Question

5) Explain how MGRMs cash flows would have changed if the basis had increased (rather than fallen) and if oi prices had increased (rather than

5) Explain how MGRMs cash flows would have changed if the basis had increased (rather than fallen) and if oi prices had increased (rather than fallen).

An increase in oil prices would have led to MGRM closing out its monthly long futures contracts with gains with a large amount of cash inflow. However, due to the losses in the forward contracts these gains would have been mitigated, but the cash flow effects would have been postponed until the date of maturity.

An increase in basis would have improved MGRMs hedge. This is because the company would have been able to close out its hedge in year 1 at a spot price that was higher than the futures price it would have to pay at the end of year 2. With a long hedge, any increase in basis increases the cash flow of the hedger.

8) Assume MGRM was able to use hedge accounting standards. Answer either question 5 or 6, but this time, explain the profit-and-loss effects under the given conditions.

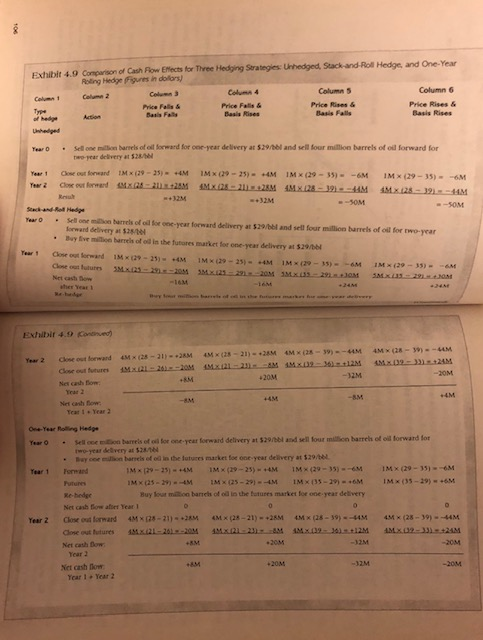

9) Assume MGRM used a stack-and-roll hedge. Use Exhibit 4.9 in this chapter to explain what would have happened to MGRMs cash flows in year 1 and year 2 if the oil basis did not change and prices rose from $30/bbl in year 0 to $35/bbl in year 1 to $39/bbl in year 2.

10) Assume MGRM used a stack-and-roll hedge. Use Exhibit 4.9 in this chapter to explain what would have happened to MGRMs cash flows in year 1 and year 2 if the oil basis did not change and prices fell from $30/bbl in year 0 to $25/bbl in year 1 to $21/bbl in year 2.

Exhibit 4.0 Comparison of Carrow Effects for Three Hedging Strategies: Unhedged, Stack and Roll Hedon and One-Yea Roling Hedge Fures in bors Cl2 Columns Column Column 5 Column 6 Price Falls & Price Fas Price Rises & Price Rises & Action Basis Rises falls| Rasi Rises M Year O . Sell one million barrels of oil forward for one-year delivery at 529/and sell four million barrels ofod forward for par delivery at 52 Yeart out and MX (29 - 25) 4M IMX029 - 25) = -4M IMX (29 - 35) -6M IMX29 - 35) Year 2 Closeout forward X 20M MX128228M AMX 128 - 19-M MX 128 -9 +32M SOM Sach -Roll Media . Selon barrels of oil for one year forward delivery at $29/ and sell four million barrels of oil for two-year forward delivery by five milhares of the futures market for ne-year delivery at / Close out forward MX - 25 M IMX20-25 M MX - 35- 6M IMX29 - 35 Close outures MX 1252 0 MX -2 JOM SMX -29 M SOM - 3M AM Exhibir 4.9 Kted 4MX - -4M --UM (25 - 39 close out forward 4M AM (28-31) - AM Year 2 (28-21) = 28MM 201 -32M Nel cash flow You Re Year o Hedge ell o barrels of for one year forward delivery at $29 and sell four m on barrels of all forward for M Year 1 IMX (29 - 3 IMX135 295 am Year 2 - Bu h arrelse in the future market for one year delivery at $29/ Formand IM 29 - 35 - 4M IMX (19-25) - M IMX (29-3) - M Futures IMX25 - 29. 4 IMX125-29 M IMX135-19 .0M Re-hedge Buy lour m on bancs of in the futures market for one year delivery Net cash flow for Year 1 Close out forward 4MX125 -21) M M X 28-21) - 2MM X (28 - 19 --44 Closeout futures AMXQL-200MMX 21238 MX. 0 341-12M Net cathow -32M Year 2 No cash flow --32M Year 1 Year 2 4M X (28-39 AMX 33 -4M +24M -20M Exhibit 4.0 Comparison of Carrow Effects for Three Hedging Strategies: Unhedged, Stack and Roll Hedon and One-Yea Roling Hedge Fures in bors Cl2 Columns Column Column 5 Column 6 Price Falls & Price Fas Price Rises & Price Rises & Action Basis Rises falls| Rasi Rises M Year O . Sell one million barrels of oil forward for one-year delivery at 529/and sell four million barrels ofod forward for par delivery at 52 Yeart out and MX (29 - 25) 4M IMX029 - 25) = -4M IMX (29 - 35) -6M IMX29 - 35) Year 2 Closeout forward X 20M MX128228M AMX 128 - 19-M MX 128 -9 +32M SOM Sach -Roll Media . Selon barrels of oil for one year forward delivery at $29/ and sell four million barrels of oil for two-year forward delivery by five milhares of the futures market for ne-year delivery at / Close out forward MX - 25 M IMX20-25 M MX - 35- 6M IMX29 - 35 Close outures MX 1252 0 MX -2 JOM SMX -29 M SOM - 3M AM Exhibir 4.9 Kted 4MX - -4M --UM (25 - 39 close out forward 4M AM (28-31) - AM Year 2 (28-21) = 28MM 201 -32M Nel cash flow You Re Year o Hedge ell o barrels of for one year forward delivery at $29 and sell four m on barrels of all forward for M Year 1 IMX (29 - 3 IMX135 295 am Year 2 - Bu h arrelse in the future market for one year delivery at $29/ Formand IM 29 - 35 - 4M IMX (19-25) - M IMX (29-3) - M Futures IMX25 - 29. 4 IMX125-29 M IMX135-19 .0M Re-hedge Buy lour m on bancs of in the futures market for one year delivery Net cash flow for Year 1 Close out forward 4MX125 -21) M M X 28-21) - 2MM X (28 - 19 --44 Closeout futures AMXQL-200MMX 21238 MX. 0 341-12M Net cathow -32M Year 2 No cash flow --32M Year 1 Year 2 4M X (28-39 AMX 33 -4M +24M -20MStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started