Answered step by step

Verified Expert Solution

Question

1 Approved Answer

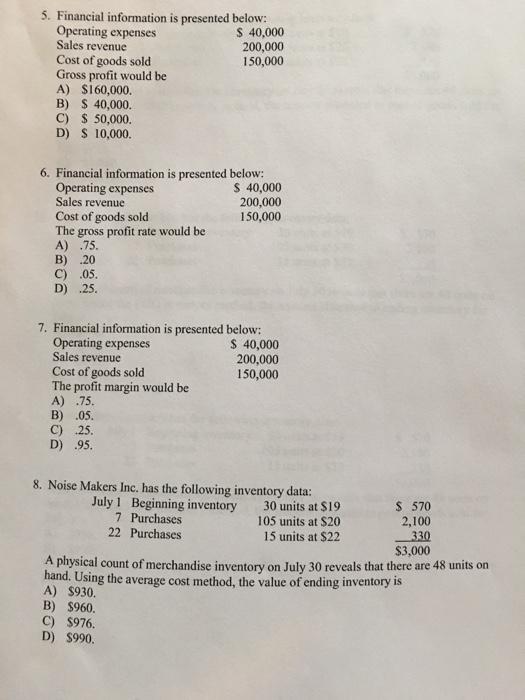

5. Financial information is presented below: Operating expenses Sales revenue Cost of goods sold Gross profit would be A) $160,000. B) $ 40,000. C)

5. Financial information is presented below: Operating expenses Sales revenue Cost of goods sold Gross profit would be A) $160,000. B) $ 40,000. C) $ 50,000. D) S 10,000. $ 40,000 200,000 150,000 6. Financial information is presented below: S 40,000 200,000 150,000 Operating expenses Sales revenue Cost of goods sold The gross profit rate would be A) .75. B) .20 C) .05. D) .25. 7. Financial information is presented below: Operating expenses Sales revenue Cost of goods sold The profit margin would be A) .75. B) .05. C) 25. D) .95. $ 40,000 200,000 150,000 8. Noise Makers Inc. has the following inventory data: July 1 Beginning inventory 7 Purchases 22 Purchases 30 units at $19 105 units at $20 15 units at $22 $ 570 2,100 330 $3,000 A physical count of merchandise inventory on July 30 reveals that there are 48 units on hand. Using the average cost method, the value of ending inventory is A) $930. B) $960. C) $976. D) $990.

Step by Step Solution

★★★★★

3.48 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

5 Gross profit Sales revenue cost of goods sold 20000015...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started