Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. Now assume that Mountain Springs recapitalized, borrowing $25 million, hence S = $131,471, D = $25,000, V = $156,471, P = $15.65, and

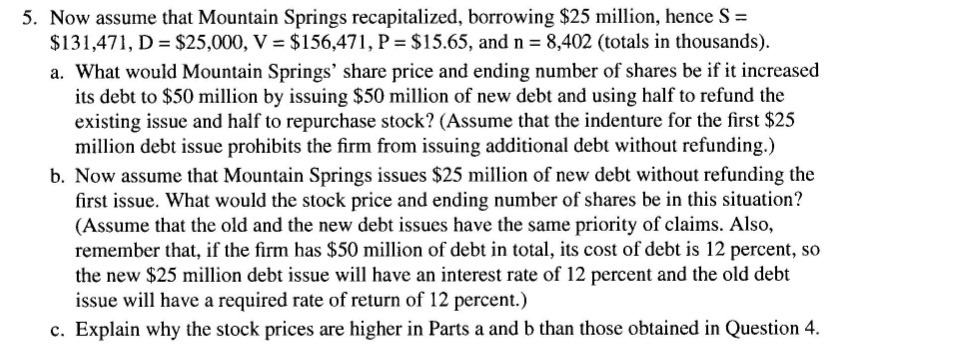

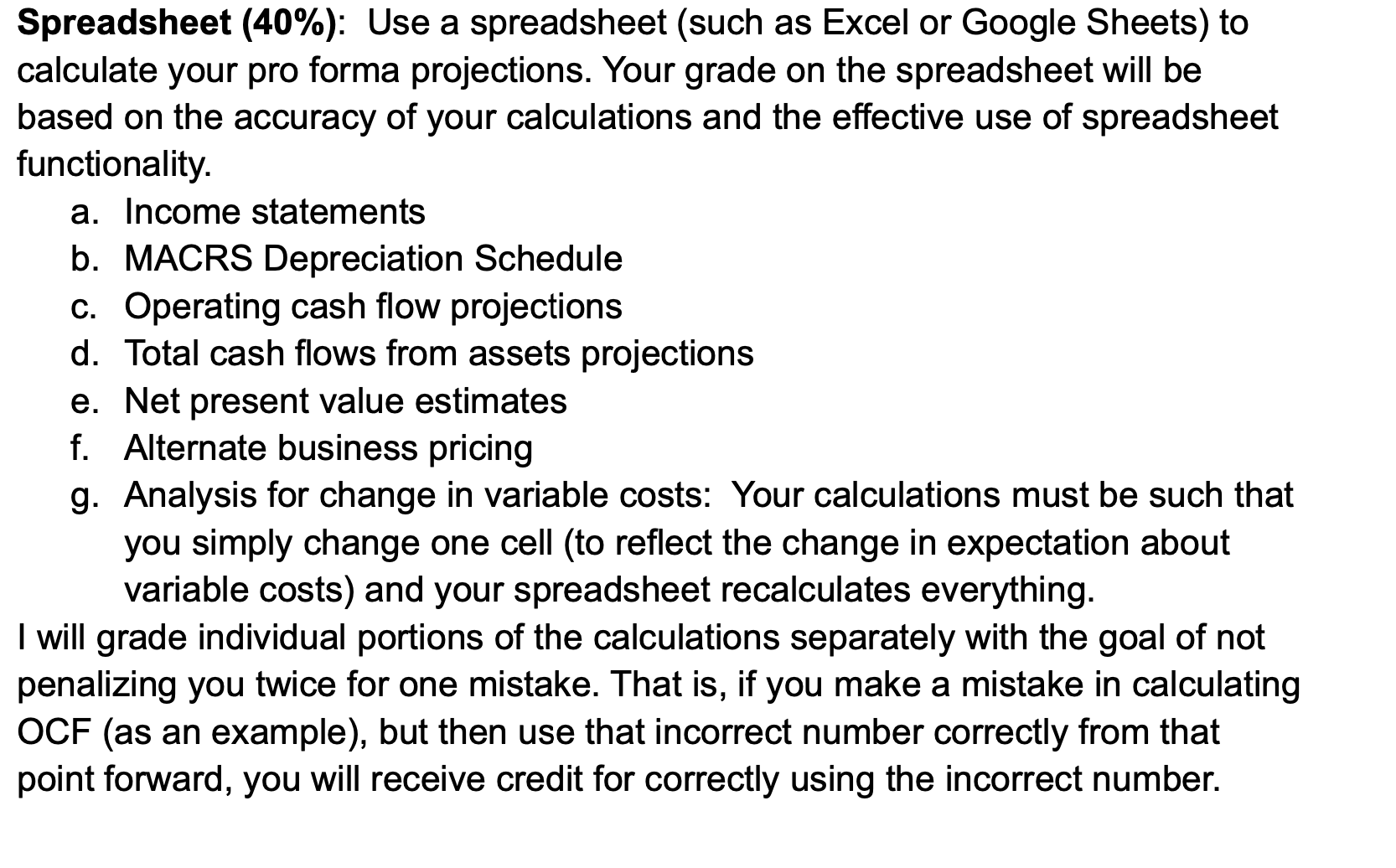

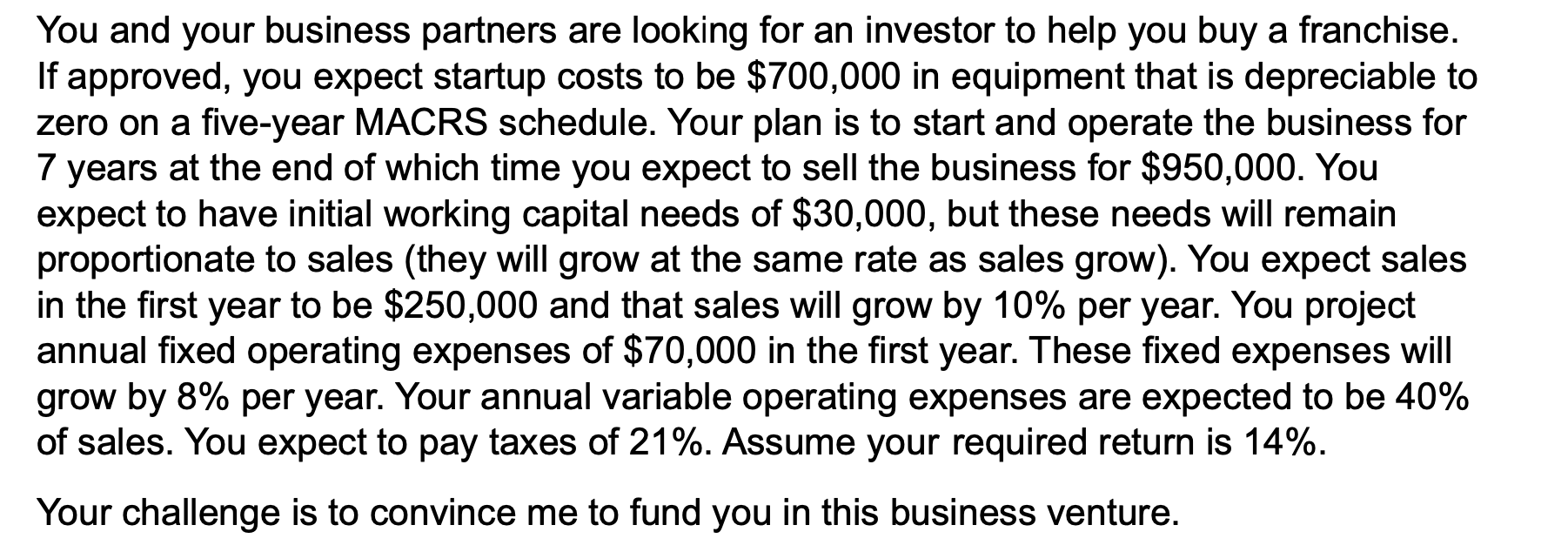

5. Now assume that Mountain Springs recapitalized, borrowing $25 million, hence S = $131,471, D = $25,000, V = $156,471, P = $15.65, and n = 8,402 (totals in thousands). a. What would Mountain Springs' share price and ending number of shares be if it increased its debt to $50 million by issuing $50 million of new debt and using half to refund the existing issue and half to repurchase stock? (Assume that the indenture for the first $25 million debt issue prohibits the firm from issuing additional debt without refunding.) b. Now assume that Mountain Springs issues $25 million of new debt without refunding the first issue. What would the stock price and ending number of shares be in this situation? (Assume that the old and the new debt issues have the same priority of claims. Also, remember that, if the firm has $50 million of debt in total, its cost of debt is 12 percent, so the new $25 million debt issue will have an interest rate of 12 percent and the old debt issue will have a required rate of return of 12 percent.) c. Explain why the stock prices are higher in Parts a and b than those obtained in Question 4. Spreadsheet (40%): Use a spreadsheet (such as Excel or Google Sheets) to calculate your pro forma projections. Your grade on the spreadsheet will be based on the accuracy of your calculations and the effective use of spreadsheet functionality. a. Income statements b. MACRS Depreciation Schedule c. Operating cash flow projections d. Total cash flows from assets projections e. Net present value estimates