Answered step by step

Verified Expert Solution

Question

1 Approved Answer

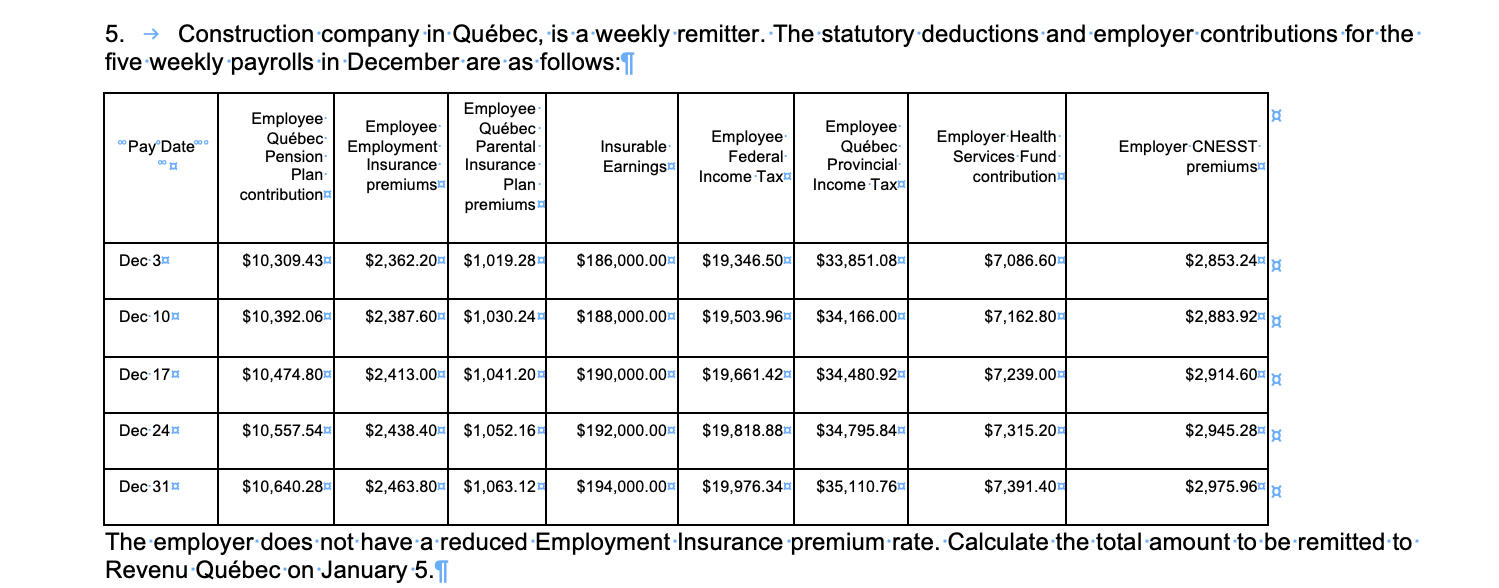

5. Construction company in Qubec, is a weekly remitter. The statutory deductions and employer contributions for the five weekly payrolls in December are as

5. Construction company in Qubec, is a weekly remitter. The statutory deductions and employer contributions for the five weekly payrolls in December are as follows: Employee Pay Date Employee Qubec Pension Plan contribution Employee Employment Qubec Parental Insurance Insurance premiums Plan premiums Insurable Earnings Employee Federal Employee Qubec Income Tax Provincial Income Tax Employer Health Services Fund contribution Employer CNESST premiums Dec-3 $10,309.43 $2,362.20 $1,019.28 $186,000.00 $19,346.50 $33,851.08 $7,086.60 $2,853.24 Dec-10 $10,392.06 $2,387.60 $1,030.24 $188,000.00 $19,503.96 $34,166.00 $7,162.80 $2,883.92 Dec 17 $10,474.80 $2,413.00 $1,041.20 $190,000.00 $19,661.42 $34,480.92 $7,239.00 $2,914.60 Dec 24 $10,557.54 $2,438.40 $1,052.16 $192,000.00 $19,818.88 $34,795.84 $7,315.20 $2,945.28 Dec 31 $10,640.28 $2,463.80 $1,063.12 $194,000.00 $19,976.34 $35,110.76 $7,391.40 $2,975.96 The employer does not have a reduced Employment Insurance premium rate. Calculate the total amount to be remitted to Revenu Qubec on January 5.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started