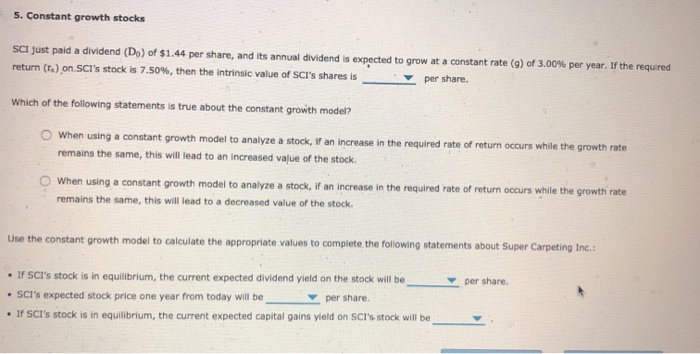

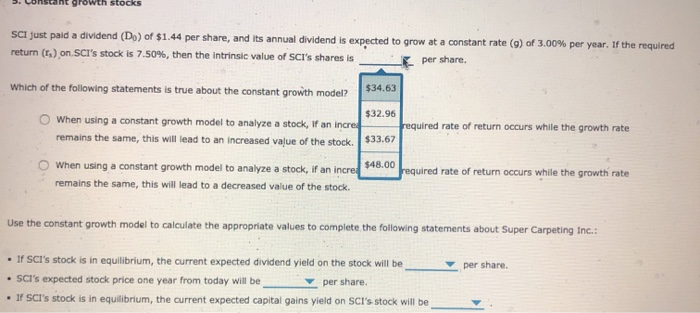

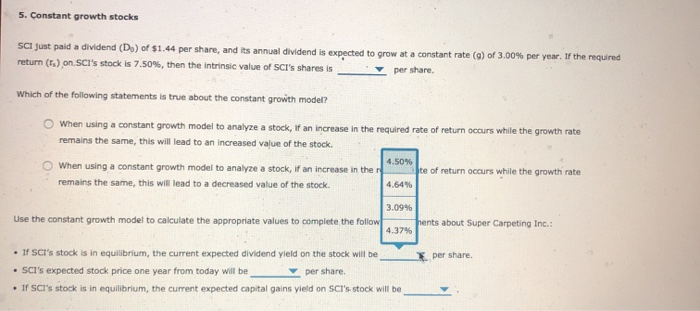

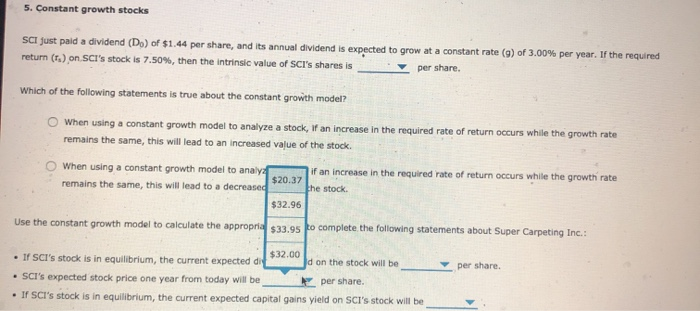

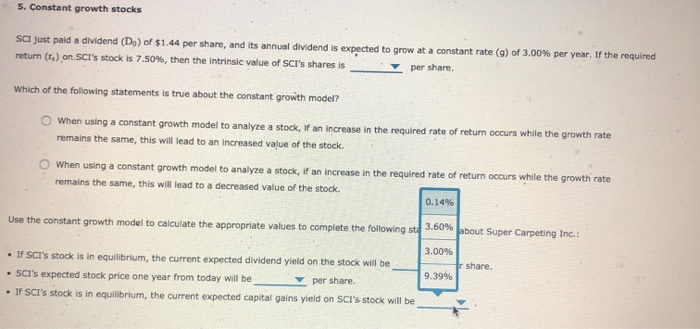

5. Constant growth stocks SCI just paid a dividend (Do) of $1.44 per share, and its annual dividend is expected to grow at a constant rate (9) of 3.00% per year. If the required return (1.) on SCI's stock is 7.50%, then the intrinsic value of SCI's shares is per share, Which of the following statements is true about the constant growth model? O When using a constant growth model to analyze a stock, If an increase in the required rate of return occurs while the growth rate remains the same, this will lead to an increased value of the stock. When using a constant growth model to analyze a stock, if an increase in the required rate of return occurs while the growth rate remains the same, this will lead to a decreased value of the stock. Use the constant growth model to calculate the appropriate values to complete the following statements about Super Carpeting Inc.: per share If SCI's stock is in equilibrium, the current expected dividend yield on the stock will be SCI's expected stock price one year from today will be per share. . If SCI's stock is in equilibrium, the current expected capital gains yield on SCI's stock will be grown SOCKS SCI just paid a dividend (D) of $1.44 per share, and its annual dividend is expected to grow at a constant rate (9) of 3.00% per year. If the required return (T) on SCI's stock is 7.50%, then the intrinsic value of SCI's shares is per share. $34.63 Which of the following statements is true about the constant growth model? $32.96 required rate of return occurs while the growth rate When using a constant growth model to analyze a stock. If an incre remains the same, this will lead to an increased value of the stock, $33.67 required rate of return occurs while the growth rate When using a constant growth model to analyze a stock, if an incred0.00 remains the same, this will lead to a decreased value of the stock. Use the constant growth model to calculate the appropriate values to complete the following statements about Super Carpeting Inc.: per share. . If SCI's stock is in equilibrium, the current expected dividend yield on the stock will be SCI's expected stock price one year from today will be per share. . If SCI's stock is in equilibrium, the current expected capital gains yield on SCI's stock will be 5. Constant growth stocks SCI just paid a dividend (De) of $1.44 per share, and its annual dividend is expected to grow at a constant rate (a) of 3.00% per year. If the required return (1.) on SCI's stock is 7.50%, then the intrinsic value of SCI's shares is per share Which of the following statements is true about the constant growth model? When using a constant growth model to analyze a stock, an increase in the required rate of return occurs while the growth rate remains the same, this will lead to an increased value of the stock 4.50% te of return occurs while the growth rate When using a constant growth model to analyze a stock, if an increase in the remains the same, this will lead to a decreased value of the stock. 