Answered step by step

Verified Expert Solution

Question

1 Approved Answer

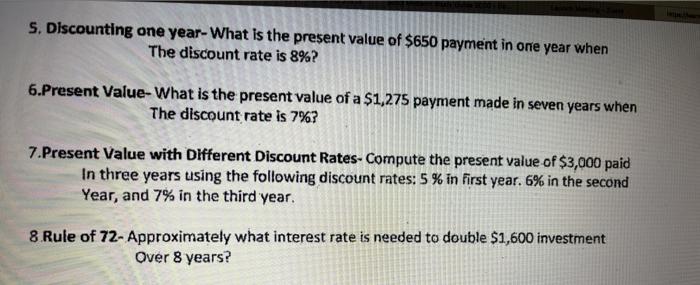

5. Discounting one year-What is the present value of $650 payment in one year when The discount rate is 8%? 6.Present Value-What is the

5. Discounting one year-What is the present value of $650 payment in one year when The discount rate is 8%? 6.Present Value-What is the present value of a $1,275 payment made in seven years when The discount rate is 7%? 7.Present Value with Different Discount Rates- Compute the present value of $3,000 paid In three years using the following discount rates: 5 % in first year. 6% in the second Year, and 7% in the third year. 8.Rule of 72- Approximately what interest rate is needed to double $1,600 investment Over 8 years?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the present value of future payments and determine the interest rate needed to double an investment using the Rule of 72 we can use the following formulas and calculations 5 Present Value of 650 payment in one year Present Value Payment 1 Discount Raten 650 1 0081 650 108 60185 The present value of a 650 payment in one year with a discount rate of 8 is approximately 60185 6 Present Value of a 1275 payment made in seven years Present Value Payment 1 Discount Raten 1275 1 0077 1275 1500730 84834 The present value of a 1275 payment made in seven years with a discount rate of 7 is approximately 84834 7 Present Value with Different Discount Rates for 3000 paid in three years To calculate the present value with different discount rates we use the same formula for each year and sum up the present values Year 1 Present Value Payment 1 Discount Raten 3000 1 0051 3000 105 285714 Year 2 Present Value Payment 1 Discount Raten 3000 1 0061 3000 106 283019 Year 3 Present Value Payment 1 Discount Raten 3000 1 0071 3000 107 280374 Total Present Value Present Value for Year 1 Present Value for Year 2 Present Value for Year 3 285714 283019 280374 849007 The present value of 3000 paid in three years with discount rates of 5 6 and 7 for each year respectively is approximately 849007 8 Rule of 72 The Rule of 72 is a quick approximation to estimate the time required to double an investment based on a given interest rate Approximate Interest Rate 72 Number of Years In this case the investment needs to be doubled over 8 years Approximate Interest Rate 72 8 9 Approximately an interest rate of 9 is needed to double a ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started