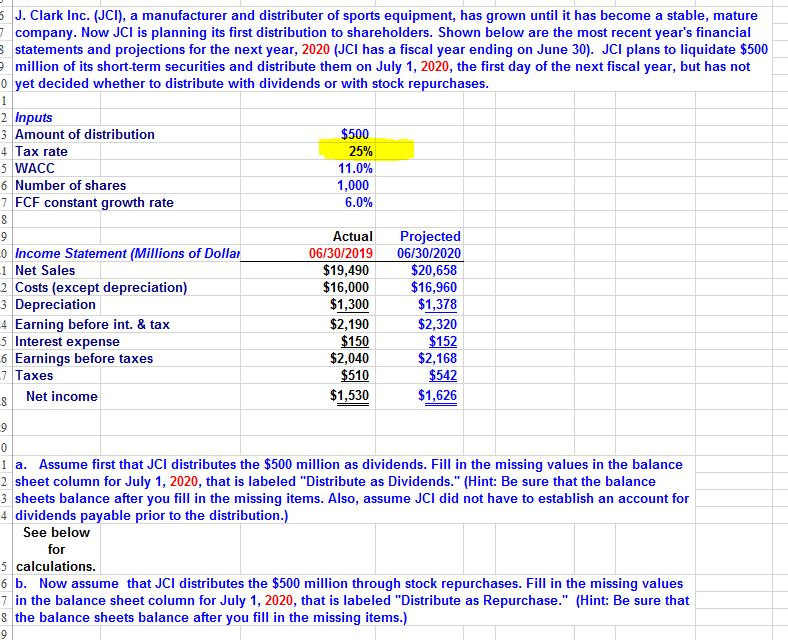

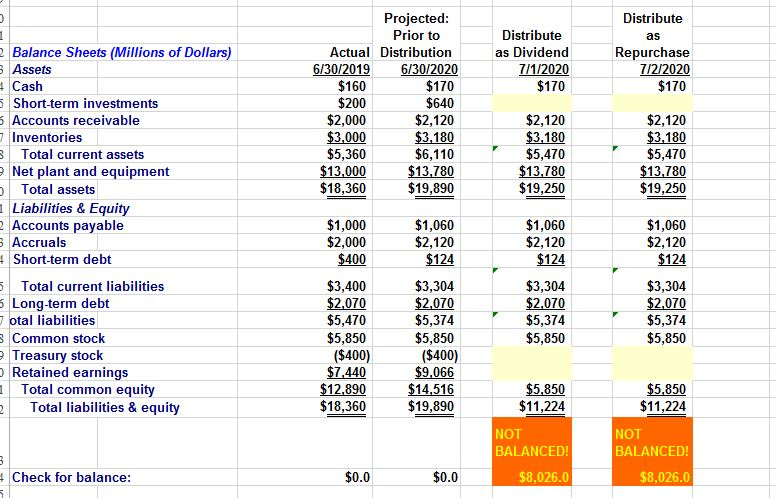

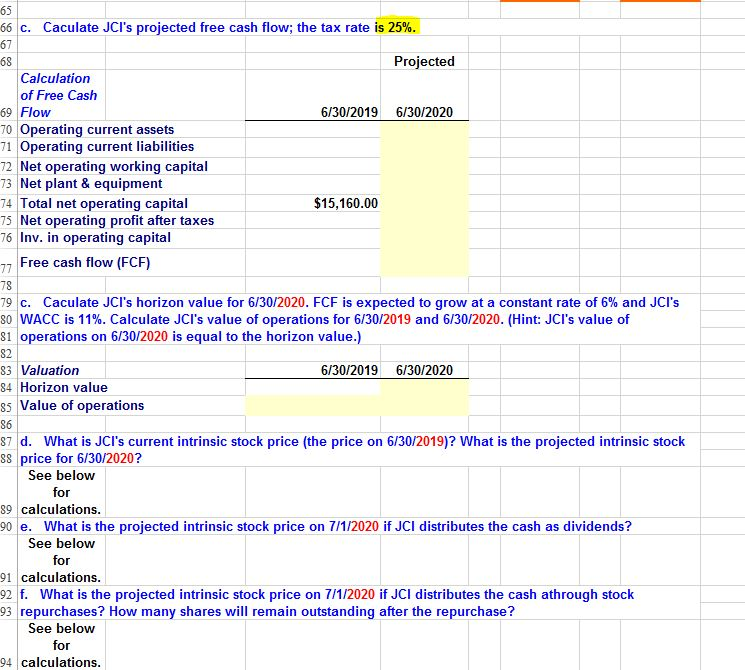

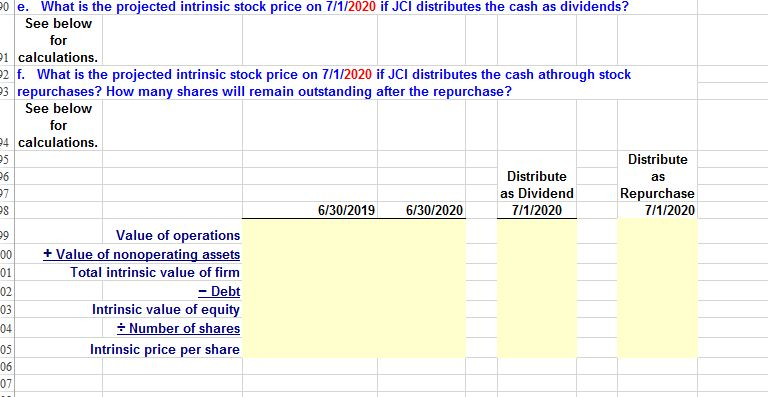

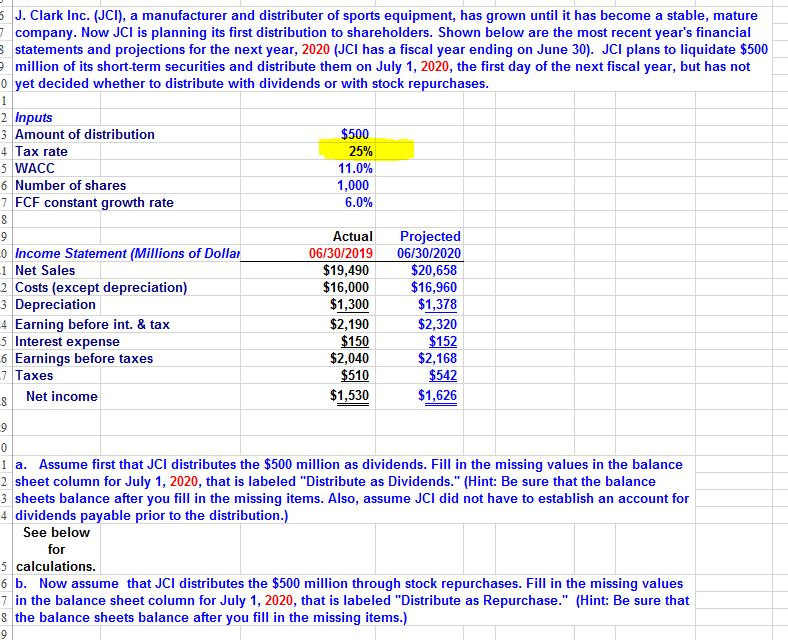

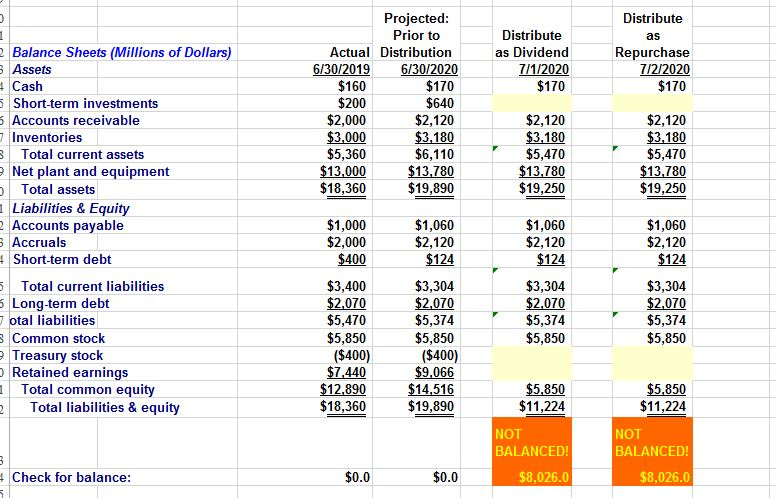

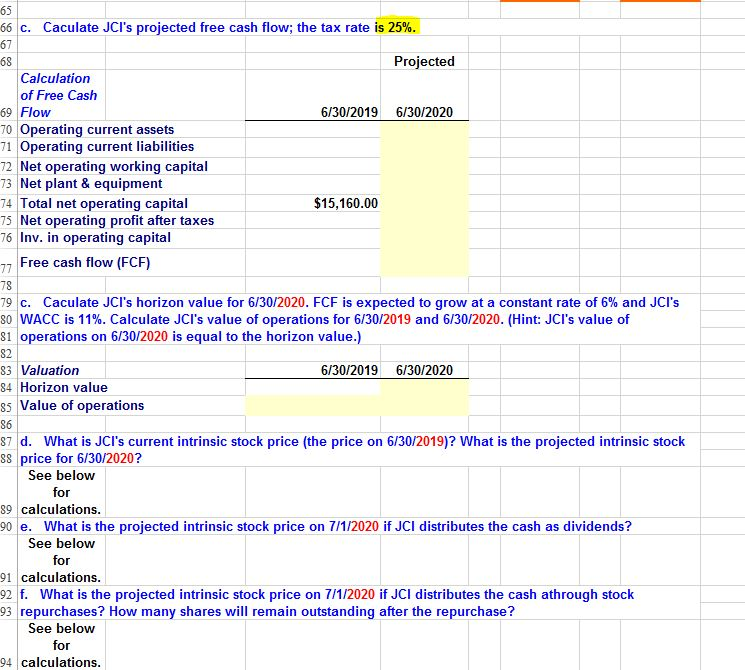

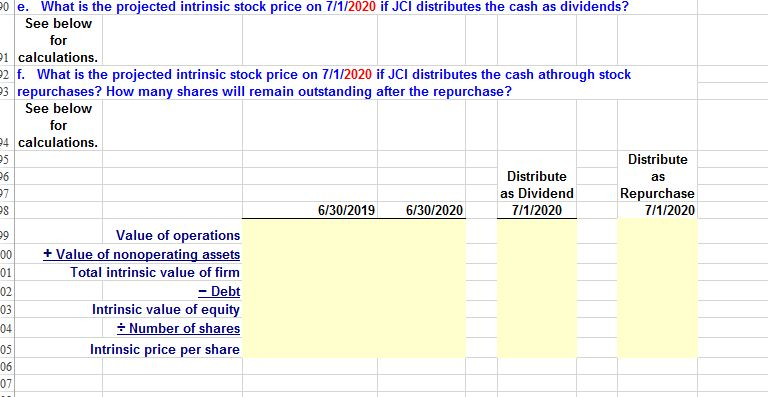

5 J. Clark Inc. (JCI), a manufacturer and distributer of sports equipment, has grown until it has become a stable, mature 7 company. Now JCI is planning its first distribution to shareholders. Shown below are the most recent year's financial s statements and projections for the next year, 2020 (JCI has a fiscal year ending on June 30). JCI plans to liquidate $500 million of its short-term securities and distribute them on July 1, 2020, the first day of the next fiscal year, but has not O yet decided whether to distribute with dividends or with stock repurchases. 2 Inputs 3 Amount of distribution 4 Tax rate 5 WACC 6 Number of shares 7 FCF constant growth rate $500 25% 11.0% 1,000 6.0% Lo Income Statement (Millions of Dollar -1 Net Sales 2 Costs (except depreciation) 3 Depreciation 4 Earning before int. & tax 5 Interest expense 6 Earnings before taxes -7 Taxes 8 Net income Actual 06/30/2019 $19,490 $16,000 $1,300 $2,190 $150 $2,040 $510 $1,530 Projected 06/30/2020 $20,658 $16,960 $1,378 $2,320 $152 $2,168 $542 $1,626 1 a. Assume first that JCI distributes the $500 million as dividends. Fill in the missing values in the balance 2 sheet column for July 1, 2020, that is labeled "Distribute as Dividends." (Hint: Be sure that the balance 3 sheets balance after you fill in the missing items. Also, assume JCI did not have to establish an account for 4 dividends payable prior to the distribution.) See below for 5 calculations. 