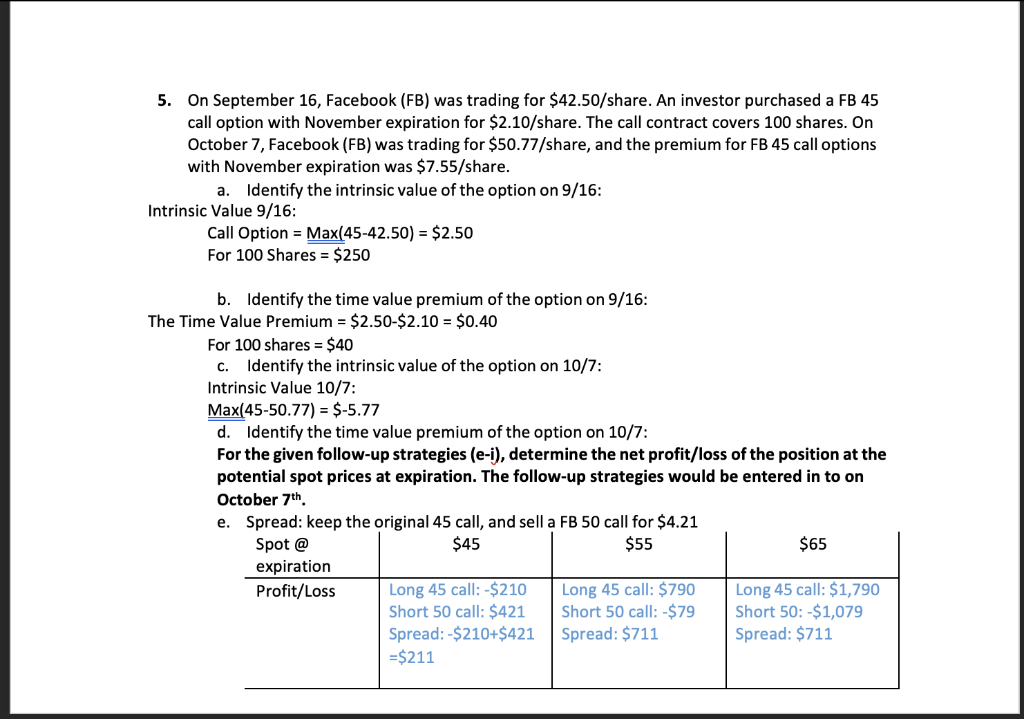

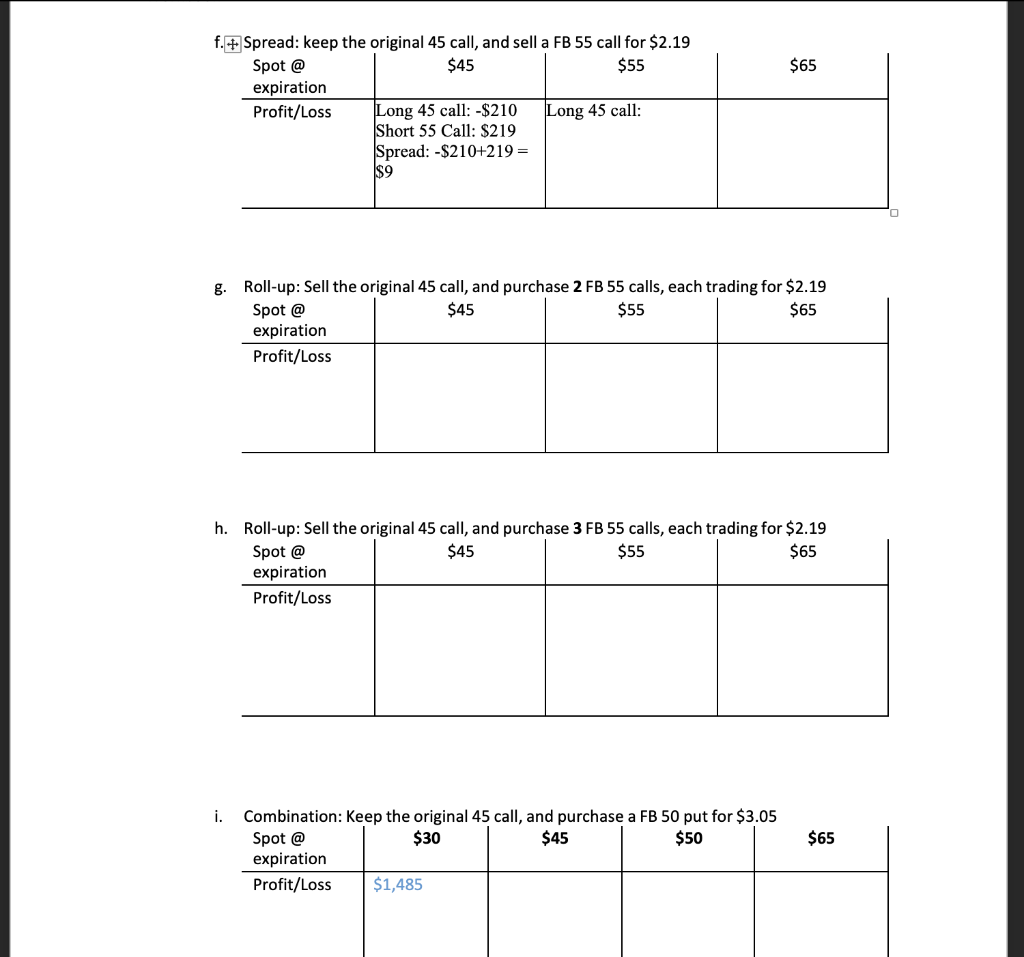

