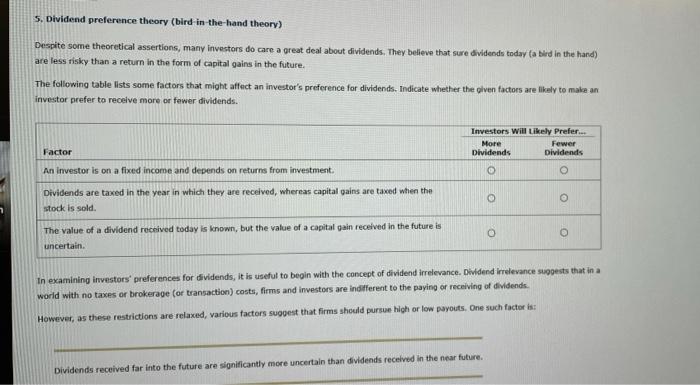

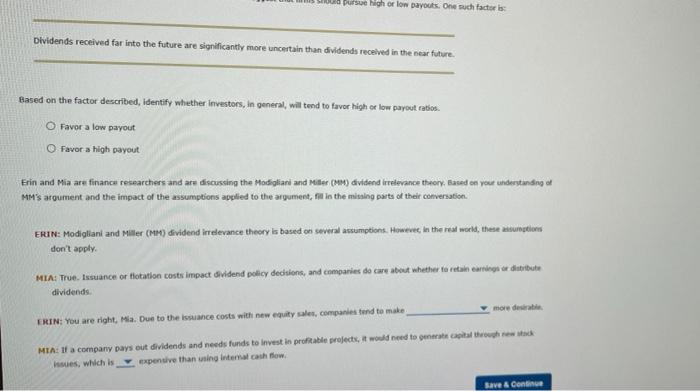

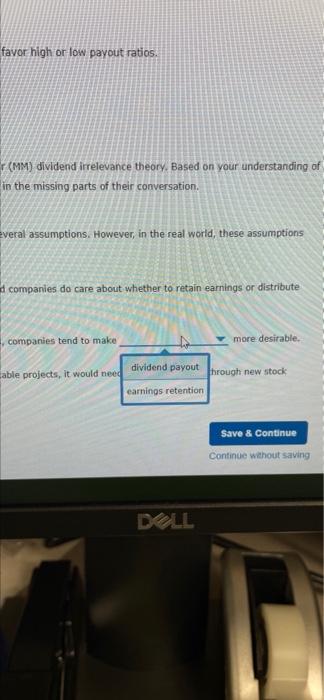

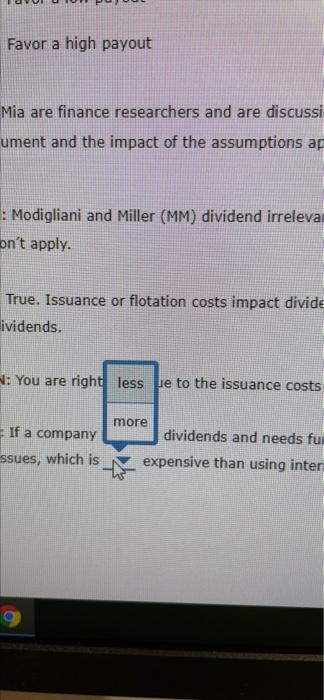

5. Dividend preference theory (bird in the hand theory) Despite some theoretical assertions, many investors do care a great deal about dividends. They believe that sure dividends today a bird in the hand) are less risky than a return in the form of capital gains in the future. The following table lists some factors that might affect an investor's preference for dividends. Indicate whether the given factors are likely to make an investor prefer to receive more or fewer dividends. Factor Investors will likely Prefer... More Fewer Dividends Dividends O An Investor is on a fixed income and depends on returns from investment. Dividends are taxed in the year in which they are received, whereas capital gains are taxed when the stock is sold. O O The value of a dividend received today is known, but the value of a capital gain received in the future is uncertain O In examining investors' preferences for dividends, it is useful to begin with the concept of dividend irrelevance. Dividend irrelevance suggests that in a world with no taxes or brokerage (or transaction) costs, firms and investors are indifferent to the paying or receiving of dividends. However, as these restrictions are relaxed, various factors suggest that firms should pursue high or low payouts. One such factor is: Dividends received far into the future are significantly more uncertain than dividends received in the near future. pursue high or low payouts. One such factors Dividends received far into the future are significantly more uncertain than dividends received in the near future Based on the factor described, identify whether investors, in general, wil tend to favor high or low payout ratios Favor a low payout Favor a high payout Erin and Mia are finance researchers and are discussing the Modigliani and Miller (9) dividend irrelevance theory, Based on your understanding of MM's argument and the impact of the assumptions applied to the argument, fill in the missing parts of their conversation ERIN: Modigliani and Miller (MM) dividend irrelevance theory is based on several assumptions. However, in the real world, these asunnotions don't apply MIA: True. Issuance or totation costs impact dividend policy decisions, and companies do care about whether to retain earnings or distribute dividends more det ERIN: You are right, Ma. Due to the issuance costs with new equity stes, companies tend to make MIA: If a company pays out dividends and needs funds to invest in profitable projects, it would need to generate capital issues, which is expensive than uning Internal cash flow. Save & Conne favor high or low payout ratios. r(MM) dividend irrelevance theory. Based on your understanding of in the missing parts of their conversation, veral assumptions. However, in the real world, these assumptions companies do care about whether to retain earnings or distribute companies tend to make more desirable. hrough new stock dividend payout able projects, it would need earnings retention Save & Continue Continue without saving DELL Favor a high payout Mia are finance researchers and are discussi ument and the impact of the assumptions ar . Modigliani and Miller (MM) dividend irreleva on't apply. True. Issuance or flotation costs impact divide ividends. W: You are right less ue to the issuance costs more If a company dividends and needs fun ssues, which is expensive than using inter