Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. Consider a three-period binomial model for a stock S whose current price is So = 100. Suppose that over each of the next

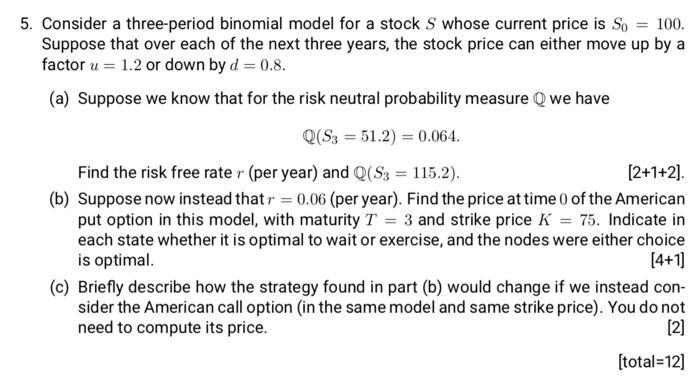

5. Consider a three-period binomial model for a stock S whose current price is So = 100. Suppose that over each of the next three years, the stock price can either move up by a factor u = 1.2 or down by d = 0.8. (a) Suppose we know that for the risk neutral probability measure Q we have == Q(S3 = 51.2)=0.064. Find the risk free rater (per year) and Q(S3 = 115.2). [2+1+2]. (b) Suppose now instead that r = 0.06 (per year). Find the price at time 0 of the American put option in this model, with maturity T = 3 and strike price K = 75. Indicate in each state whether it is optimal to wait or exercise, and the nodes were either choice is optimal. [4+1] (c) Briefly describe how the strategy found in part (b) would change if we instead con- sider the American call option (in the same model and same strike price). You do not need to compute its price. [2] [total=12]

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a To find the riskfree rate per year and the probability mathbbQS3 1152 we need to use the information provided and solve the equations Lets denote the riskfree rate as r and the probability of an up ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started