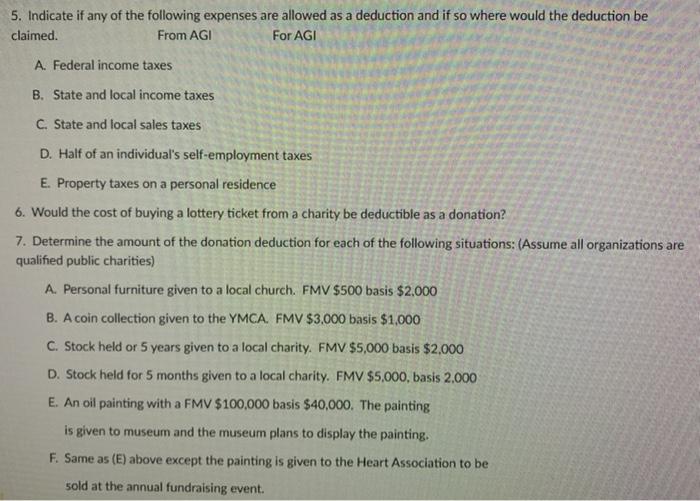

5. Indicate if any of the following expenses are allowed as a deduction and if so where would the deduction be claimed. From AGI For AGI A. Federal income taxes B. State and local income taxes C. State and local sales taxes D. Half of an individual's self-employment taxes E. Property taxes on a personal residence 6. Would the cost of buying a lottery ticket from a charity be deductible as a donation? 7. Determine the amount of the donation deduction for each of the following situations: (Assume all organizations are qualified public charities) A. Personal furniture given to a local church. FMV $500 basis $2.000 B. A coin collection given to the YMCA, FMV $3,000 basis $1,000 C. Stock held or 5 years given to a local charity. FMV $5,000 basis $2,000 D. Stock held for 5 months given to a local charity. FMV $5,000, basis 2.000 E. An oil painting with a FMV $100,000 basis $40,000. The painting is given to museum and the museum plans to display the painting. F. Same as (E) above except the painting is given to the Heart Association to be sold at the annual fundraising event. 5. Indicate if any of the following expenses are allowed as a deduction and if so where would the deduction be claimed. From AGI For AGI A. Federal income taxes B. State and local income taxes C. State and local sales taxes D. Half of an individual's self-employment taxes E. Property taxes on a personal residence 6. Would the cost of buying a lottery ticket from a charity be deductible as a donation? 7. Determine the amount of the donation deduction for each of the following situations: (Assume all organizations are qualified public charities) A. Personal furniture given to a local church. FMV $500 basis $2.000 B. A coin collection given to the YMCA, FMV $3,000 basis $1,000 C. Stock held or 5 years given to a local charity. FMV $5,000 basis $2,000 D. Stock held for 5 months given to a local charity. FMV $5,000, basis 2.000 E. An oil painting with a FMV $100,000 basis $40,000. The painting is given to museum and the museum plans to display the painting. F. Same as (E) above except the painting is given to the Heart Association to be sold at the annual fundraising event