Question

5) Mr and Mrs Bruce, aged 65 and 55 respectively, have approached you regarding their investments. Mr Bruce currently has a pension income of 50,000

5) Mr and Mrs Bruce, aged 65 and 55 respectively, have approached you regarding their investments. Mr Bruce currently has a pension income of 50,000 per annum, and Mrs Bruce has Buy to Let income of 30,000.

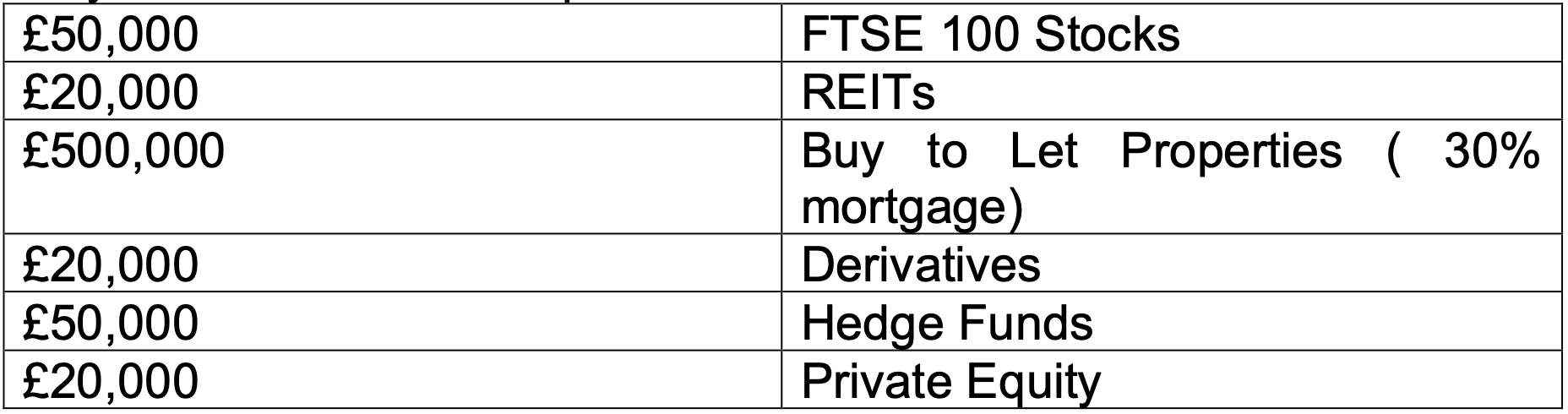

They have an investment portfolio as follows:

The portfolio is representative of their attitude to risk. All monies are currently held in Mr Bruces name apart from buy to let.

Mr Bruce has recently had a heart attack and is in poor health. They have made a will, and they have expressed their wish to reduce the tax and risk on their investments.

They wish to invest an additional 150,000, which they have recently received from a deceased relatives estate.

Given Mr and Mrs Bruces circumstance and attitude change to risk, explore the appropriateness of their range of investment activities and propose immediate financial actions that they should be considering.

(40 marks, approximately 1000-1250 words required). Please reference your writing if you're going to use sources. Thank you in advance for taking the time to answer my question.

50,000 20,000 500,000 FTSE 100 Stocks REITS Buy to Let Properties ( 30% mortgage) Derivatives Hedge Funds Private Equity 20,000 50,000 20,000 50,000 20,000 500,000 FTSE 100 Stocks REITS Buy to Let Properties ( 30% mortgage) Derivatives Hedge Funds Private Equity 20,000 50,000 20,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started