Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. On 6/30/20, at 7AM, Firm Green and Firm Red announced a merger agreement. The merger was expected to be completed by June 2021.

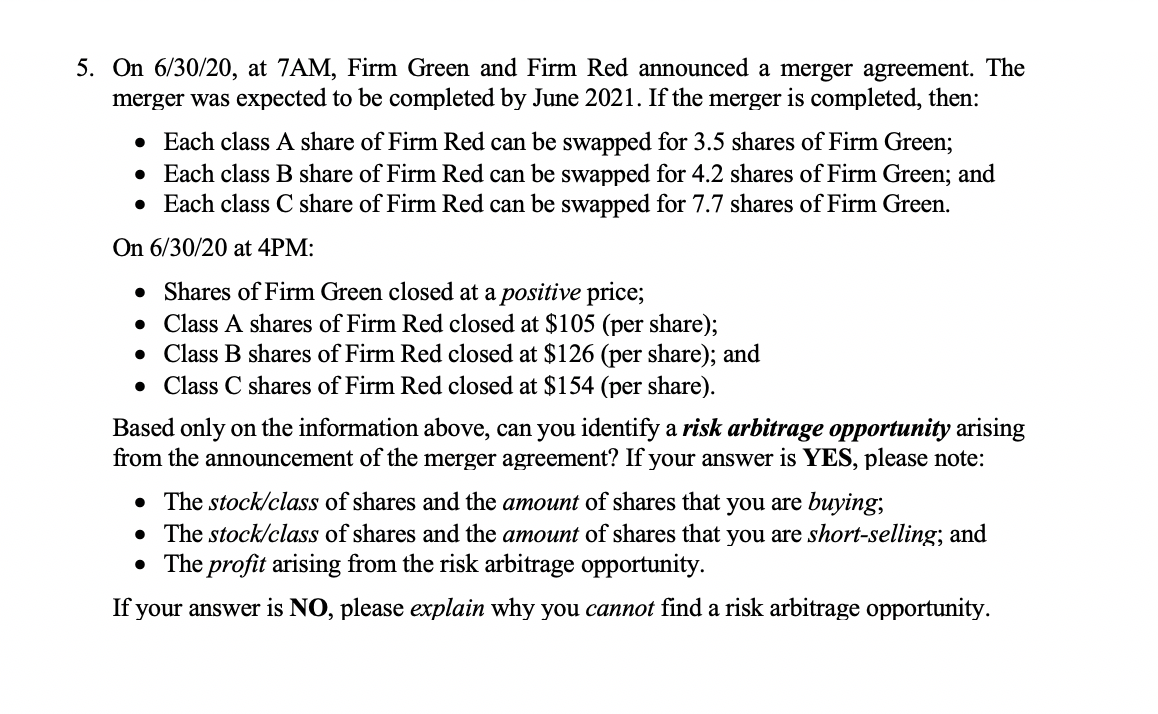

5. On 6/30/20, at 7AM, Firm Green and Firm Red announced a merger agreement. The merger was expected to be completed by June 2021. If the merger is completed, then: Each class A share of Firm Red can be swapped for 3.5 shares of Firm Green; Each class B share of Firm Red can be swapped for 4.2 shares of Firm Green; and Each class C share of Firm Red can be swapped for 7.7 shares of Firm Green. On 6/30/20 at 4PM: Shares of Firm Green closed at a positive price; Class A shares of Firm Red closed at $105 (per share); Class B shares of Firm Red closed at $126 (per share); and Class C shares of Firm Red closed at $154 (per share). Based only on the information above, can you identify a risk arbitrage opportunity arising from the announcement of the merger agreement? If your answer is YES, please note: The stock/class of shares and the amount of shares that you are buying; The stock/class of shares and the amount of shares that you are short-selling; and The profit arising from the risk arbitrage opportunity. If your answer is NO, please explain why you cannot find a risk arbitrage opportunity.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Yes there is a potential risk arbitrage opportunity based on the information provided Arbitrage stra...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started