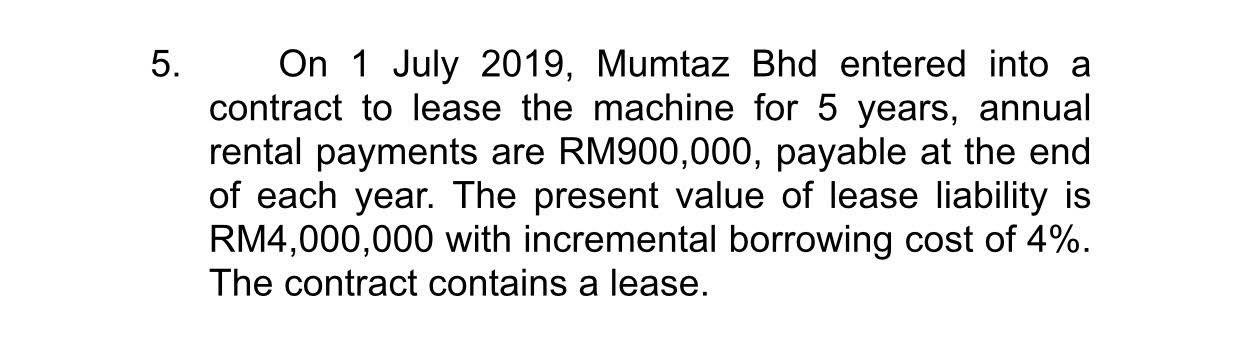

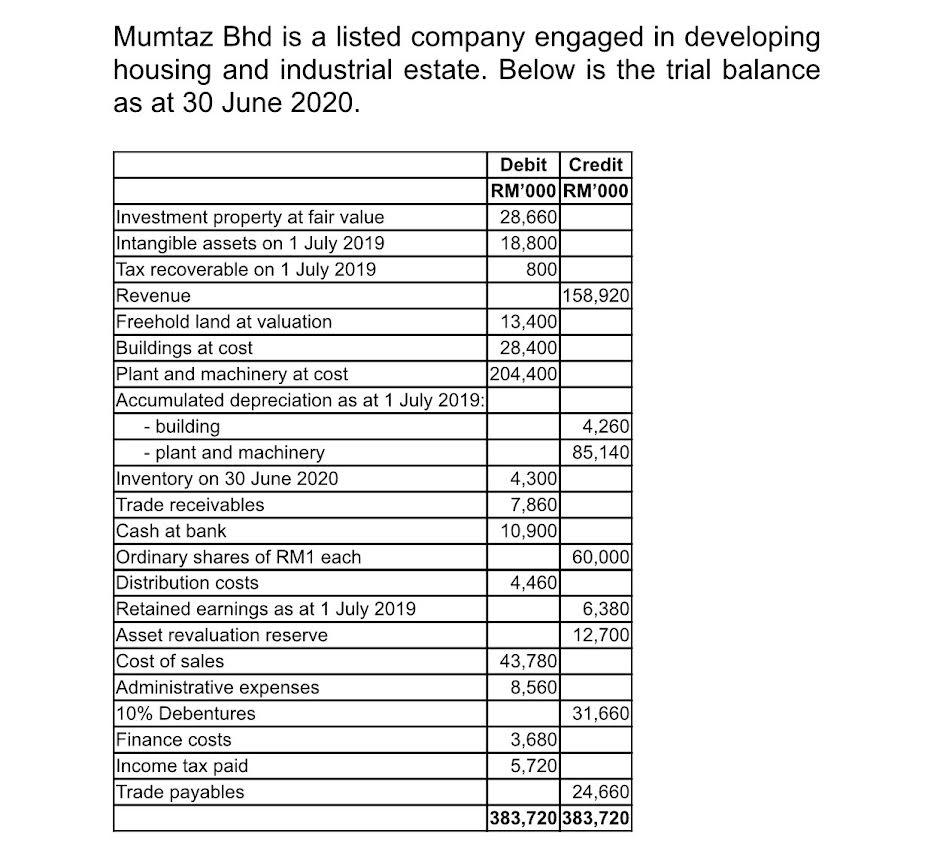

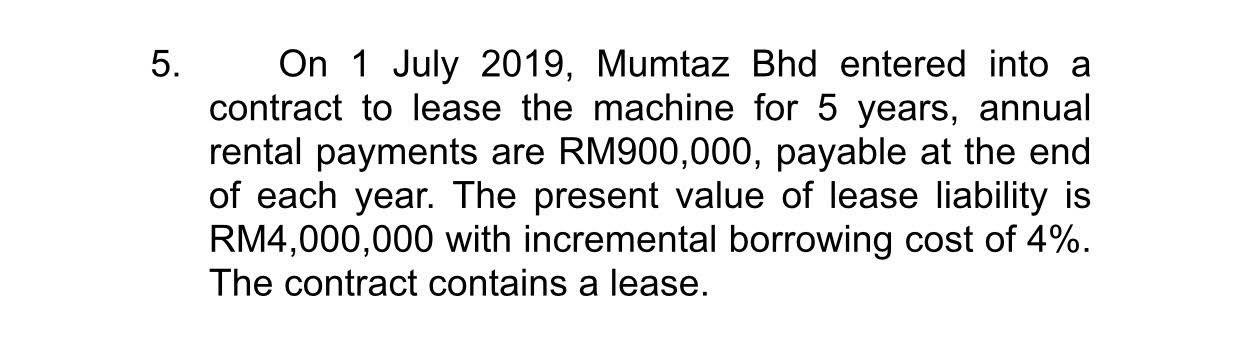

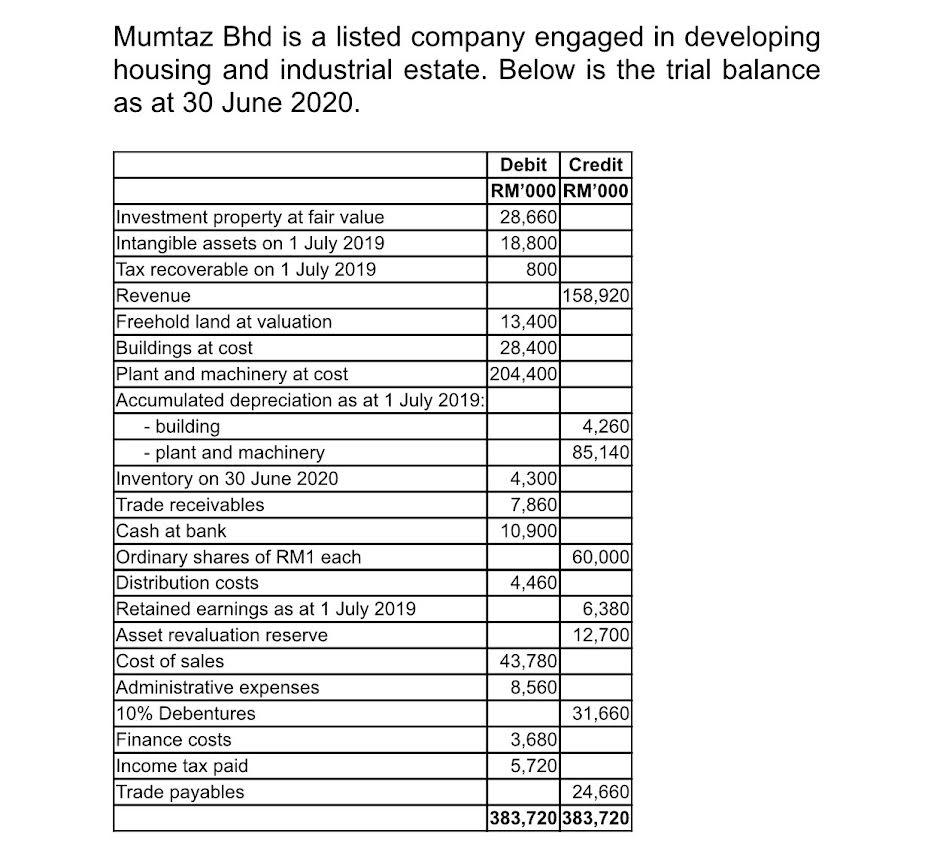

5. On 1 July 2019, Mumtaz Bhd entered into a contract to lease the machine for 5 years, annual rental payments are RM900,000, payable at the end of each year. The present value of lease liability is RM4,000,000 with incremental borrowing cost of 4%. The contract contains a lease. Mumtaz Bhd is a listed company engaged in developing housing and industrial estate. Below is the trial balance as at 30 June 2020. Debit Credit RM'000 RM'000 Investment property at fair value 28,660 Intangible assets on 1 July 2019 18,800 Tax recoverable on 1 July 2019 800 Revenue 158,920 Freehold land at valuation 13,400 Buildings at cost 28,400 Plant and machinery at cost 204,400 Accumulated depreciation as at 1 July 2019: - building 4,260 - plant and machinery 85,140 Inventory on 30 June 2020 4,3001 Trade receivables 7,860 Cash at bank 10,900 Ordinary shares of RM1 each 60,000 Distribution costs 4,460 Retained earnings as at 1 July 2019 6,380 Asset revaluation reserve 12,700 Cost of sales 43,780 Administrative expenses 8,560 10% Debentures 