3.09% Use the constant growth model to calculate the appropriate values to complete the follow rents about Super Carpeting Inc.: 4.37% per share. If SCI's stock is in equilibrium, the current expected dividend yield on the stock will be SCI's expected stock price one year from today will be per share If SCI's stock is in equilibrium, the current expected capital gains yield on SCI's stock will be 5. Constant growth stocks SCI just paid a dividend (D) of $1.44 per share, and its annual dividend is expected to grow at a constant rate (9) of 3.00% per year. If the required return (1.) on SCI's stock is 7.50%, then the intrinsic value of SCI's shares is v per share. Which of the following statements is true about the constant growth model? O When using a constant growth model to analyze a stock, If an increase in the required rate of return occurs while the growth rate remains the same, this will lead to an increased value of the stock. When using a constant growth model to analyz remains the same, this will lead to a decreased $20.37 if an increase in the required rate of return occurs while the growth rate he stock. $32.96 Use the constant growth model to calculate the appropria $33.95 to complete the following statements about Super Carpeting Inc.: $32.00 per share. If SCI's stock is in equilibrium, the current expected Jd on the stock will be SCI's expected stock price one year from today will be per share. If SCI's stock is in equilibrium, the current expected capital gains yield on SCI's stock will be 5. Constant growth stocks SCI just paid a dividend (Do) of $1.44 per share, and its annual dividend is expected to grow at a constant rate () of 3.00% per year. If the required return (1.) on SCI's stock is 7.50%, then the intrinsic value of SCI's shares is per share, Which of the following statements is true about the constant growth model? When using a constant growth model to analyze a stock, if an increase in the required rate of return occurs while the growth rate remains the same, this will lead to an increased value of the stock. When using a constant growth model to analyze a stock, if an increase in the required rate of return occurs while the growth rate remains the same, this will lead to a decreased value of the stock. 0.14% Use the constant growth model to calculate the appropriate values to complete the following st 3.60% about Super Carpeting Inc.: 3.00% share. 9.39% . IF SCI's stock is in equilibrium, the current expected dividend yield on the stock will be SCI's expected stock price one year from today will be per share. If SCI's stock is in equilibrium, the current expected capital gains yield on SCI's stock will be