6 b. Now assume that JCI distributes the $500 million through stock repurchases. Fill in the missing values 7 in the balance sheet column for July 1, 2020, that is labeled "Distribute as Repurchase." (Hint: Be sure that 8 the balance sheets balance after you fill in the missing items.) Distribute as Dividend 7/1/2020 $170 Distribute as Repurchase 7/2/2020 $170 2 Balance Sheets (Millions of Dollars) B Assets Cash 5 Short-term investments 3 Accounts receivable 7 Inventories 3 Total current assets Net plant and equipment Total assets Liabilities & Equity 2 Accounts payable B Accruals Short-term debt Projected: Prior to Actual Distribution 6/30/2019 6/30/2020 $160 $170 $200 $640 $2,000 $2,120 $3,000 $3,180 $5,360 $6,110 $13,000 $13,780 $18,360 $19,890 $2,120 $3,180 $5,470 $13,780 $19,250 $2,120 $3,180 $5,470 $13,780 $19,250 $1,000 $2,000 $400 $1,060 $2,120 $124 $1,060 $2,120 $124 $3,304 $2,070 $5,374 $5,850 $1,060 $2,120 $124 $3,304 $2,070 $5,374 $5,850 5 Total current liabilities Long-term debt otal liabilities s Common stock Treasury stock Retained earnings 1 Total common equity 2 Total liabilities & equity $3,400 $2,070 $5,470 $5,850 ($400) $7,440 $12,890 $18,360 $3,304 $2,070 $5,374 $5,850 ($400) $9,066 $14,516 $19,890 $5,850 $11,224 $5,850 $11,224 NOT BALANCED! NOT BALANCED! # Check for balance: $0.0 $0.0 $8,026.0 $8,026.0 66 c. Caculate JCI's projected free cash flow; the tax rate is 25%. Projected 6/30/2019 6/30/2020 Duties Calculation of Free Cash 69 Flow 70 Operating current assets 71 Operating current liabilities 72 Net operating working capital 73 Net plant & equipment 74 Total net operating capital 75 Net operating profit after taxes 76 Inv. in operating capital 27 Free cash flow (FCF) $15,160.00 79 C. Caculate JCI's horizon value for 6/30/2020. FCF is expected to grow at a constant rate of 6% and JCI's 80 WACC is 11%. Calculate JCI's value of operations for 6/30/2019 and 6/30/2020. (Hint: JCI's value of 81 operations on 6/30/2020 is equal to the horizon value.) 