Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. In developing the uncovered interest parity condition, we ignored taxes. A government could impose taxes on interest earnings and/or any capital gain or due

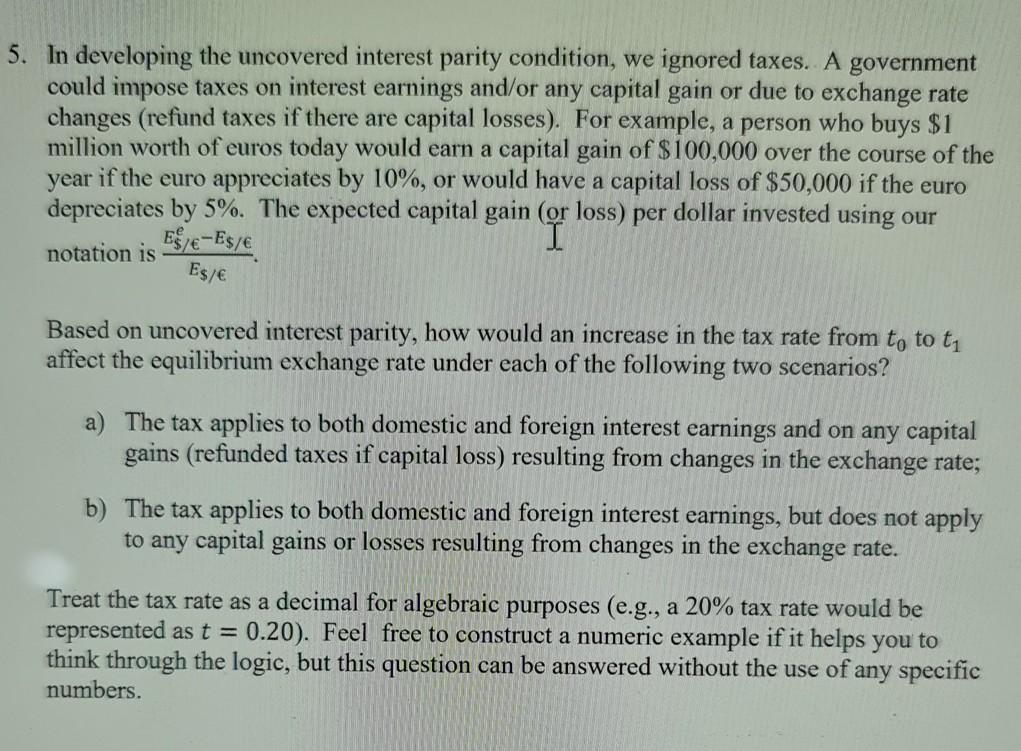

5. In developing the uncovered interest parity condition, we ignored taxes. A government could impose taxes on interest earnings and/or any capital gain or due to exchange rate changes (refund taxes if there are capital losses). For example, a person who buys $1 million worth of euros today would earn a capital gain of $100,000 over the course of the year if the euro appreciates by 10%, or would have a capital loss of $50,000 if the euro depreciates by 5%. The expected capital gain (or loss) per dollar invested using our Eg/e-Es/e I notation is Es/ Based on uncovered interest parity, how would an increase in the tax rate from to to ti affect the equilibrium exchange rate under each of the following two scenarios? a) The tax applies to both domestic and foreign interest earnings and on any capital gains (refunded taxes if capital loss) resulting from changes in the exchange rate; b) The tax applies to both domestic and foreign interest earnings, but does not apply to any capital gains or losses resulting from changes in the exchange rate. Treat the tax rate as a decimal for algebraic purposes (e.g., a 20% tax rate would be represented as t = 0.20). Feel free to construct a numeric example if it helps you to think through the logic, but this question can be answered without the use of any specific numbers. 5. In developing the uncovered interest parity condition, we ignored taxes. A government could impose taxes on interest earnings and/or any capital gain or due to exchange rate changes (refund taxes if there are capital losses). For example, a person who buys $1 million worth of euros today would earn a capital gain of $100,000 over the course of the year if the euro appreciates by 10%, or would have a capital loss of $50,000 if the euro depreciates by 5%. The expected capital gain (or loss) per dollar invested using our Eg/e-Es/e I notation is Es/ Based on uncovered interest parity, how would an increase in the tax rate from to to ti affect the equilibrium exchange rate under each of the following two scenarios? a) The tax applies to both domestic and foreign interest earnings and on any capital gains (refunded taxes if capital loss) resulting from changes in the exchange rate; b) The tax applies to both domestic and foreign interest earnings, but does not apply to any capital gains or losses resulting from changes in the exchange rate. Treat the tax rate as a decimal for algebraic purposes (e.g., a 20% tax rate would be represented as t = 0.20). Feel free to construct a numeric example if it helps you to think through the logic, but this question can be answered without the use of any specific numbers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started