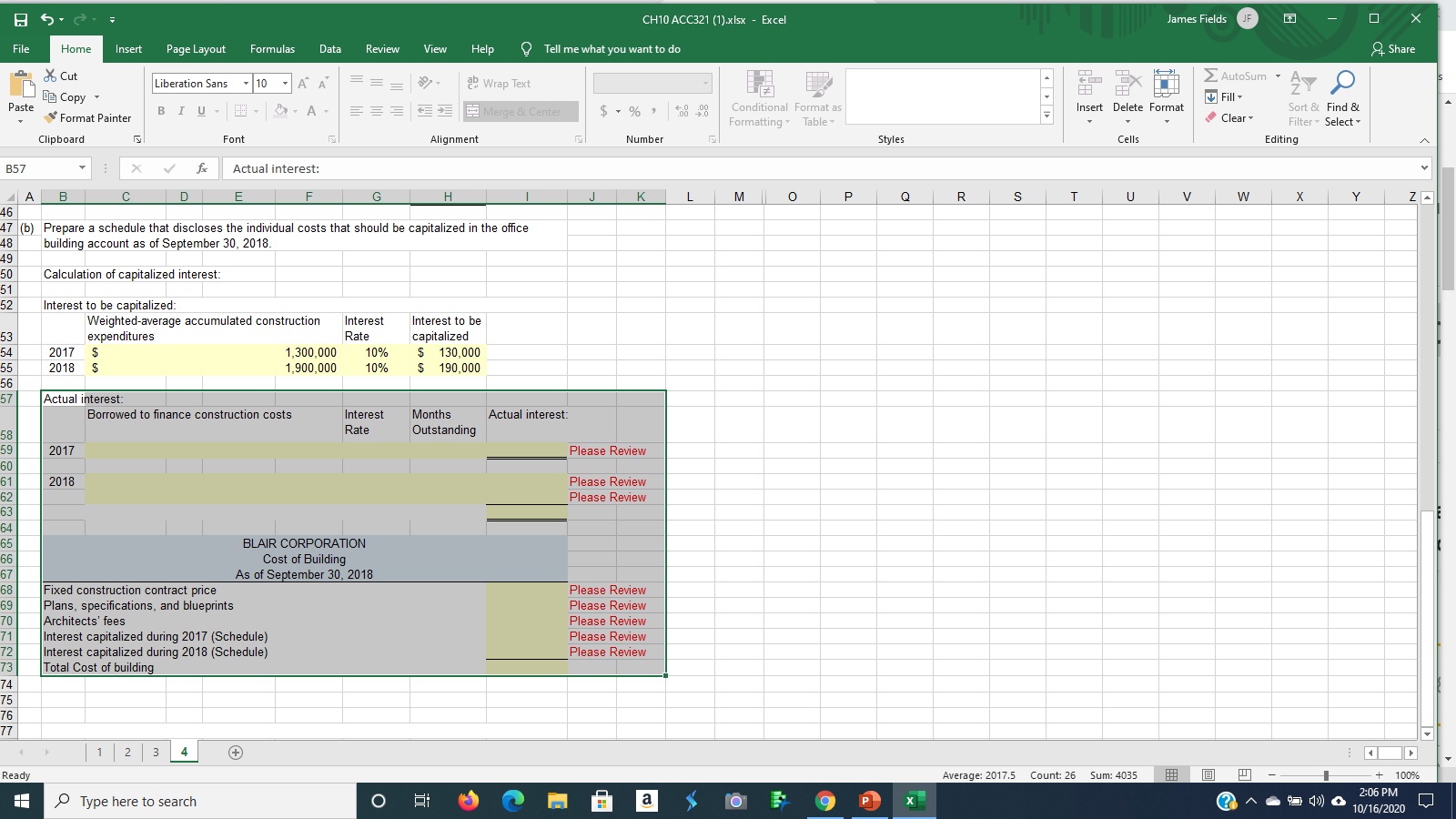

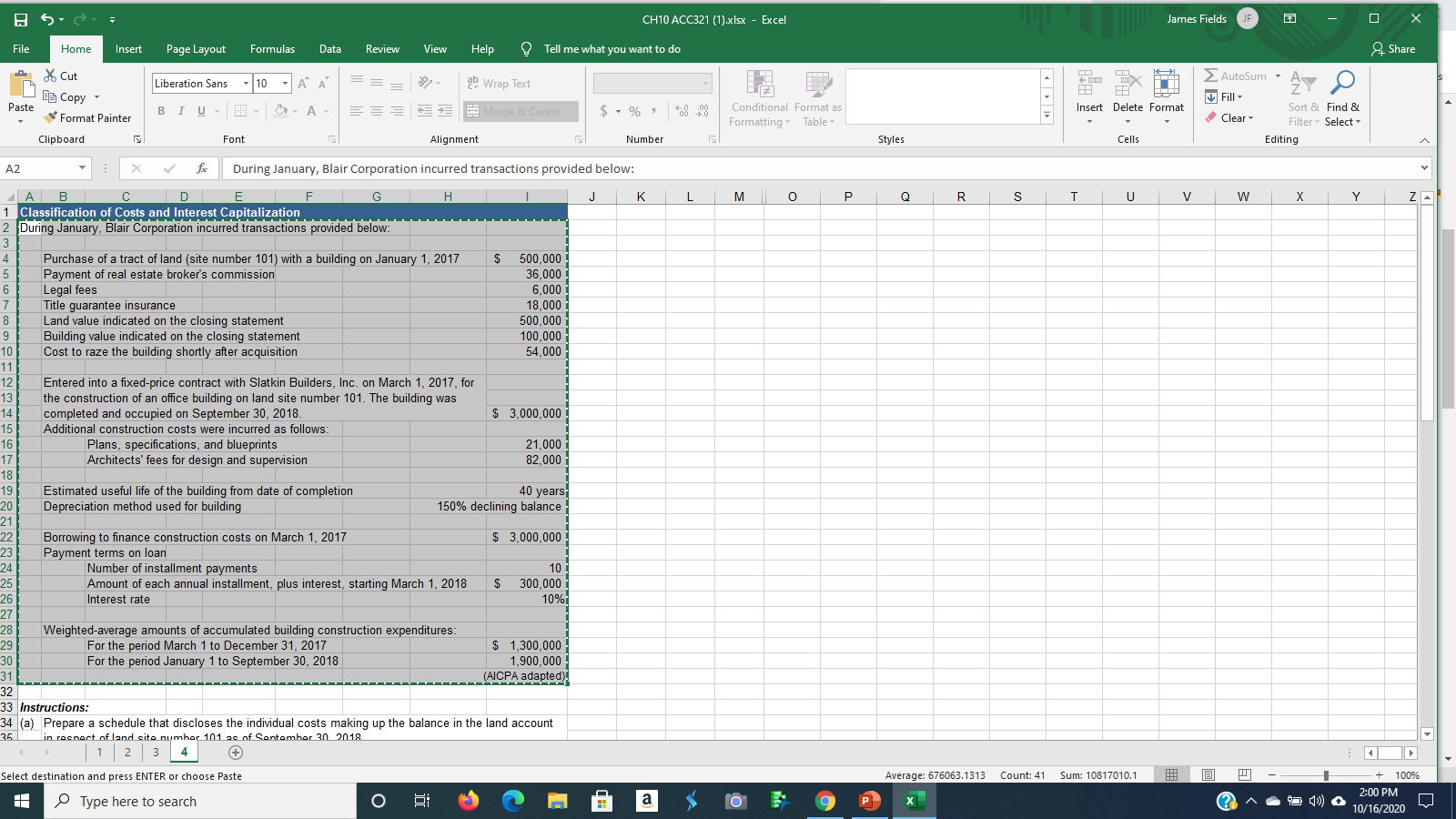

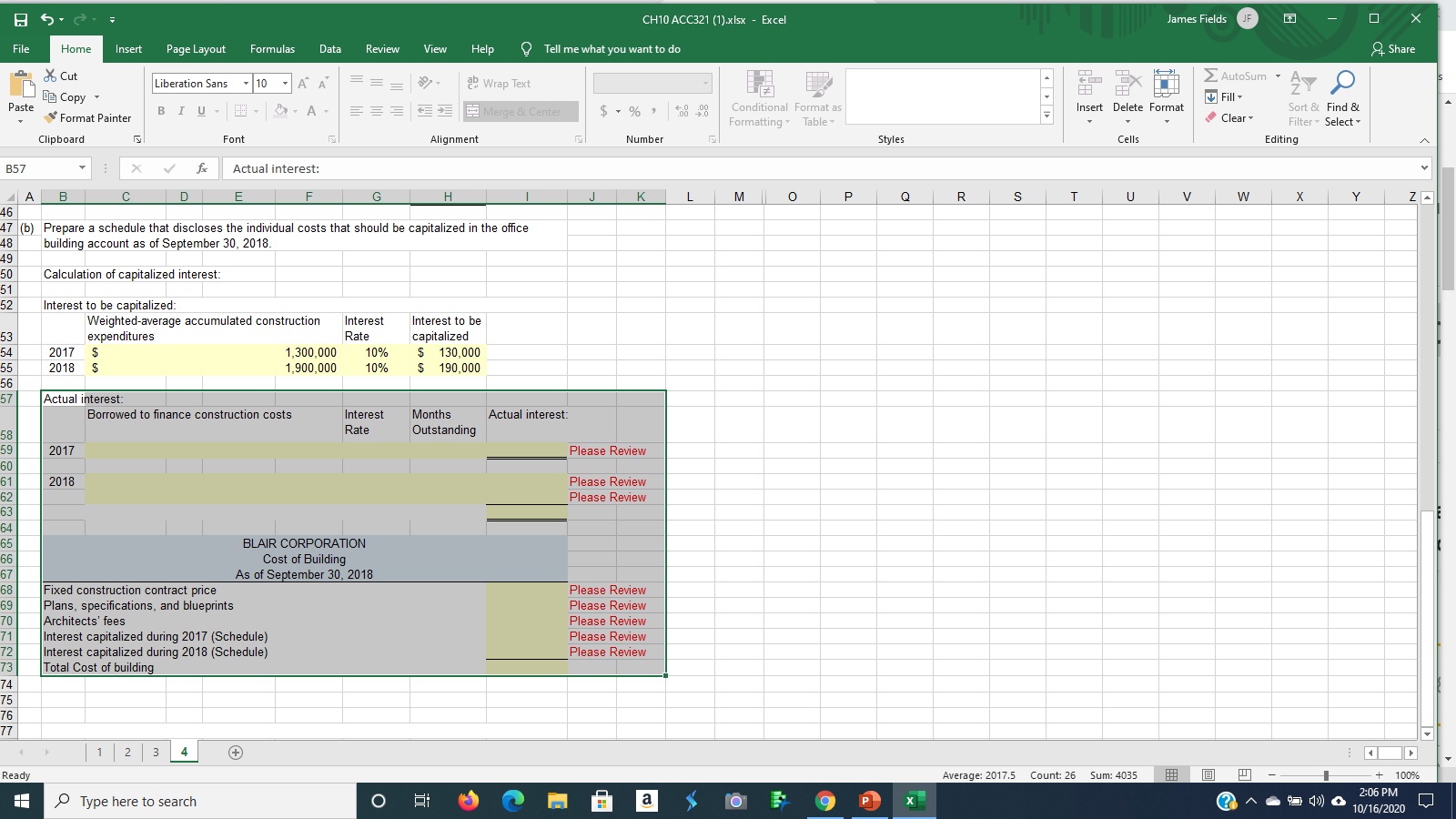

5. CH10 ACC321 (1).xlsx - Excel James Fields File Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do Share A! >AutoSum - Liberation Sans 10 Wrap Text A O * Cut E Copy Format Painter Paste BIU - P - === Merge 8 Center $ - % Insert Delete Format Conditional Format as Formatting Table Fill - Clear Sort & Find & Filter -Select- Editing Clipboard Font Alignment Number Styles Cells D L M 0 R S T U V w x Y A2 During January, Blair Corporation incurred transactions provided below: B C E G . J K 1 Classification of Costs and Interest Capitalization 2 During ring January, Blair Corporation incurred transactions provided below: 3 4 Purchase of a tract of land (site number 101) with a building on January 1, 2017 $ 500,000 5 Payment of real estate broker's commission 36,000! 