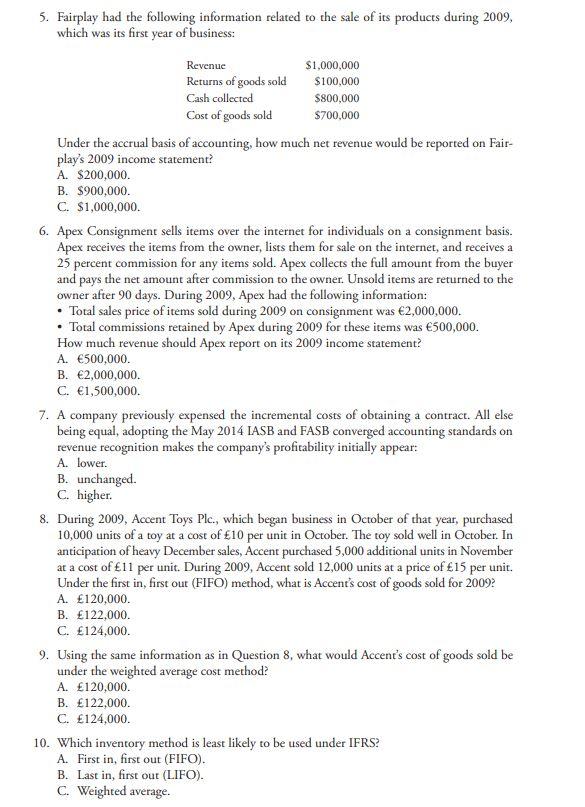

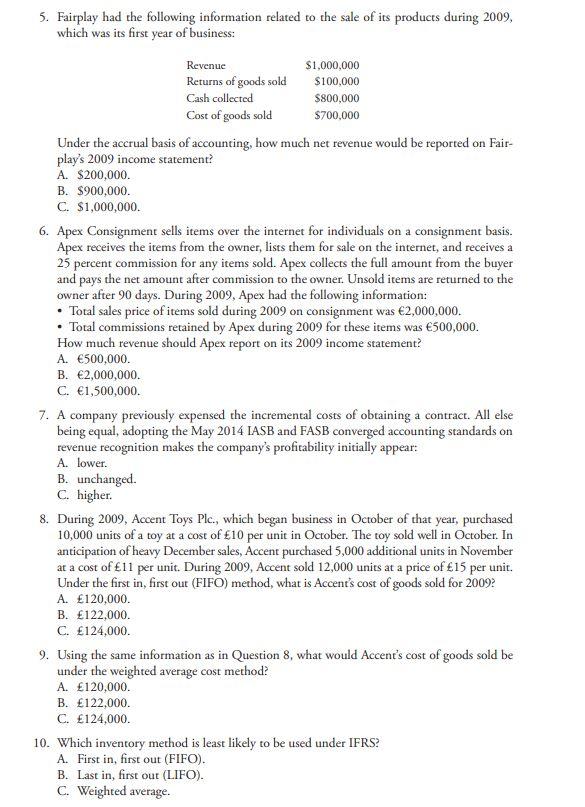

5. Fairplay had the following information related to the sale of its products during 2009, which was its first year of business: Revenue $1,000,000 Returns of goods sold $100,000 Cash collected $800,000 Cost of goods sold $700.000 Under the accrual basis of accounting, how much net revenue would be reported on Fair- play's 2009 income statement? A. $200,000. B. $900,000 C. $1,000,000. 6. Apex Consignment sells items over the internet for individuals on a consignment basis. Apex receives the items from the owner, lists them for sale on the internet, and receives a 25 percent commission for any items sold. Apex collects the full amount from the buyer and pays the net amount after commission to the owner. Unsold items are returned to the owner after 90 days. During 2009, Apex had the following information: Total sales price of items sold during 2009 on consignment was 2,000,000. Total commissions retained by Apex during 2009 for these items was 500,000. How much revenue should Apex report on its 2009 income statement? A. 500,000. B. 2,000,000 C. 1,500,000. 7. A company previously expensed the incremental costs of obtaining a contract. All else being equal, adopting the May 2014 IASB and FASB converged accounting standards on revenue recognition makes the company's profitability initially appear: A. lower. B. unchanged. C. higher. 8. During 2009, Accent Toys Plc., which began business in October of that year, purchased 10,000 units of a toy at a cost of 10 per unit in October. The toy sold well in October. In anticipation of heavy December sales, Accent purchased 5,000 additional units in November at a cost of 11 per unit. During 2009, Accent sold 12,000 units at a price of 15 per unit. Under the first in, first out (FIFO) method, what is Accent's cost of goods sold for 2009 A. 120,000 B. 122,000. C. 124,000. 9. Using the same information as in Question 8, what would Accent's cost of goods sold be under the weighted average cost method? A. 120,000 B. 122,000. C. 124,000. 10. Which inventory method is least likely to be used under IFRS? A. First in, first out (FIFO). B. Last in, first out (LIFO). C. Weighted average