Question

5. In Figure 5(b), we assumed that when savings rise, none of the additional savings enter a loanable funds market. Suppose, instead, that 40 percent

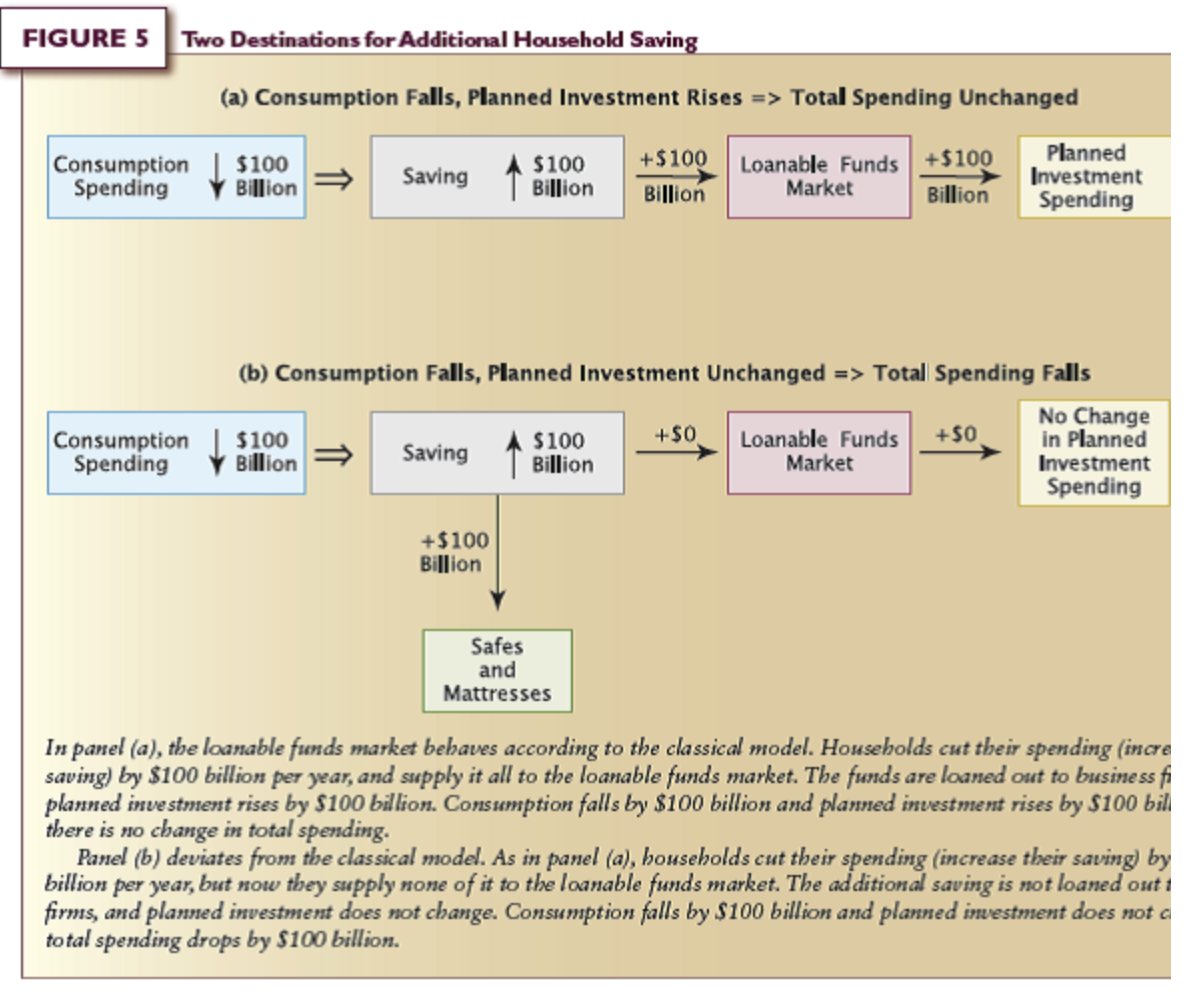

5. In Figure 5(b), we assumed that when savings rise, none of the additional savings enter a loanable funds market. Suppose, instead, that 40 percent of any additional savings is supplied to financial intermediaries, while the rest goes into safes and mattresses. Also, assume that 30 cents out of every dollar provided to a financial intermediary is lent out. If there is no other deviation from the normal functioning of the loanable funds market, determine the impact of a $100 billion increase in annual savings on (a) planned investment per year and (b) total spending per year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started