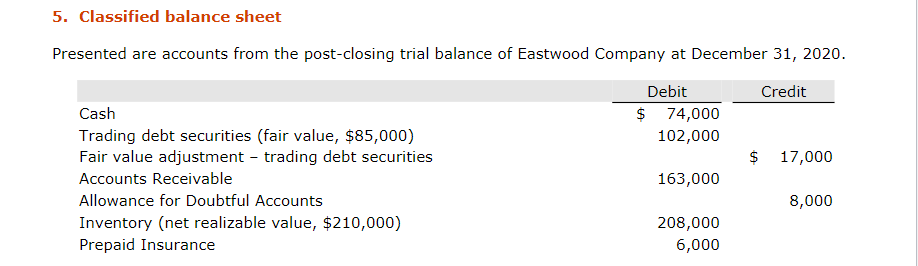

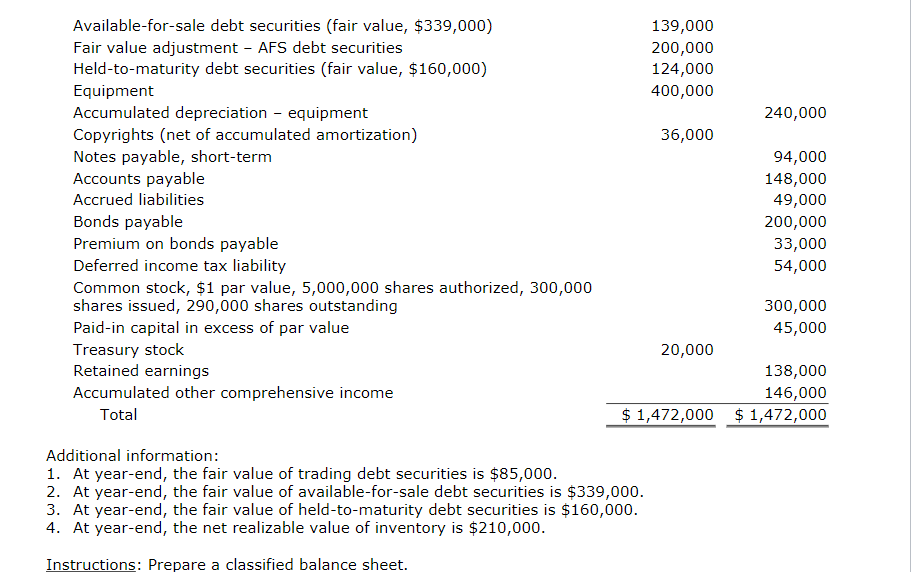

5. Classified balance sheet Presented are accounts from the post-closing trial balance of Eastwood Company at December 31, 2020. Credit Debit $ 74,000 102,000 $ 17,000 Cash Trading debt securities (fair value, $85,000) Fair value adjustment - trading debt securities Accounts Receivable Allowance for Doubtful Accounts Inventory (net realizable value, $210,000) Prepaid Insurance 163,000 8,000 208,000 6,000 139,000 200,000 124,000 400,000 240,000 36,000 Available-for-sale debt securities (fair value, $339,000) Fair value adjustment - AFS debt securities Held-to-maturity debt securities (fair value, $160,000) Equipment Accumulated depreciation - equipment Copyrights (net of accumulated amortization) Notes payable, short-term Accounts payable Accrued liabilities Bonds payable Premium on bonds payable Deferred income tax liability Common stock, $1 par value, 5,000,000 shares authorized, 300,000 shares issued, 290,000 shares outstanding Paid-in capital in excess of par value Treasury stock Retained earnings Accumulated other comprehensive income Total 94,000 148,000 49,000 200,000 33,000 54,000 300,000 45,000 20,000 138,000 146,000 $ 1,472,000 $1,472,000 Additional information: 1. At year-end, the fair value of trading debt securities is $85,000. 2. At year-end, the fair value of available-for-sale debt securities is $339,000. 3. At year-end, the fair value of held-to-maturity debt securities is $160,000. 4. At year-end, the net realizable value of inventory is $210,000. Instructions: Prepare a classified balance sheet. 5. Classified balance sheet Presented are accounts from the post-closing trial balance of Eastwood Company at December 31, 2020. Credit Debit $ 74,000 102,000 $ 17,000 Cash Trading debt securities (fair value, $85,000) Fair value adjustment - trading debt securities Accounts Receivable Allowance for Doubtful Accounts Inventory (net realizable value, $210,000) Prepaid Insurance 163,000 8,000 208,000 6,000 139,000 200,000 124,000 400,000 240,000 36,000 Available-for-sale debt securities (fair value, $339,000) Fair value adjustment - AFS debt securities Held-to-maturity debt securities (fair value, $160,000) Equipment Accumulated depreciation - equipment Copyrights (net of accumulated amortization) Notes payable, short-term Accounts payable Accrued liabilities Bonds payable Premium on bonds payable Deferred income tax liability Common stock, $1 par value, 5,000,000 shares authorized, 300,000 shares issued, 290,000 shares outstanding Paid-in capital in excess of par value Treasury stock Retained earnings Accumulated other comprehensive income Total 94,000 148,000 49,000 200,000 33,000 54,000 300,000 45,000 20,000 138,000 146,000 $ 1,472,000 $1,472,000 Additional information: 1. At year-end, the fair value of trading debt securities is $85,000. 2. At year-end, the fair value of available-for-sale debt securities is $339,000. 3. At year-end, the fair value of held-to-maturity debt securities is $160,000. 4. At year-end, the net realizable value of inventory is $210,000. Instructions: Prepare a classified balance sheet