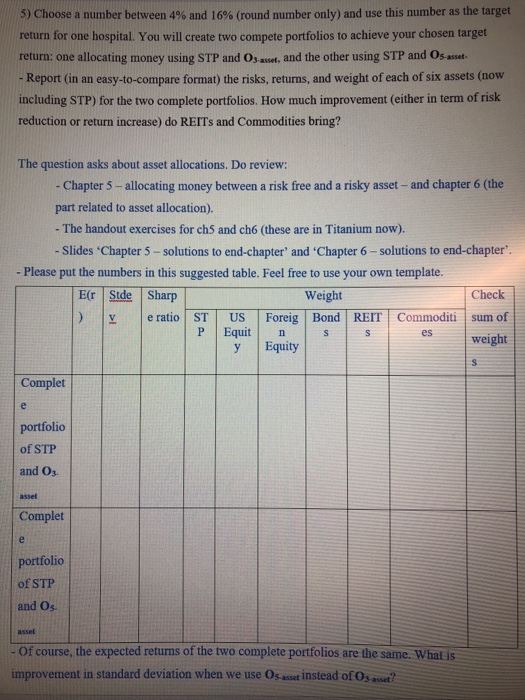

5) Choose a number between 4% and 16% (round number only) and use this number as the target return for one hospital. You will create two compete portfolios to achieve your chosen target return: one allocating money using STP and Osast, and the other using STP and Os asset - Report (in an easy-to-compare format) the risks, returns, and weight of each of six assets (now including STP) for the two complete portfolios. How much improvement (either in term of risk reduction or return increase) do REITs and Commodities bring? The question asks about asset allocations. Do review: - Chapter 5 -allocating money between a risk free and a risky asset- and chapter 6 (the part related to asset allocation). - The handout exercises for ch5 and ch6 (these are in Titanium now). - Slides Chapter 5 -solutions to end-chapter' and 'Chapter 6 - solutions to end-chapter'. - Please put the numbers in this suggested table. Feel free to use your own template. E(r Stde Sharp Weight Check e ratio ST US Foreig Bond REIT Commoditi sum of P Equit n S S weight Equity Complet portfolio of STP and 03 Complet portfolio of STP and Os - Of course, the expected retums of the two complete portfolios are the same. What is improvement in standard deviation when we use Osasset instead of Os asset? 5) Choose a number between 4% and 16% (round number only) and use this number as the target return for one hospital. You will create two compete portfolios to achieve your chosen target return: one allocating money using STP and Osast, and the other using STP and Os asset - Report (in an easy-to-compare format) the risks, returns, and weight of each of six assets (now including STP) for the two complete portfolios. How much improvement (either in term of risk reduction or return increase) do REITs and Commodities bring? The question asks about asset allocations. Do review: - Chapter 5 -allocating money between a risk free and a risky asset- and chapter 6 (the part related to asset allocation). - The handout exercises for ch5 and ch6 (these are in Titanium now). - Slides Chapter 5 -solutions to end-chapter' and 'Chapter 6 - solutions to end-chapter'. - Please put the numbers in this suggested table. Feel free to use your own template. E(r Stde Sharp Weight Check e ratio ST US Foreig Bond REIT Commoditi sum of P Equit n S S weight Equity Complet portfolio of STP and 03 Complet portfolio of STP and Os - Of course, the expected retums of the two complete portfolios are the same. What is improvement in standard deviation when we use Osasset instead of Os asset