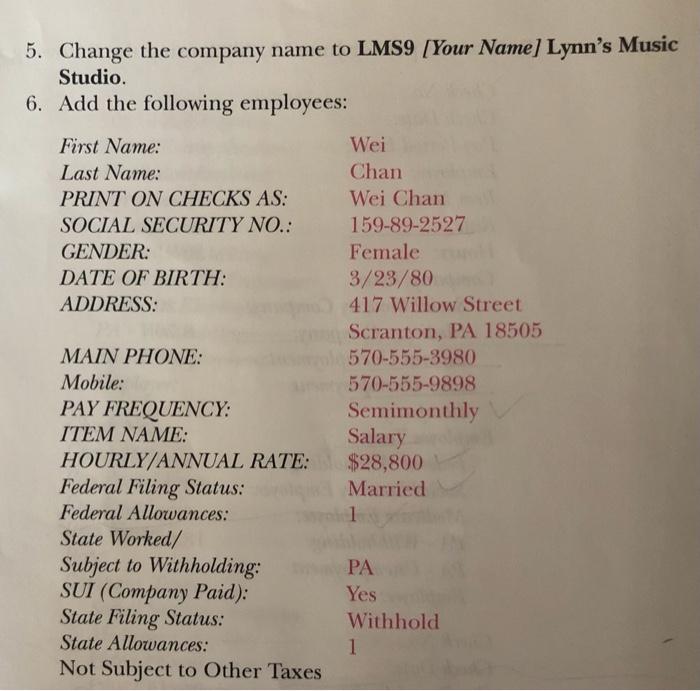

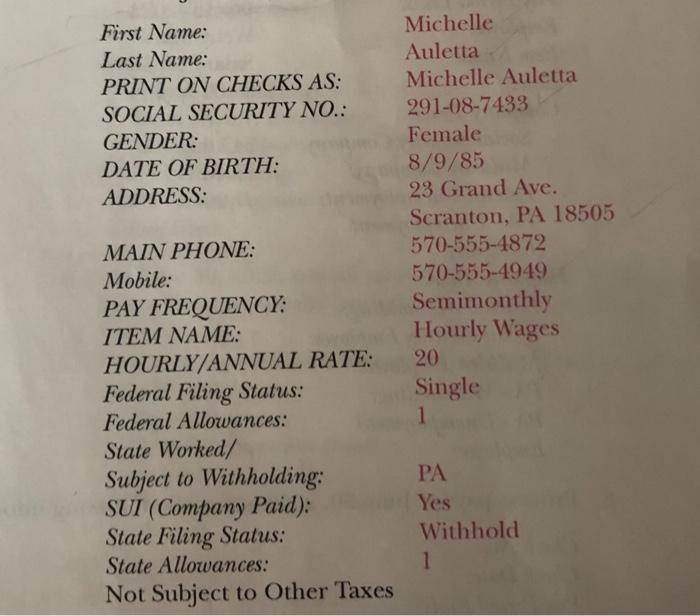

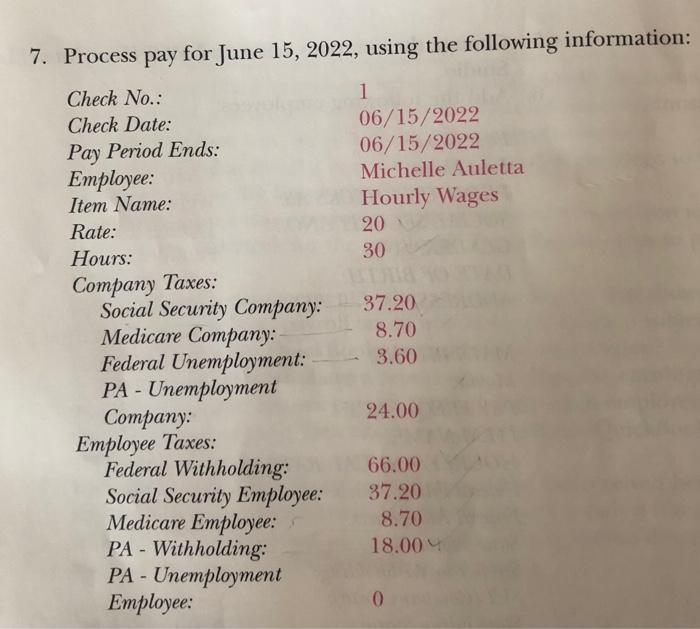

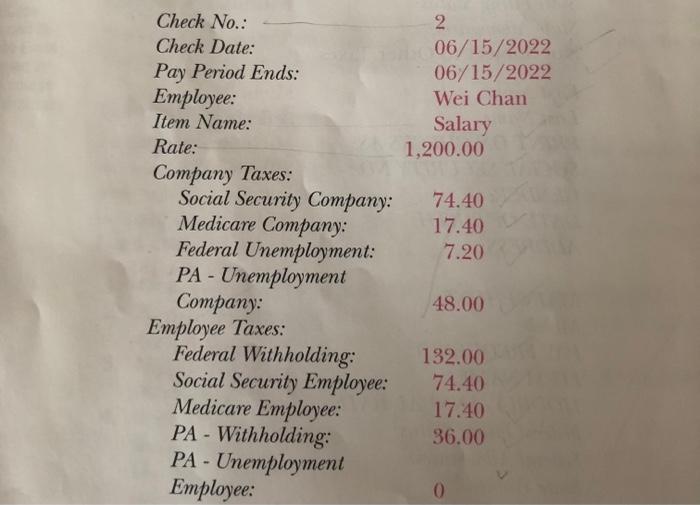

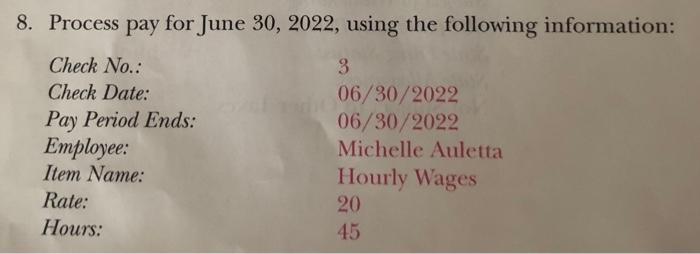

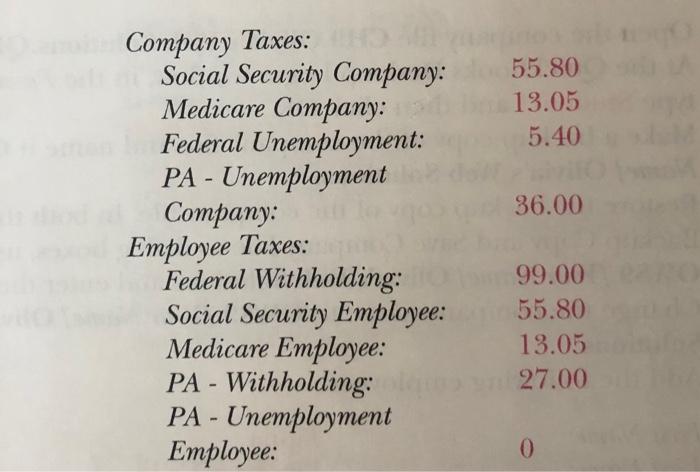

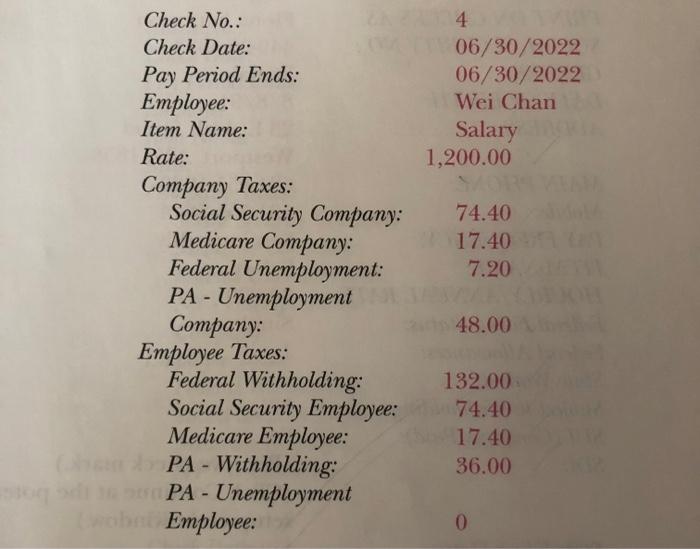

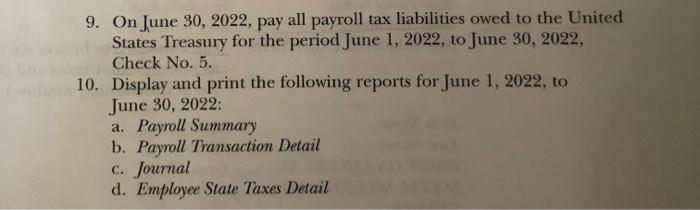

5. Change the company name to LMS9 [Your Name] Lynn's Music Studio. 6. Add the following employees: First Name: Last Name: PRINT ON CHECKS AS: SOCIAL SECURITY NO.: GENDER: DATE OF BIRTH: ADDRESS: Wei Chan Wei Chan 159-89-2527 Female 3/23/80 417 Willow Street Scranton, PA 18505 570-555-3980 570-555-9898 Semimonthly Salary $28,800 Married MAIN PHONE: Mobile: PAY FREQUENCY: ITEM NAME: HOURLY/ANNUAL RATE: Federal Filing Status: Federal Allowances: State Worked/ Subject to Withholding: SUI (Company Paid): State Filing Status: State Allowances: Not Subject to Other Taxes PA Yes Withhold 1 First Name: Last Name: PRINT ON CHECKS AS: SOCIAL SECURITY NO.: GENDER: DATE OF BIRTH: ADDRESS: Michelle Auletta Michelle Auletta 291-08-7433 Female 8/9/85 23 Grand Ave. Scranton, PA 18505 570-555-4872 570-555-4949 Semimonthly Hourly Wages 20 Single 1 MAIN PHONE: Mobile: PAY FREQUENCY: ITEM NAME: HOURLY/ANNUAL RATE: Federal Filing Status: Federal Allowances: State Worked/ Subject to Withholding: SUI (Company Paid): State Filing Status: State Allowances: Not Subject to Other Taxes PA Yes Withhold 1 7. Process pay for June 15, 2022, using the following information: 1 06/15/2022 06/15/2022 Michelle Auletta Hourly Wages 20 30 Check No.: Check Date: Pay Period Ends: Employee: Item Name: Rate: Hours: Company Taxes: Social Security Company: Medicare