82 6/30/2019 6/30/2020 83 Valuation 84 Horizon value 85 Value of operations 86 87 d. What is JCI's current intrinsic stock price (the price on 6/30/2019)? What is the projected intrinsic stock 88 price for 6/30/2020? See below for 89 calculations. 90 e. What is the projected intrinsic stock price on 7/1/2020 if JCI distributes the cash as dividends? See below for 91 calculations. 92 f. What is the projected intrinsic stock price on 7/1/2020 if JCI distributes the cash athrough stock 93 repurchases? How many shares will remain outstanding after the repurchase? See below for 94 calculations. 0 e. What is the projected intrinsic stock price on 7/1/2020 if JCI distributes the cash as dividends? See below for 1 calculations. 22 f. What is the projected intrinsic stock price on 7/1/2020 if JCI distributes the cash athrough stock 3 repurchases? How many shares will remain outstanding after the repurchase? See below for 24 calculations. Distribute Distribute as as Dividend Repurchase 6/30/2019 6/30/2020 7/1/2020 7/1/2020 Value of operations + Value of nonoperating assets Total intrinsic value of firm - Debt Intrinsic value of equity Number of shares Intrinsic price per share 5 J. Clark Inc. (JCI), a manufacturer and distributer of sports equipment, has grown until it has become a stable, mature 7 company. Now JCI is planning its first distribution to shareholders. Shown below are the most recent year's financial s statements and projections for the next year, 2020 (JCI has a fiscal year ending on June 30). JCI plans to liquidate $500 million of its short-term securities and distribute them on July 1, 2020, the first day of the next fiscal year, but has not O yet decided whether to distribute with dividends or with stock repurchases. 