31,660 Finance costs 3,680 Income tax paid 5,720 Trade payables 24,660 383,720 383,720 5. On 1 July 2019, Mumtaz Bhd entered into a contract to lease the machine for 5 years, annual rental payments are RM900,000, payable at the end of each year. The present value of lease liability is RM4,000,000 with incremental borrowing cost of 4%. The contract contains a lease. Mumtaz Bhd is a listed company engaged in developing housing and industrial estate. Below is the trial balance as at 30 June 2020. Debit Credit RM'000 RM'000 Investment property at fair value 28,660 Intangible assets on 1 July 2019 18,800 Tax recoverable on 1 July 2019 800 Revenue 158,920 Freehold land at valuation 13,400 Buildings at cost 28,400 Plant and machinery at cost 204,400 Accumulated depreciation as at 1 July 2019: - building 4,260 - plant and machinery 85,140 Inventory on 30 June 2020 4,3001 Trade receivables 7,860 Cash at bank 10,900 Ordinary shares of RM1 each 60,000 Distribution costs 4,460 Retained earnings as at 1 July 2019 6,380 Asset revaluation reserve 12,700 Cost of sales 43,780 Administrative expenses 8,560 10% Debentures 31,660 Finance costs 3,680 Income tax paid 5,720 Trade payables 24,660 383,720 383,720