f. Alternate business pricing g. Analysis for change in variable costs: Your calculations must be such that you simply change one cell (to reflect the change in expectation about variable costs) and your spreadsheet recalculates everything. I will grade individual portions of the calculations separately with the goal of not penalizing you twice for one mistake. That is, if you make a mistake in calculating OCF (as an example), but then use that incorrect number correctly from that point forward, you will receive credit for correctly using the incorrect number. You and your business partners are looking for an investor to help you buy a franchise. If approved, you expect startup costs to be $700,000 in equipment that is depreciable to zero on a five-year MACRS schedule. Your plan is to start and operate the business for 7 years at the end of which time you expect to sell the business for $950,000. You expect to have initial working capital needs of $30,000, but these needs will remain proportionate to sales (they will grow at the same rate as sales grow). You expect sales in the first year to be $250,000 and that sales will grow by 10% per year. You project annual fixed operating expenses of $70,000 in the first year. These fixed expenses will grow by 8% per year. Your annual variable operating expenses are expected to be 40% of sales. You expect to pay taxes of 21%. Assume your required return is 14%. Your challenge is to convince me to fund you in this business venture.

Step by Step Solution

★★★★★

3.48 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Answer a What would Mountain Springs share price and ending number of shares be if it increased its debt to 50 million by issuing 50 million of new debt and using half to refund the existing issue and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started