Company: Federal Unemployment: PA - Unemployment Company: Employee Taxes: Federal Withholding: Social Security Employee: Medicare Employee: PA - Withholding: PA - Unemployment Employee: 37.20 8.70 3.60 24.00 66.00 37.20 8.70 18.00 2 06/15/2022 06/15/2022 Wei Chan Salary 1,200.00 Check No.: Check Date: Pay Period Ends: Employee: Item Name: Rate: Company Taxes: Social Security Company: Medicare Company: Federal Unemployment: PA - Unemployment Company: Employee Taxes: Federal Withholding: Social Security Employee: Medicare Employee: PA - Withholding: PA - Unemployment Employee: 74.40 17.40 7.20 48.00 132.00 74.40 17.40 36.00 0 8. Process pay for June 30, 2022, using the following information: Check No.: 3 Check Date: 06/30/2022 Pay Period Ends: 06/30/2022 Employee: Michelle Auletta Item Name: Hourly Wages Rate: 20 Hours: 45 55.80 13.05 5.40 36.00 Company Taxes: Social Security Company: Medicare Company: Federal Unemployment: PA - Unemployment Company: Employee Taxes: Federal Withholding: Social Security Employee: Medicare Employee: PA - Withholding: PA - Unemployment Employee: 99.00 55.80 13.05 27.00 0 4. 06/30/2022 06/30/2022 Wei Chan Salary 1,200.00 Check No.: Check Date: Pay Period Ends: Employee: Item Name: Rate: Company Taxes: Social Security Company: Medicare Company: Federal Unemployment: PA - Unemployment Company: Employee Taxes: Federal Withholding: Social Security Employee: Medicare Employee: PA - Withholding: PA - Unemployment on Employee: 74.40 17.40 7.20 48.00 132.00 74.40 17.40 36.00 0 9. On June 30, 2022, pay all payroll tax liabilities owed to the United States Treasury for the period June 1, 2022, to June 30, 2022, Check No. 5. 