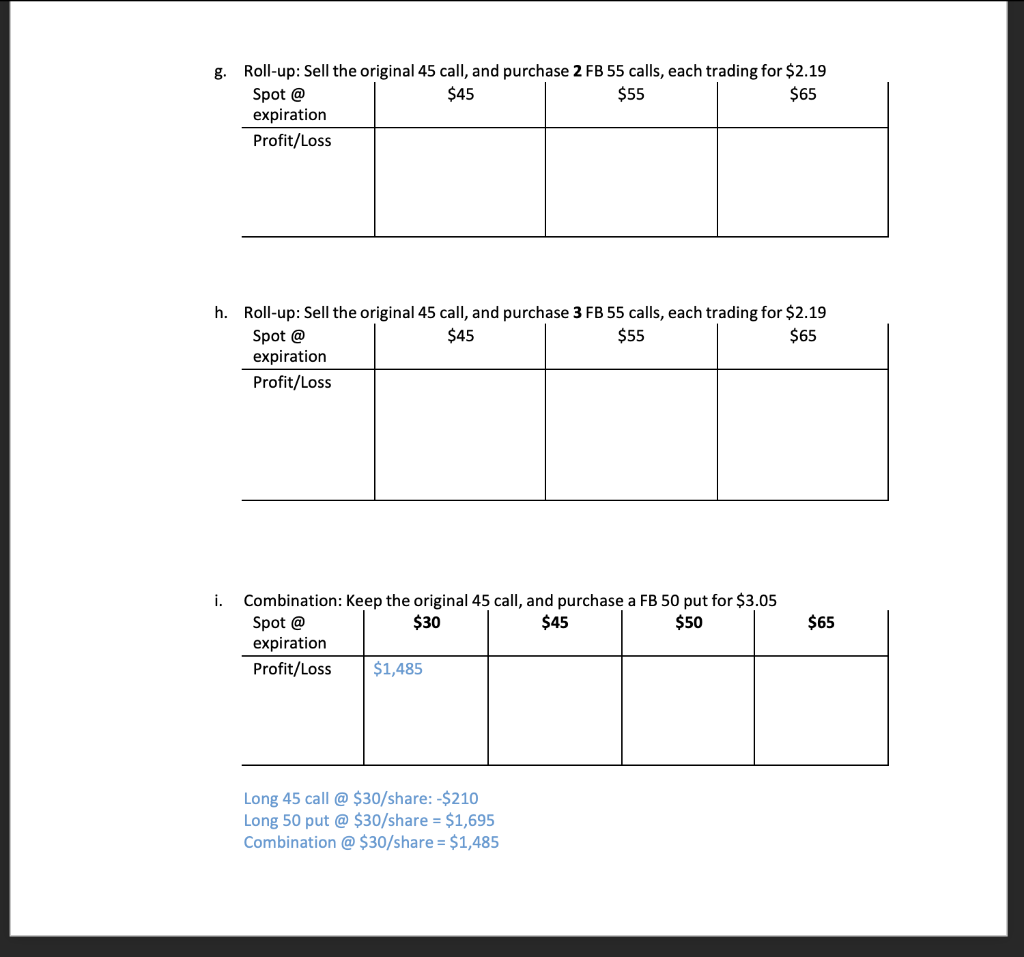

