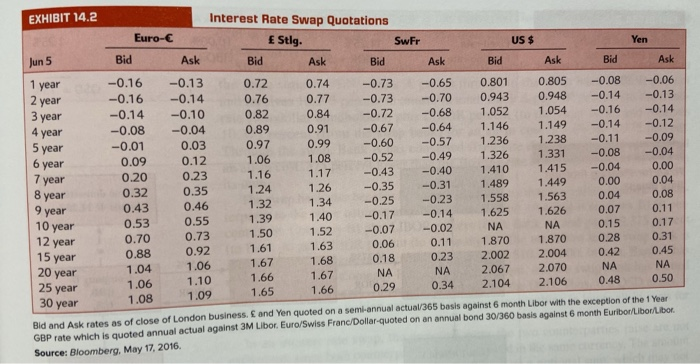

5. Interest Rate Swap a. Design an interest rate swap contract for USS (6 years). Use the interest rate swap quotations retrieved from Financial Times in your textbook (Exhibit 14.2, p351) with diagrams (arrows, boxes and circles as used in the textbook and lecture), assigning LIBOR and appropriate bid and ask rates in right places along the arrow. Specifically, the name of swap dealer is GS Finance. IBM enters into an interest rate swap contract with GS Finance: pay a fixed rate and receive LIBOR. Simultaneously, UBS enters into an interest rate swap contract with GS Finance with the same maturity (6 years) and same notional principal ($10,000,000): pay LIBOR and receive a fixed rate. Be specific about major component interest rates they receive or pay) of each party for swap contracts above each arrow. Assume the interest swap contracts signed on March 6, 2020, and LIBOR on that day is 1% per annum. b. Explain the possible motivation of IBM and UBS, respectively, to enter into the interest rate swap contract with GS Finance. What is the major purpose of IBM and UBS to sign interest rate swap contracts? c. Discuss the costs and benefits of GS Finance as a swap dealer. Does GS Finance have an exposure to interest rate risk? d. Value of swap: Calculate the value of swap if IBM wants to get out of the contract on March 6, 2021. Assume LIBOR rate is 1.5% per annum on that day. Be specific who pays to whom how much? EXHIBIT 14.2 Interest Rate Swap Quotations Euro- E Stlg. SwFr US $ Yen Jun 5 Bid Ask Bid Ask Bid Ask Bid Ask Bid Ask 1 year -0.16 -0.13 0.72 0.74 -0.73 -0.65 0.801 0.805 -0.08 -0.06 2 year -0.16 0.14 0.76 0.77 -0.73 -0.70 0.943 0.948 -0.14 -0.13 3 year -0.14 -0.10 0.82 0.84 -0.72 -0.68 1.052 1.054 -0.16 -0.14 4 year -0.08 -0.04 0.89 0.91 -0.67 -0.64 1.146 1.149 -0.14 -0.12 -0.01 0.03 5 year 0.97 0.99 -0.60 -0.57 1.236 -0.11 1.238 -0.09 0.09 1.06 1.08 6 year 0.12 1.331 -0.52 1.326 -0.49 -0.04 -0.08 1.17 1.16 7 year 1.410 1.415 0.20 -0.43 0.23 0.00 -0.04 -0.40 -0.35 1.26 -0.31 1.449 1.489 1.24 0.00 0.04 8 year 0.32 1.34 -0.25 1.563 -0.23 1.558 0.04 0.46 0.08 1.32 0.43 9 year -0.17 -0.14 0.07 1.626 1.625 0.11 1.40 0.55 1.39 0.53 10 year NA -0.07 -0.02 0.15 0.17 1.52 1.50 0.70 12 year 0.73 0.06 0.11 1.870 1.870 0.28 1.63 0.31 1.61 0.92 0.88 15 year 2.004 2.002 0.23 0.45 0.42 0.18 1.68 1.67 1.06 1.04 20 year . NA NA 2.070 NA 2.067 1.67 1.66 1.10 1.06 25 year 2.104 2.106 0.50 0.48 0.29 1.65 1.66 1.09 30 year 1.08 Bid and Ask rates as of close of London business and Yen quoted on a semi-annual actual/365 basis against 6 month Libor with the exception of the Year GOP rate which is quoted annual actual against 3M Libor Euro/Swiss Franc/Dollar-quoted on an annual bond 30/360 basis against 6 month Euribor Libor Libor Source: Bloomberg, May 17, 2016. 