10. Display and print the following reports for June 1, 2022, to June 30, 2022: a. Payroll Summary b. Payroll Transaction Detail c. Journal d. Employee State Taxes Detail 5. Change the company name to LMS9 [Your Name] Lynn's Music Studio. 6. Add the following employees: First Name: Last Name: PRINT ON CHECKS AS: SOCIAL SECURITY NO.: GENDER: DATE OF BIRTH: ADDRESS: Wei Chan Wei Chan 159-89-2527 Female 3/23/80 417 Willow Street Scranton, PA 18505 570-555-3980 570-555-9898 Semimonthly Salary $28,800 Married MAIN PHONE: Mobile: PAY FREQUENCY: ITEM NAME: HOURLY/ANNUAL RATE: Federal Filing Status: Federal Allowances: State Worked/ Subject to Withholding: SUI (Company Paid): State Filing Status: State Allowances: Not Subject to Other Taxes PA Yes Withhold 1 First Name: Last Name: PRINT ON CHECKS AS: SOCIAL SECURITY NO.: GENDER: DATE OF BIRTH: ADDRESS: Michelle Auletta Michelle Auletta 291-08-7433 Female 8/9/85 23 Grand Ave. Scranton, PA 18505 570-555-4872 570-555-4949 Semimonthly Hourly Wages 20 Single 1 MAIN PHONE: Mobile: PAY FREQUENCY: ITEM NAME: HOURLY/ANNUAL RATE: Federal Filing Status: Federal Allowances: State Worked/ Subject to Withholding: SUI (Company Paid): State Filing Status: State Allowances: Not Subject to Other Taxes PA Yes Withhold 1 7. Process pay for June 15, 2022, using the following information: 1 06/15/2022 06/15/2022 Michelle Auletta Hourly Wages 20 30 Check No.: Check Date: Pay Period Ends: Employee: Item Name: Rate: Hours: Company Taxes: Social Security Company: Medicare Company: Federal Unemployment: PA - Unemployment Company: Employee Taxes: Federal Withholding: Social Security Employee: Medicare Employee: PA - Withholding: PA - Unemployment Employee: 37.20 8.70 3.60 24.00 66.00 37.20 8.70 18.00 2 06/15/2022 06/15/2022 Wei Chan Salary 1,200.00 Check No.: Check Date: Pay Period Ends: Employee: Item Name: Rate: Company Taxes: Social Security Company: Medicare Company: Federal Unemployment: PA - Unemployment Company: Employee Taxes: Federal Withholding: Social Security Employee: Medicare Employee: PA - Withholding: PA - Unemployment Employee: 74.40 17.40 7.20 48.00 132.00 74.40 17.40 36.00 0 8. Process pay for June 30, 2022, using the following information: Check No.: 3 Check Date: 06/30/2022 Pay Period Ends: 06/30/2022 Employee: Michelle Auletta Item Name: Hourly Wages Rate: 20 Hours: 45 55.80 13.05 5.40 36.00 Company Taxes: Social Security Company: Medicare Company: Federal Unemployment: PA - Unemployment Company: Employee Taxes: Federal Withholding: Social Security Employee: Medicare Employee: PA - Withholding: PA - Unemployment Employee: 99.00 55.80 13.05 27.00 0 4. 06/30/2022 06/30/2022 Wei Chan Salary 1,200.00 Check No.: Check Date: Pay Period Ends: Employee: Item Name: Rate: Company Taxes: Social Security Company: Medicare Company: Federal Unemployment: PA - Unemployment Company: Employee Taxes: Federal Withholding: Social Security Employee: Medicare Employee: PA - Withholding: PA - Unemployment on Employee: 74.40 17.40 7.20 48.00 132.00 74.40 17.40 36.00 0 9. On June 30, 2022, pay all payroll tax liabilities owed to the United States Treasury for the period June 1, 2022, to June 30, 2022, Check No. 5. 10. Display and print the following reports for June 1, 2022, to June 30, 2022: a. Payroll Summary b. Payroll Transaction Detail c. Journal d. Employee State Taxes Detail