6 Legal fees 6.000 7 Title guarantee insurance 18,000 8 Land value indicated on the closing statement 500,000 9 Building value indicated on the closing statement 100,000 : 10 Cost to raze the building shortly after acquisition 54,000 11 12 Entered into a fixed-price contract with Slatkin Builders, Inc. on March 1, 2017, for 13 the construction of an office building on land site number 101. The building was 14 completed and occupied on September 30, 2018 $ 3,000,000 15: Additional construction costs were incurred as follows: 16 Plans, specifications, and blueprints 21,000 : 17 Architects' fees for design and supervision 82,000 18 19 Estimated useful life of the building from date of completion 20 Depreciation method used for building 150% declining balance 21 22 Borrowing to finance construction costs on March 1, 2017 $ 3,000,000 23 Payment terms on loan 24 Number of installment payments 10! 25 Amount of each annual installment, plus interest, starting March 1, 2018 $ 300,000 26 Interest rate 10% 27 28 Weighted-average amounts of accumulated building construction expenditures: 29 For the period March 1 to December 31, 2017 $ 1,300,000 30 For the period January 1 to September 30, 2018 1,900,000 31 (AICPA adapted). 32 33 Instructions: 34 (a) Prepare a schedule that discloses the individual costs making up the balance in the land account 35 in recnect of land cite numer 101 ac of Santambar 30 2018 4 + 40 years "' 11 12 13 14 Average: 676063.1313 Count: 41 Sum: 10817010.1 O Select destination and press ENTER or choose Paste H Type here to search a 100% 2:00 PM 10/16/2020 O x (? 171 Ss CH10 ACC321 (1).xlsx - Excel James Fields JF File Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do Share >AutoSum - Liberation Sans 10 ab Wrap Text A O HH * Cut E Copy Format Painter H Fill - Paste BIU-- BA A- Merge & Center $ - % 60 00 .00 0 Insert Delete Format Conditional Format as Formatting Table Clear Sort & Find & Filter - Select - Editing Clipboard Font Alignment Number Styles Cells B57 X for Actual interest: L M 0 0 R S T U V w x Y ZA B D E F G . K 46 47 (6) Prepare a schedule that discloses the individual costs that should be capitalized in the office 48 building account as of September 30, 2018. 49 50 Calculation of capitalized interest 51 52 Interest to be capitalized: Weighted average accumulated construction Interest Interest to be 53 expenditures Rate capitalized 54 2017 $ 1,300,000 10% $ 130,000 55 2018 $ 1,900,000 10% $ 190,000 56 571 Actual interest: Borrowed to finance construction costs Interest Months Actual interest: 58 Rate Outstanding 59 2017 Please Review 60 61 2018 Please Review 62 Please Review 63 64 65 BLAIR CORPORATION 66 Cost of Building 67 As of September 30, 2018 68 Fixed construction contract price Please Review 69 Plans, specifications, and blueprints Please Review 70 Architects' fees Please Review 71 Interest capitalized during 2017 (Schedule) Please Review 72 Interest capitalized during 2018 (Schedule) Please Review 73 Total Cost of building 74 75 76 77 1 2 3 4 Ready Average: 2017.5 Count: 26 Sum: 4035 + 100% Type here to search 5 a O X (? 2:06 PM 10/16/2020