2 Inputs 3 Amount of distribution 4 Tax rate 5 WACC 6 Number of shares 7 FCF constant growth rate $500 25% 11.0% 1,000 6.0% Lo Income Statement (Millions of Dollar -1 Net Sales 2 Costs (except depreciation) 3 Depreciation 4 Earning before int. & tax 5 Interest expense 6 Earnings before taxes -7 Taxes 8 Net income Actual 06/30/2019 $19,490 $16,000 $1,300 $2,190 $150 $2,040 $510 $1,530 Projected 06/30/2020 $20,658 $16,960 $1,378 $2,320 $152 $2,168 $542 $1,626 1 a. Assume first that JCI distributes the $500 million as dividends. Fill in the missing values in the balance 2 sheet column for July 1, 2020, that is labeled "Distribute as Dividends." (Hint: Be sure that the balance 3 sheets balance after you fill in the missing items. Also, assume JCI did not have to establish an account for 4 dividends payable prior to the distribution.) See below for 5 calculations. 6 b. Now assume that JCI distributes the $500 million through stock repurchases. Fill in the missing values 7 in the balance sheet column for July 1, 2020, that is labeled "Distribute as Repurchase." (Hint: Be sure that 8 the balance sheets balance after you fill in the missing items.) Distribute as Dividend 7/1/2020 $170 Distribute as Repurchase 7/2/2020 $170 2 Balance Sheets (Millions of Dollars) B Assets Cash 5 Short-term investments 3 Accounts receivable 7 Inventories 3 Total current assets Net plant and equipment Total assets Liabilities & Equity 2 Accounts payable B Accruals Short-term debt Projected: Prior to Actual Distribution 6/30/2019 6/30/2020 $160 $170 $200 $640 $2,000 $2,120 $3,000 $3,180 $5,360 $6,110 $13,000 $13,780 $18,360 $19,890 $2,120 $3,180 $5,470 $13,780 $19,250 $2,120 $3,180 $5,470 $13,780 $19,250 $1,000 $2,000 $400 $1,060 $2,120 $124 $1,060 $2,120 $124 $3,304 $2,070 $5,374 $5,850 $1,060 $2,120 $124 $3,304 $2,070 $5,374 $5,850 5 Total current liabilities Long-term debt otal liabilities s Common stock Treasury stock Retained earnings 1 Total common equity 2 Total liabilities & equity $3,400 $2,070 $5,470 $5,850 ($400) $7,440 $12,890 $18,360 $3,304 $2,070 $5,374 $5,850 ($400) $9,066 $14,516 $19,890 $5,850 $11,224 $5,850 $11,224 