0.35 NA 5. Interest Rate Swap a. Design an interest rate swap contract for USS (6 years). Use the interest rate swap quotations retrieved from Financial Times in your textbook (Exhibit 14.2, p351) with diagrams (arrows, boxes and circles as used in the textbook and lecture), assigning LIBOR and appropriate bid and ask rates in right places along the arrow. Specifically, the name of swap dealer is GS Finance. IBM enters into an interest rate swap contract with GS Finance: pay a fixed rate and receive LIBOR. Simultaneously, UBS enters into an interest rate swap contract with GS Finance with the same maturity (6 years) and same notional principal ($10,000,000): pay LIBOR and receive a fixed rate. Be specific about major component interest rates they receive or pay) of each party for swap contracts above each arrow. Assume the interest swap contracts signed on March 6, 2020, and LIBOR on that day is 1% per annum. b. Explain the possible motivation of IBM and UBS, respectively, to enter into the interest rate swap contract with GS Finance. What is the major purpose of IBM and UBS to sign interest rate swap contracts? c. Discuss the costs and benefits of GS Finance as a swap dealer. Does GS Finance have an exposure to interest rate risk? d. Value of swap: Calculate the value of swap if IBM wants to get out of the contract on March 6, 2021. Assume LIBOR rate is 1.5% per annum on that day. Be specific who pays to whom how much? EXHIBIT 14.2 Interest Rate Swap Quotations Euro- E Stlg. SwFr US $ Yen Jun 5 Bid Ask Bid Ask Bid Ask Bid Ask Bid Ask 1 year -0.16 -0.13 0.72 0.74 -0.73 -0.65 0.801 0.805 -0.08 -0.06 2 year -0.16 0.14 0.76 0.77 -0.73 -0.70 0.943 0.948 -0.14 -0.13 3 year -0.14 -0.10 0.82 0.84 -0.72 -0.68 1.052 1.054 -0.16 -0.14 4 year -0.08 -0.04 0.89 0.91 -0.67 -0.64 1.146 1.149 -0.14 -0.12 -0.01 0.03 5 year 0.97 0.99 -0.60 -0.57 1.236 -0.11 1.238 -0.09 0.09 1.06 1.08 6 year 0.12 1.331 -0.52 1.326 -0.49 -0.04 -0.08 1.17 1.16 7 year 1.410 1.415 0.20 -0.43 0.23 0.00 -0.04 -0.40 -0.35 1.26 -0.31 1.449 1.489 1.24 0.00 0.04 8 year 0.32 1.34 -0.25 1.563 -0.23 1.558 0.04 0.46 0.08 1.32 0.43 9 year -0.17 -0.14 0.07 1.626 1.625 0.11 1.40 0.55 1.39 0.53 10 year NA -0.07 -0.02 0.15 0.17 1.52 1.50 0.70 12 year 0.73 0.06 0.11 1.870 1.870 0.28 1.63 0.31 1.61 0.92 0.88 15 year 2.004 2.002 0.23 0.45 0.42 0.18 1.68 1.67 1.06 1.04 20 year . NA NA 2.070 NA 2.067 1.67 1.66 1.10 1.06 25 year 2.104 2.106 0.50 0.48 0.29 1.65 1.66 1.09 30 year 1.08 Bid and Ask rates as of close of London business and Yen quoted on a semi-annual actual/365 basis against 6 month Libor with the exception of the Year GOP rate which is quoted annual actual against 3M Libor Euro/Swiss Franc/Dollar-quoted on an annual bond 30/360 basis against 6 month Euribor Libor Libor Source: Bloomberg, May 17, 2016. 0.35 NA