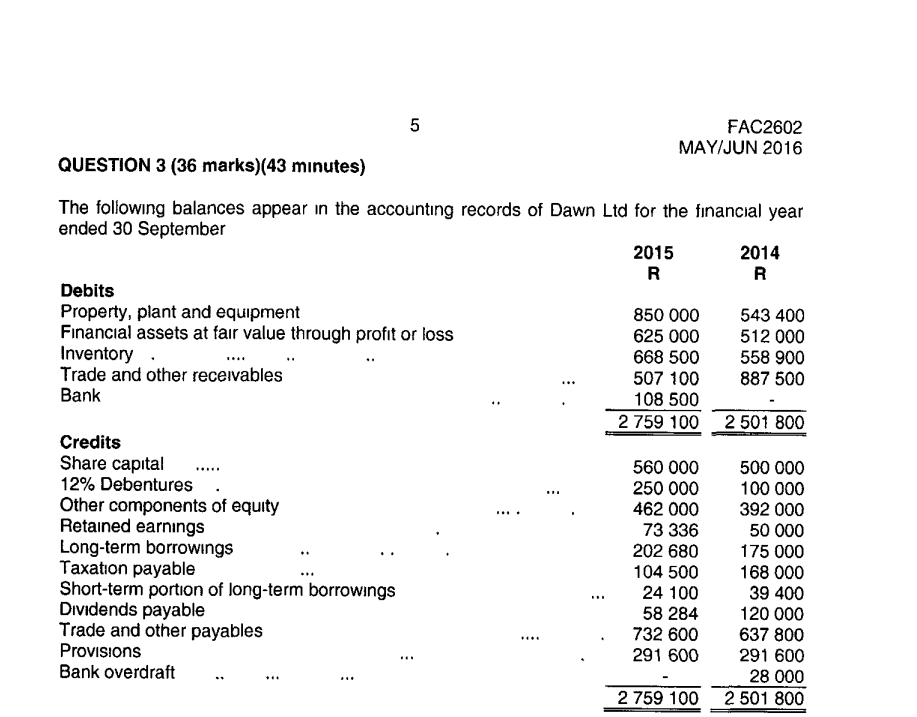

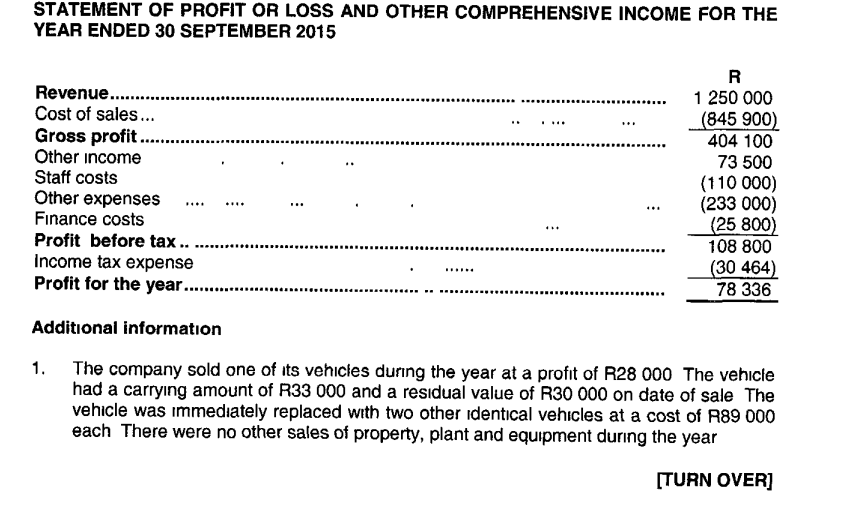

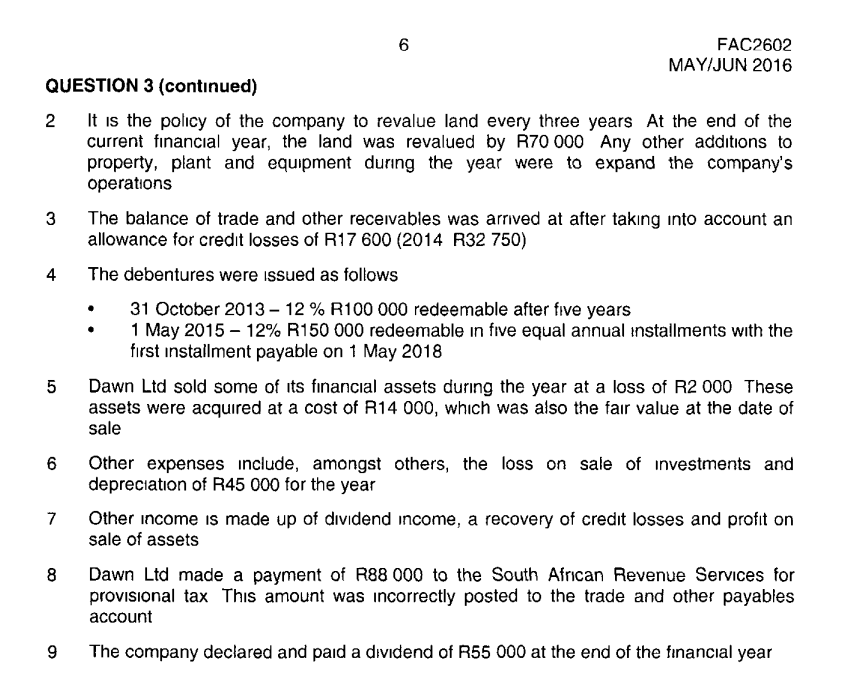

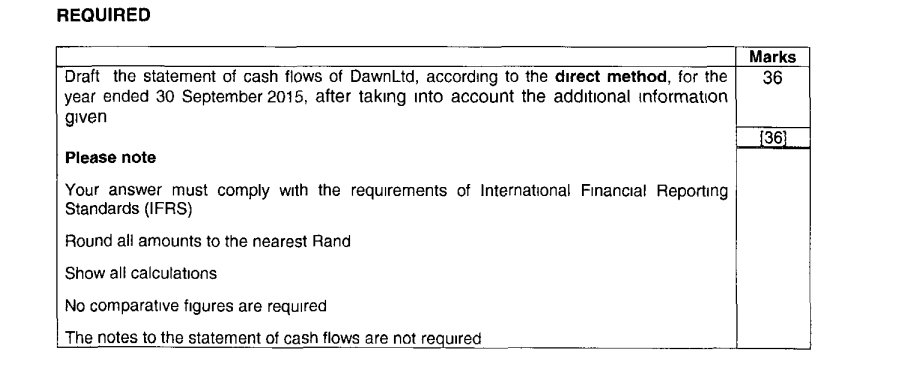

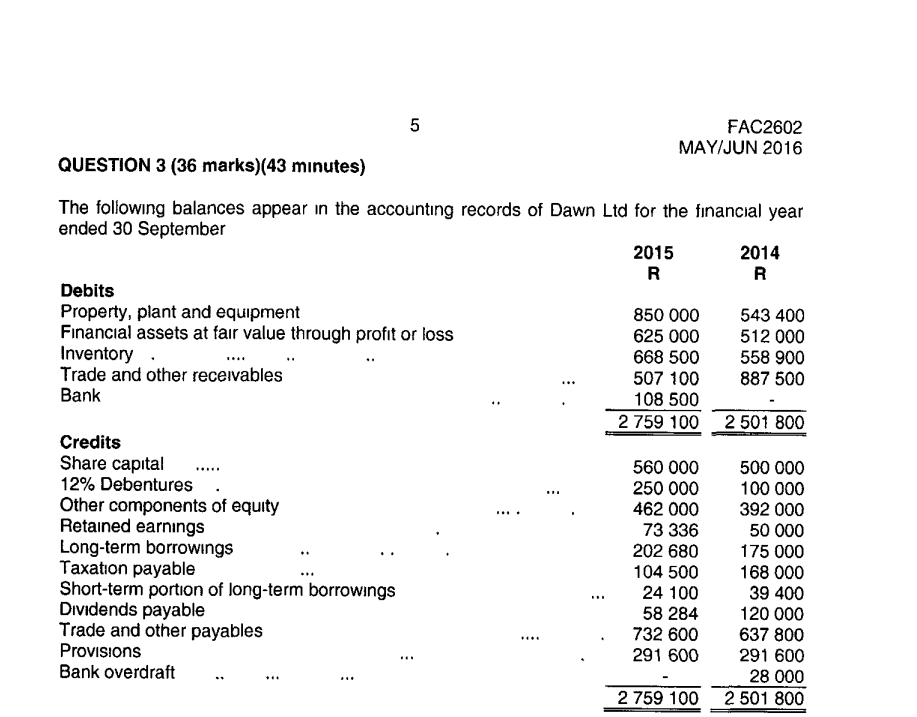

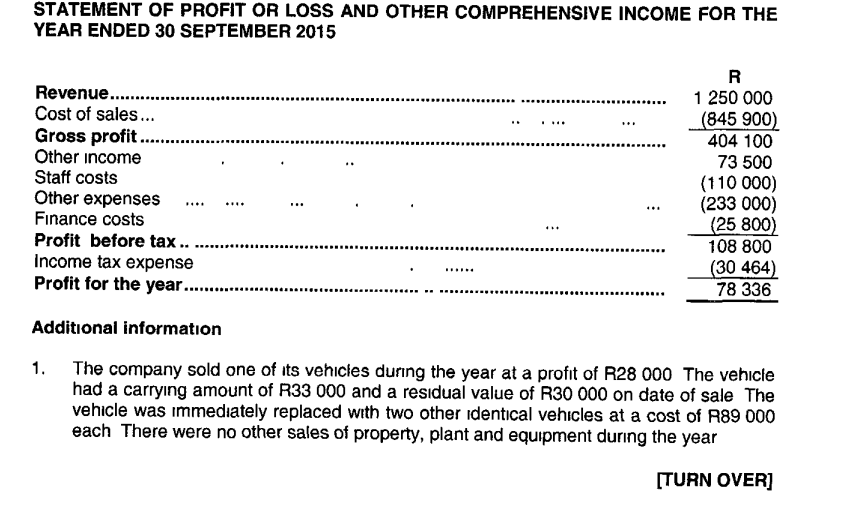

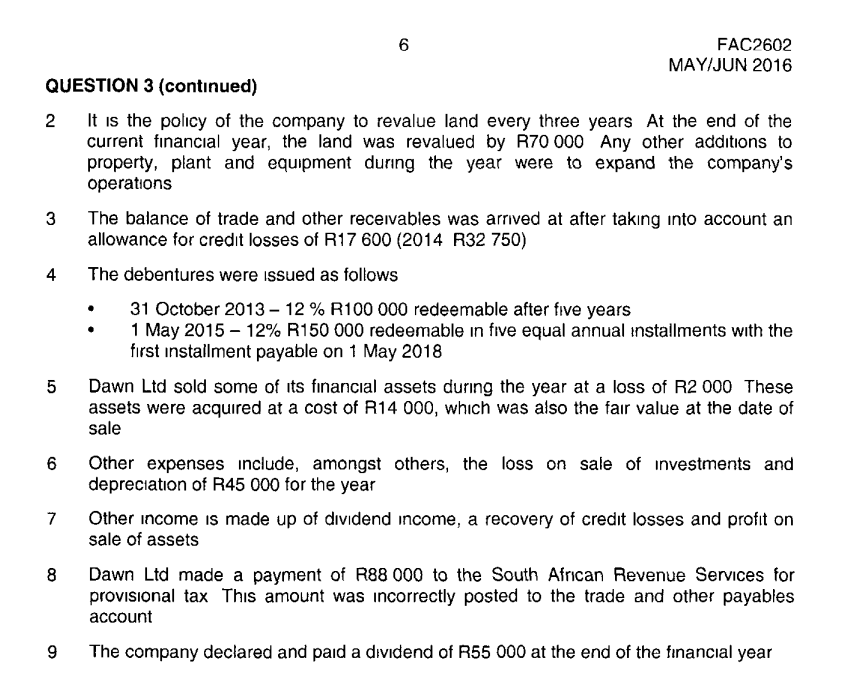

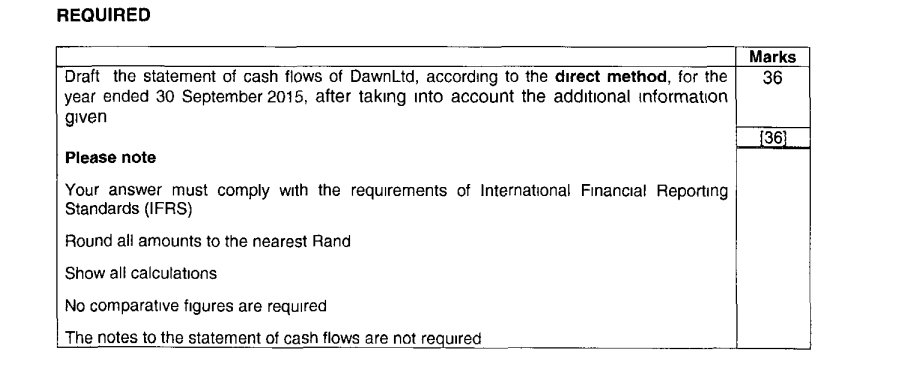

5 FAC2602 MAY/JUN 2016 QUESTION 3 (36 marks) (43 minutes) The following balances appear in the accounting records of Dawn Ltd for the financial year ended 30 September 2015 2014 R R Debits Property, plant and equipment 850 000 543 400 625 000 512 000 Financial assets at fair value through profit or loss Inventory. 668 500 558 900 Trade and other receivables 507 100 887 500 Bank 108 500 2 759 100 2 501 800 Credits Share capital 560 000 500 000 12% Debentures 250 000 100 000 Other components of equity 462 000 392 000 Retained earnings 73 336 50 000 Long-term borrowings 202 680 175 000 Taxation payable 104 500 168 000 39 400 Short-term portion of long-term borrowings Dividends payable 24 100 58 284 732 600 120 000 637 800 Trade and other payables Provisions 291 600 291 600 Bank overdraft 28 000 2 501 800 2 759 100 **** *** STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR ENDED 30 SEPTEMBER 2015 R 1 250 000 *************** ** *** Revenue............ Cost of sales... Gross profit...... Other income Staff costs . (845 900) 404 100 73 500 (110 000) (233 000) (25 800) Other expenses Finance costs 108 800 Profit before tax.. Income tax expense Profit for the year...... (30 464) 78 336 ******.. Additional information 1. The company sold one of its vehicles during the year at a profit of R28 000 The vehicle had a carrying amount of R33 000 and a residual value of R30 000 on date of sale The vehicle was immediately replaced with two other identical vehicles at a cost of R89 000 each There were no other sales of property, plant and equipment during the year [TURN OVER] 6 FAC2602 MAY/JUN 2016 QUESTION 3 (continued) 2 It is the policy of the company to revalue land every three years At the end of the current financial year, the land was revalued by R70 000 Any other additions to property, plant and equipment during the year were to expand the company's operations 3 The balance of trade and other receivables was arrived at after taking into account an allowance for credit losses of R17 600 (2014 R32 750) 4 The debentures were issued as follows 31 October 2013-12 % R100 000 redeemable after five years 1 May 2015 - 12% R150 000 redeemable in five equal annual installments with the first installment payable on 1 May 2018 5 Dawn Ltd sold some of its financial assets during the year at a loss of R2 000 These assets were acquired at a cost of R14 000, which was also the fair value at the date of sale 6 Other expenses include, amongst others, the loss on sale of