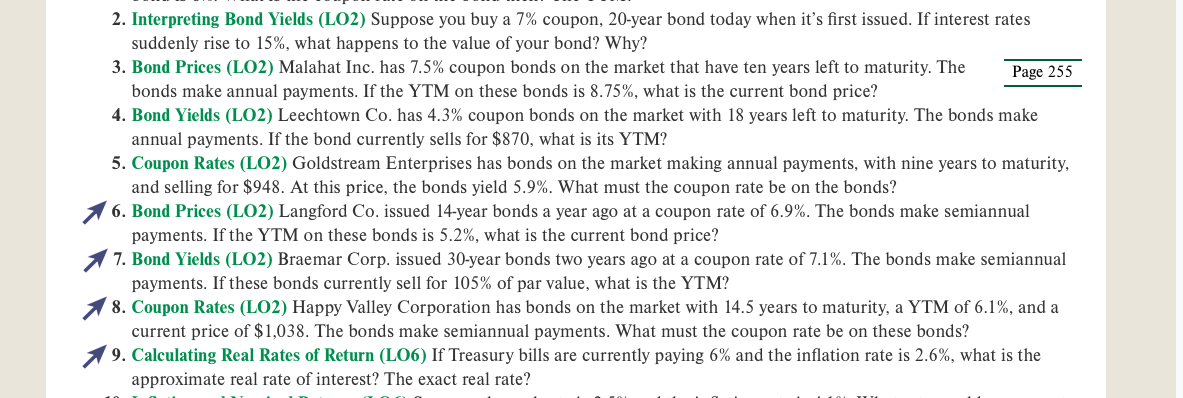

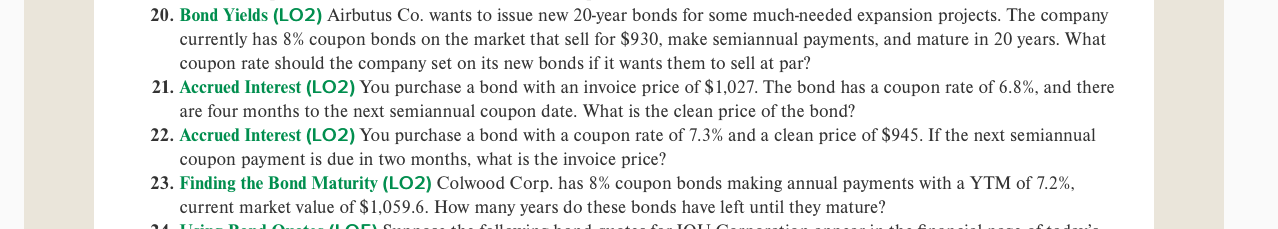

5. f6. f7. [8. [9. _____ __ _._. ___ __ ____r_______ ___ ____ _____ ______. __ _ __.__ . Interpreting Bond Yields (L02) Suppose you buy a 7% coupon, 20-year bond today when it's rst issued. If interest rates suddenly rise to 15%, what happens to the value of your bond? Why? . Bond Prices (L02) Malahat Inc. has 7.5% coupon bonds on the market that have ten years left to maturity. The page 255 bonds make annual payments. If the YTM on these bonds is 8.75%, what is the current bond price? . Bond Yields (L02) Leechtown Co. has 4.3% coupon bonds on the market with 18 years left to maturity. The bonds make annual payments. If the bond currently sells for 387%), what is its YTM? Coupon Rates (L02) Goldstream Enterprises has bonds on the market making annual payments, with nine years to maturity, and selling for $948. At this price, the bonds yield 5.9%. What must the coupon rate be on the bonds? Bond Prices (L02) Langford Co. issued 14-year bonds a year ago at a coupon rate of 6.9%. The bonds make semiannual payments. If the YTM on these bonds is 5.2%, what is the current bond price? Bond Yields (L02) Braemar Corp. issued 30-year bonds two years ago at a coupon rate of 11%. The bonds make semiannual payments. If these bonds currently sell for 105% of par value, what is the YTM? Coupon Rates (L02) Happy Valley Corporation has bonds on the market with 14.5 years to maturity. a YTM of 6.1 %, and a current price of $1,038. The bonds make semiannual payments. What must the coupon rate be on these bonds? Calculating Real Rates of Return (L06) If Treasury bills are currently paying 6% and the ination rate is 2.6%, what is the approximate real rate of interest? The exact real rate? 20. Bond Yields (LO2) Airbutus Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 8% coupon bonds on the market that sell for $930, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? 21. Accrued Interest (LO2) You purchase a bond with an invoice price of $1,027. The bond has a coupon rate of 6.8%, and there are four months to the next semiannual coupon date. What is the clean price of the bond? 22. Accrued Interest (LO2) You purchase a bond with a coupon rate of 7.3% and a clean price of $945. If the next semiannual coupon payment is due in two months, what is the invoice price? 23. Finding the Bond Maturity (LO2) Colwood Corp. has 8% coupon bonds making annual payments with a YTM of 7.2%, current market value of $1,059.6. How many years do these bonds have left until they mature