Question

5. Elsa has two bond funds in herportfolio: American Century, which is 100% low quality limited term bonds, and Fidelity short duration, which is 100%

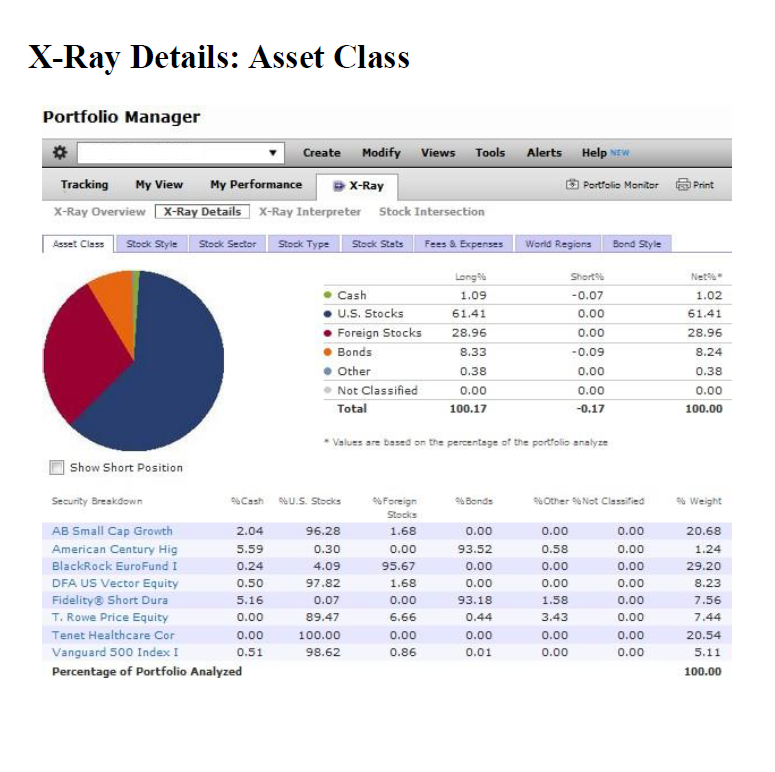

5. Elsa has two bond funds in herportfolio: American Century, which is 100% low quality limited term bonds, and Fidelity short duration, which is 100% low quality limited term bonds.a.Based on the information in the X-Ray Overview, does your friend need to make any changes regarding the allocation of the bond fundsbased on style?Why? Your friend is looking for some high credit bond funds in order to replace the current ones. You can help find bond funds through Vanguard. Go to the website https://personal.vanguard.com/us/funds/vanguardand scroll down to lookat Bond funds. Find two bond funds that still satisfy the desired bond Allocation and give at least 2 reasons why you chose those bonds.ii.Should your friend add municipal bonds totheportfolio? Why or why not? Would muni bonds have any advantages over the high-yield, low quality bonds she currently has

Please cite your references.

X-Ray Details: Asset Class Portfolio Manager Create Modify Views Tools Alerts Help NEW Tracking My View My Performance X-Ray Portfolio Monitor X-Ray Overview X-Ray Details X-Ray Interpreter Stock Intersection Print Asset Class Stock Style Stock Sector Stock Type Stock Stats Fees & Expenses World Regions Bond Style Short Net Longs 1.09 61.41 -0.07 0.00 28.96 0.00 Cash U.S. Stocks Foreign Stocks Bonds Other Not Classified Total 8.33 -0.09 1.02 61.41 28.96 8.24 0.38 0.00 100.00 0.38 0.00 100.17 0.00 0.00 -0.17 * Values are based on the percentage of the portfolio analyze Cash U.S. Stocks Bonds Weight Show Short Position Secunty Breakdown AB Small Cap Growth 2.04 American Century Hig 5.59 BlackRock EuroFund I 0.24 DFA US Vector Equity 0.50 Fidelity Short Dura 5.16 T. Rowe Price Equity 0.00 Tenet Healthcare Cor 0.00 Vanguard 500 Index I 0.51 Percentage of Portfolio Analyzed 96.28 0.30 4.09 97.82 0.07 89.47 100.00 98.62 of Foreign Stocks 1.68 0.00 95.67 1.68 0.00 6.66 0.00 0.86 0.00 93.52 0.00 0.00 93.18 0.44 0.00 0.01 Other Not Classified 0.00 0.00 0.58 0.00 0.00 0.00 0.00 0.00 1.58 0.00 3.43 0.00 0.00 0.00 0.00 0.00 20.68 1.24 29.20 8.23 7.56 7.44 20.54 5.11 100.00 X-Ray Details: Asset Class Portfolio Manager Create Modify Views Tools Alerts Help NEW Tracking My View My Performance X-Ray Portfolio Monitor X-Ray Overview X-Ray Details X-Ray Interpreter Stock Intersection Print Asset Class Stock Style Stock Sector Stock Type Stock Stats Fees & Expenses World Regions Bond Style Short Net Longs 1.09 61.41 -0.07 0.00 28.96 0.00 Cash U.S. Stocks Foreign Stocks Bonds Other Not Classified Total 8.33 -0.09 1.02 61.41 28.96 8.24 0.38 0.00 100.00 0.38 0.00 100.17 0.00 0.00 -0.17 * Values are based on the percentage of the portfolio analyze Cash U.S. Stocks Bonds Weight Show Short Position Secunty Breakdown AB Small Cap Growth 2.04 American Century Hig 5.59 BlackRock EuroFund I 0.24 DFA US Vector Equity 0.50 Fidelity Short Dura 5.16 T. Rowe Price Equity 0.00 Tenet Healthcare Cor 0.00 Vanguard 500 Index I 0.51 Percentage of Portfolio Analyzed 96.28 0.30 4.09 97.82 0.07 89.47 100.00 98.62 of Foreign Stocks 1.68 0.00 95.67 1.68 0.00 6.66 0.00 0.86 0.00 93.52 0.00 0.00 93.18 0.44 0.00 0.01 Other Not Classified 0.00 0.00 0.58 0.00 0.00 0.00 0.00 0.00 1.58 0.00 3.43 0.00 0.00 0.00 0.00 0.00 20.68 1.24 29.20 8.23 7.56 7.44 20.54 5.11 100.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started