investments and depreciation of R45 000 for the year 7 Other income is made up of dividend income, a recovery of credit losses and profit on sale of assets 8 Dawn Ltd made a payment of R88 000 to the South African Revenue Services for provisional tax This amount was incorrectly posted to the trade and other payables account 9 The company declared and paid a dividend of R55 000 at the end of the financial year REQUIRED Marks 36 Draft the statement of cash flows of DawnLtd, according to the direct method, for the year ended 30 September 2015, after taking into account the additional information given [36] Please note Your answer must comply with the requirements of International Financial Reporting Standards (IFRS) Round all amounts to the nearest Rand Show all calculations No comparative figures are required The notes to the statement of cash flows are not required 5 FAC2602 MAY/JUN 2016 QUESTION 3 (36 marks) (43 minutes) The following balances appear in the accounting records of Dawn Ltd for the financial year ended 30 September 2015 2014 R R Debits Property, plant and equipment 850 000 543 400 625 000 512 000 Financial assets at fair value through profit or loss Inventory. 668 500 558 900 Trade and other receivables 507 100 887 500 Bank 108 500 2 759 100 2 501 800 Credits Share capital 560 000 500 000 12% Debentures 250 000 100 000 Other components of equity 462 000 392 000 Retained earnings 73 336 50 000 Long-term borrowings 202 680 175 000 Taxation payable 104 500 168 000 39 400 Short-term portion of long-term borrowings Dividends payable 24 100 58 284 732 600 120 000 637 800 Trade and other payables Provisions 291 600 291 600 Bank overdraft 28 000 2 501 800 2 759 100 **** *** STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR ENDED 30 SEPTEMBER 2015 R 1 250 000 *************** ** *** Revenue............ Cost of sales... Gross profit...... Other income Staff costs . (845 900) 404 100 73 500 (110 000) (233 000) (25 800) Other expenses Finance costs 108 800 Profit before tax.. Income tax expense Profit for the year...... (30 464) 78 336 ******.. Additional information 1. The company sold one of its vehicles during the year at a profit of R28 000 The vehicle had a carrying amount of R33 000 and a residual value of R30 000 on date of sale The vehicle was immediately replaced with two other identical vehicles at a cost of R89 000 each There were no other sales of property, plant and equipment during the year [TURN OVER] 6 FAC2602 MAY/JUN 2016 QUESTION 3 (continued) 2 It is the policy of the company to revalue land every three years At the end of the current financial year, the land was revalued by R70 000 Any other additions to property, plant and equipment during the year were to expand the company's operations 3 The balance of trade and other receivables was arrived at after taking into account an allowance for credit losses of R17 600 (2014 R32 750) 4 The debentures were issued as follows 31 October 2013-12 % R100 000 redeemable after five years 1 May 2015 - 12% R150 000 redeemable in five equal annual installments with the first installment payable on 1 May 2018 5 Dawn Ltd sold some of its financial assets during the year at a loss of R2 000 These assets were acquired at a cost of R14 000, which was also the fair value at the date of sale 6 Other expenses include, amongst others, the loss on sale of investments and depreciation of R45 000 for the year 7 Other income is made up of dividend income, a recovery of credit losses and profit on sale of assets 8 Dawn Ltd made a payment of R88 000 to the South African Revenue Services for provisional tax This amount was incorrectly posted to the trade and other payables account 9 The company declared and paid a dividend of R55 000 at the end of the financial year REQUIRED Marks 36 Draft the statement of cash flows of DawnLtd, according to the direct method, for the year ended 30 September 2015, after taking into account the additional information given [36] Please note Your answer must comply with the requirements of International Financial Reporting Standards (IFRS) Round all amounts to the nearest Rand Show all calculations No comparative figures are required The notes to the statement of cash flows are not required