Answered step by step

Verified Expert Solution

Question

1 Approved Answer

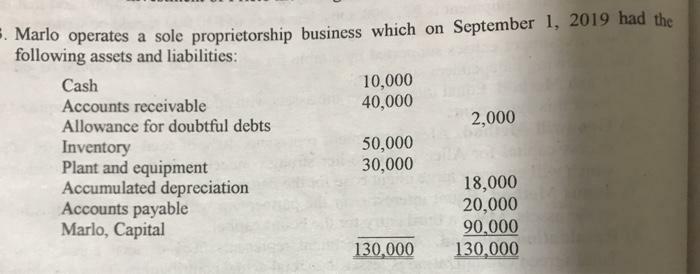

5. Marlo operates a sole proprietorship business which on September 1, 2019 had the following assets and liabilities: Cash 10,000 Accounts receivable 40,000 Allowance for

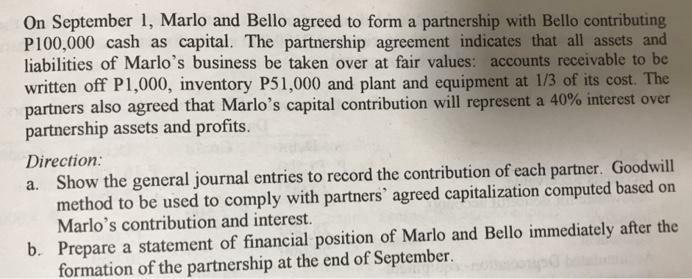

5. Marlo operates a sole proprietorship business which on September 1, 2019 had the following assets and liabilities: Cash 10,000 Accounts receivable 40,000 Allowance for doubtful debts 2,000 Inventory 50,000 Plant and equipment 30,000 Accumulated depreciation 18,000 Accounts payable 20,000 Marlo, Capital 90,000 130,000 130,000 On September 1, Marlo and Bello agreed to form a partnership with Bello contributing P100,000 cash as capital. The partnership agreement indicates that all assets and liabilities of Marlo's business be taken over at fair values: accounts receivable to be written off P1,000, inventory P51,000 and plant and equipment at 1/3 of its cost. The partners also agreed that Marlo's capital contribution will represent a 40% interest over partnership assets and profits. Direction: a. Show the general journal entries to record the contribution of each partner. Goodwill method to be used to comply with partners' agreed capitalization computed based on Marlo's contribution and interest. b. Prepare a statement of financial position of Marlo and Bello immediately after the formation of the partnership at the end of September

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started