NOT BALANCED! NOT BALANCED! # Check for balance: $0.0 $0.0 $8,026.0 $8,026.0 66 c. Caculate JCI's projected free cash flow; the tax rate is 25%. Projected 6/30/2019 6/30/2020 Duties Calculation of Free Cash 69 Flow 70 Operating current assets 71 Operating current liabilities 72 Net operating working capital 73 Net plant & equipment 74 Total net operating capital 75 Net operating profit after taxes 76 Inv. in operating capital 27 Free cash flow (FCF) $15,160.00 79 C. Caculate JCI's horizon value for 6/30/2020. FCF is expected to grow at a constant rate of 6% and JCI's 80 WACC is 11%. Calculate JCI's value of operations for 6/30/2019 and 6/30/2020. (Hint: JCI's value of 81 operations on 6/30/2020 is equal to the horizon value.) 82 6/30/2019 6/30/2020 83 Valuation 84 Horizon value 85 Value of operations 86 87 d. What is JCI's current intrinsic stock price (the price on 6/30/2019)? What is the projected intrinsic stock 88 price for 6/30/2020? See below for 89 calculations. 90 e. What is the projected intrinsic stock price on 7/1/2020 if JCI distributes the cash as dividends? See below for 91 calculations. 92 f. What is the projected intrinsic stock price on 7/1/2020 if JCI distributes the cash athrough stock 93 repurchases? How many shares will remain outstanding after the repurchase? See below for 94 calculations. 0 e. What is the projected intrinsic stock price on 7/1/2020 if JCI distributes the cash as dividends? See below for 1 calculations. 22 f. What is the projected intrinsic stock price on 7/1/2020 if JCI distributes the cash athrough stock 3 repurchases? How many shares will remain outstanding after the repurchase? See below for 24 calculations. Distribute Distribute as as Dividend Repurchase 6/30/2019 6/30/2020 7/1/2020 7/1/2020 Value of operations + Value of nonoperating assets Total intrinsic value of firm - Debt Intrinsic value of equity Number of shares Intrinsic price per share