Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. Hedging with Futures, with Target Date = Maturity (20 points) Suppose that on October 15, 1997, in the midst of the Asian Financial

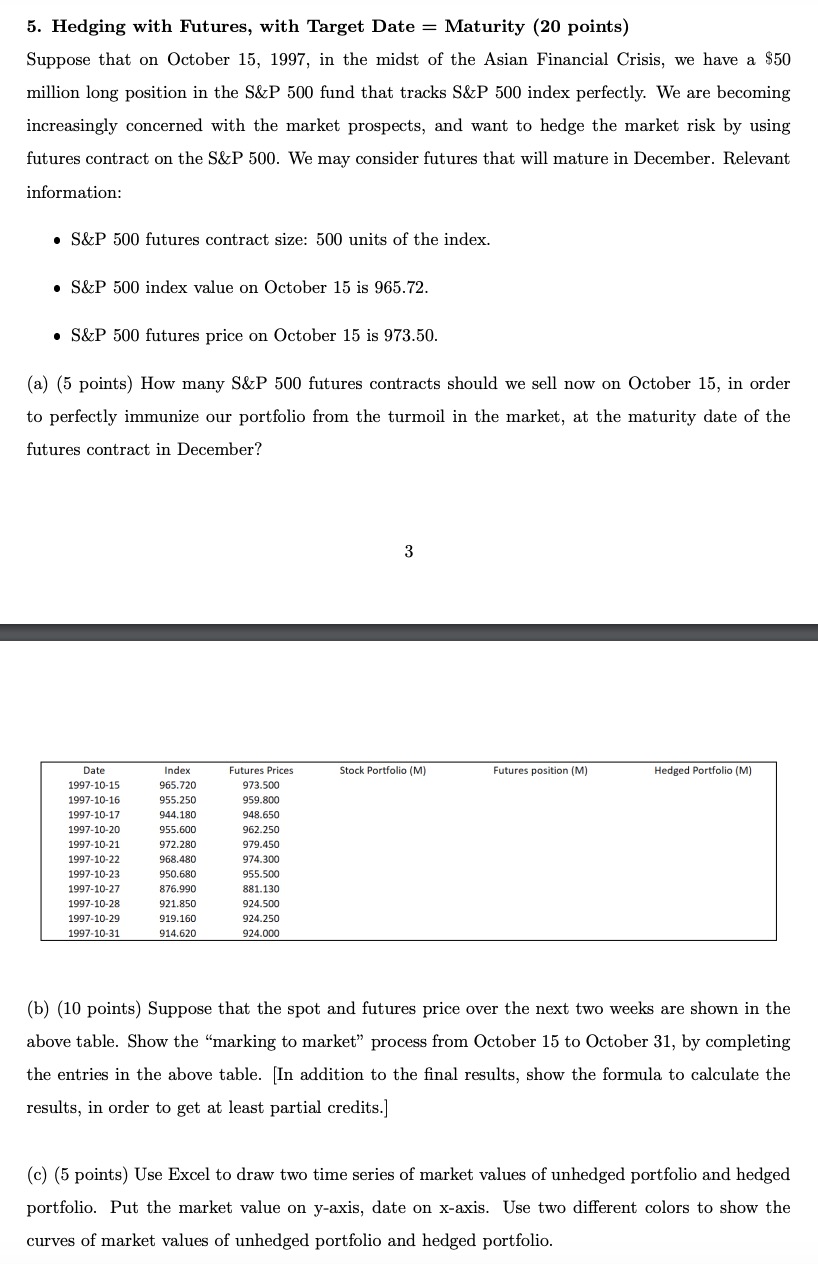

5. Hedging with Futures, with Target Date = Maturity (20 points) Suppose that on October 15, 1997, in the midst of the Asian Financial Crisis, we have a $50 million long position in the S&P 500 fund that tracks S&P 500 index perfectly. We are becoming increasingly concerned with the market prospects, and want to hedge the market risk by using futures contract on the S&P 500. We may consider futures that will mature in December. Relevant information: S&P 500 futures contract size: 500 units of the index. S&P 500 index value on October 15 is 965.72. S&P 500 futures price on October 15 is 973.50. (a) (5 points) How many S&P 500 futures contracts should we sell now on October 15, in order to perfectly immunize our portfolio from the turmoil in the market, at the maturity date of the futures contract in December? 3 Date 1997-10-15 1997-10-16 Index 965.720 Futures Prices 973.500 Stock Portfolio (M) Futures position (M) Hedged Portfolio (M) 955.250 959.800 1997-10-17 944.180 948.650 1997-10-20 955.600 962.250 1997-10-21 972.280 979.450 1997-10-22 968.480 974.300 1997-10-23 950.680 955.500 1997-10-27 876.990 881.130 1997-10-28 921.850 924.500 1997-10-29 919.160 1997-10-31 914.620 924.250 924.000 (b) (10 points) Suppose that the spot and futures price over the next two weeks are shown in the above table. Show the "marking to market process from October 15 to October 31, by completing the entries in the above table. [In addition to the final results, show the formula to calculate the results, in order to get at least partial credits.] (c) (5 points) Use Excel to draw two time series of market values of unhedged portfolio and hedged portfolio. Put the market value on y-axis, date on x-axis. Use two different colors to show the curves of market values of unhedged portfolio and hedged portfolio.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started