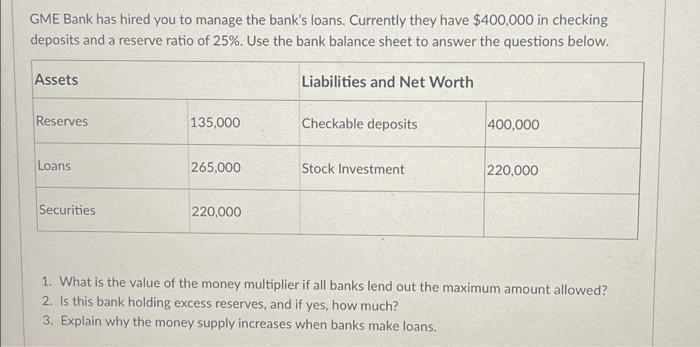

GME Bank has hired you to manage the bank's loans. Currently they have $400,000 in checking deposits and a reserve ratio of 25%. Use

GME Bank has hired you to manage the bank's loans. Currently they have $400,000 in checking deposits and a reserve ratio of 25%. Use the bank balance sheet to answer the questions below. Assets Reserves Loans Securities 135,000 265,000 220,000 Liabilities and Net Worth Checkable deposits Stock Investment 400,000 220,000 1. What is the value of the money multiplier if all banks lend out the maximum amount allowed? 2. Is this bank holding excess reserves, and if yes, how much? 3. Explain why the money supply increases when banks make loans. GME Bank has hired you to manage the bank's loans. Currently they have $400,000 in checking deposits and a reserve ratio of 25%. Use the bank balance sheet to answer the questions below. Assets Reserves Loans Securities 135,000 265,000 220,000 Liabilities and Net Worth Checkable deposits Stock Investment 400,000 220,000 1. What is the value of the money multiplier if all banks lend out the maximum amount allowed? 2. Is this bank holding excess reserves, and if yes, how much? 3. Explain why the money supply increases when banks make loans.

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 Value of money multiplier 1 reserve requirement 125 4 2 Required reserves ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started