Answered step by step

Verified Expert Solution

Question

1 Approved Answer

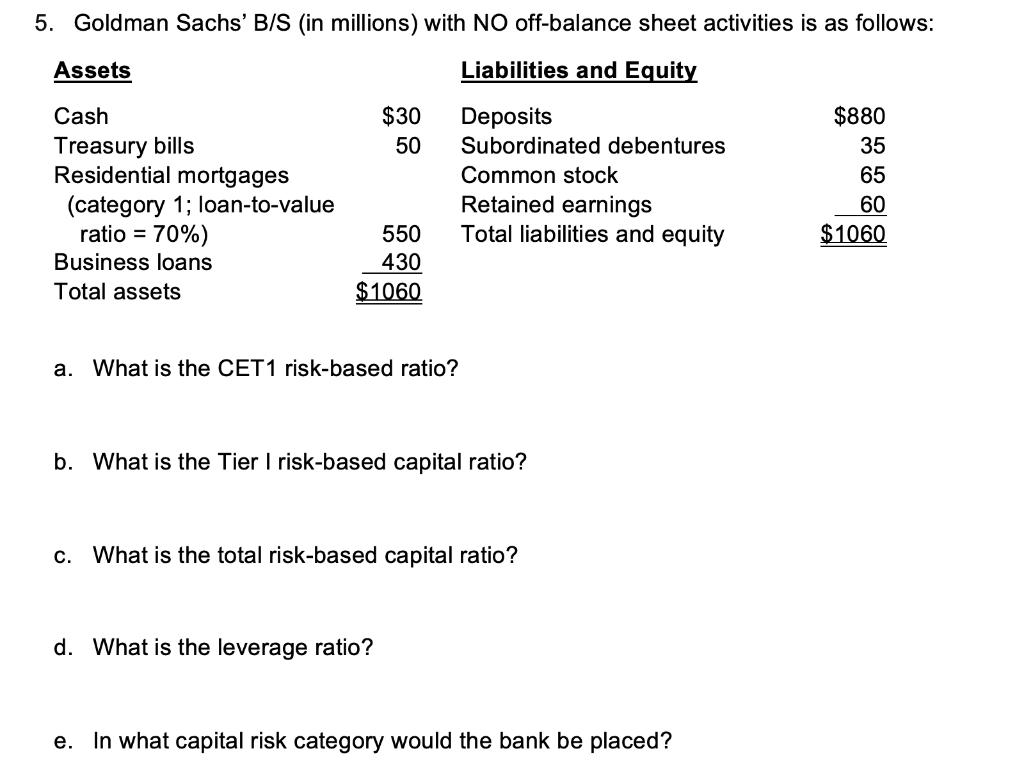

5. Goldman Sachs' B/S (in millions) with NO off-balance sheet activities is as follows: Liabilities and Equity Deposits Subordinated debentures Common stock Retained earnings

5. Goldman Sachs' B/S (in millions) with NO off-balance sheet activities is as follows: Liabilities and Equity Deposits Subordinated debentures Common stock Retained earnings Total liabilities and equity Assets Cash Treasury bills Residential mortgages (category 1; loan-to-value ratio = 70%) Business loans Total assets $30 50 550 430 $1060 a. What is the CET1 risk-based ratio? b. What is the Tier I risk-based capital ratio? c. What is the total risk-based capital ratio? d. What is the leverage ratio? e. In what capital risk category would the bank be placed? $880 35 65 60 $1060

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the capital ratios we need to determine the components of each ratio based on the information provided a CET1 RiskBased Ratio The Common ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started