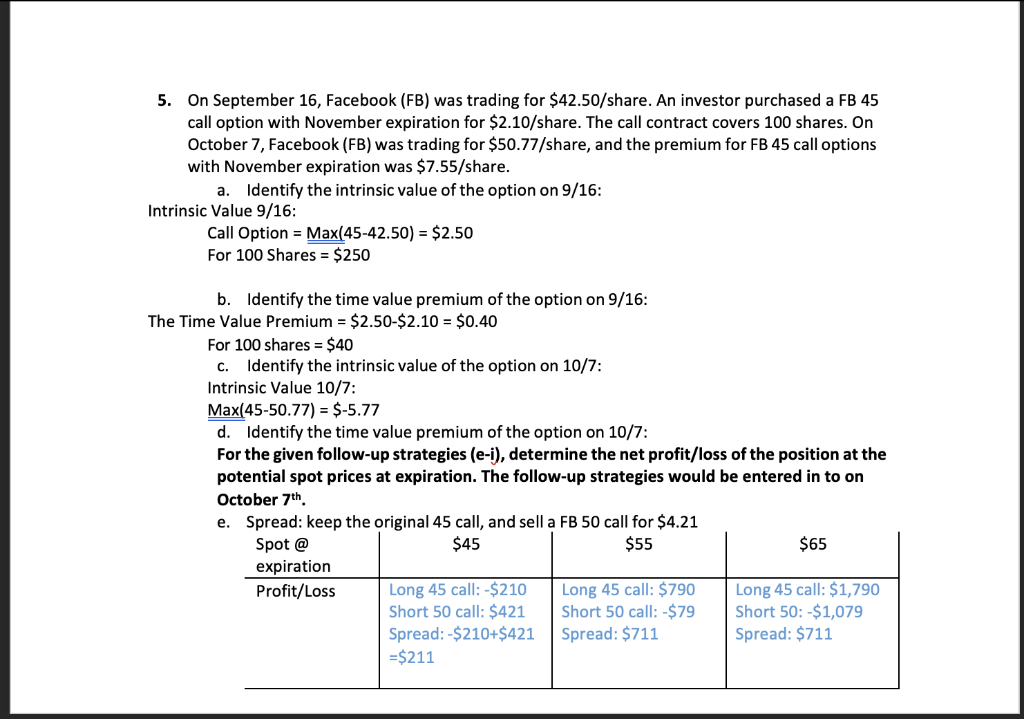

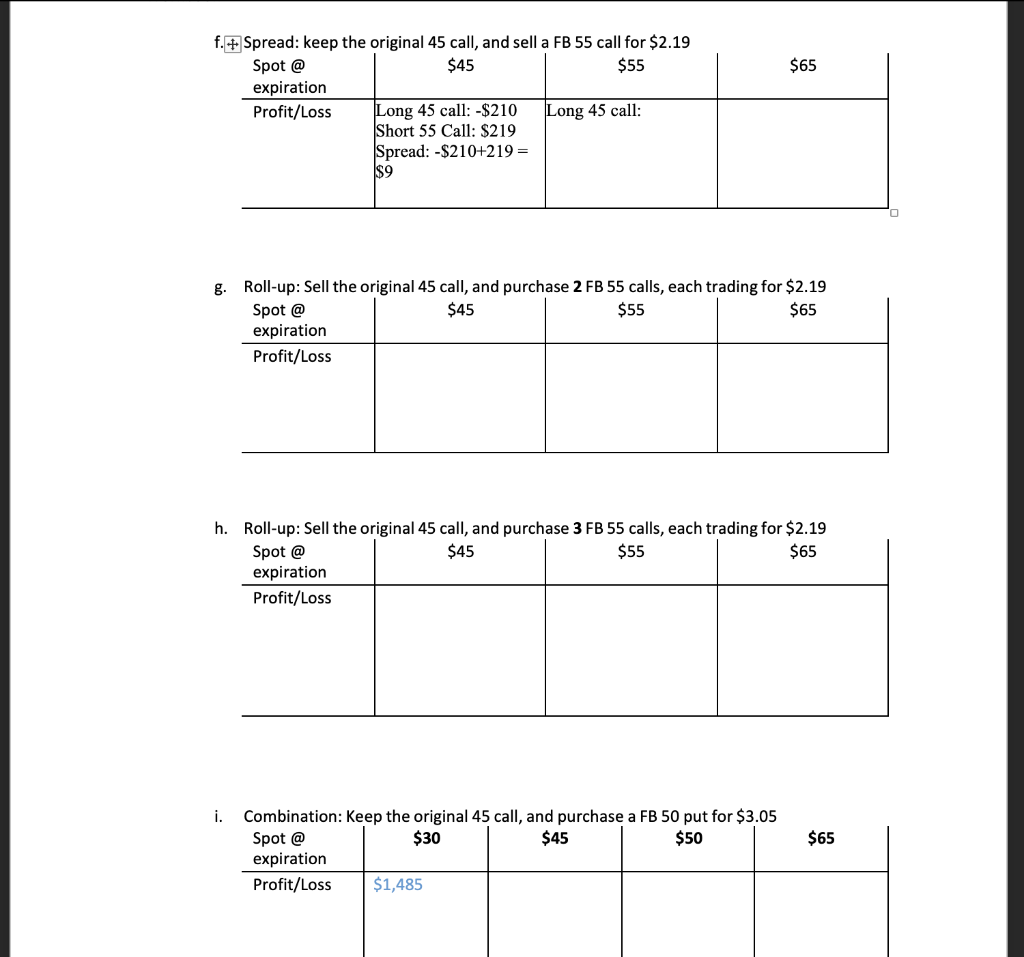

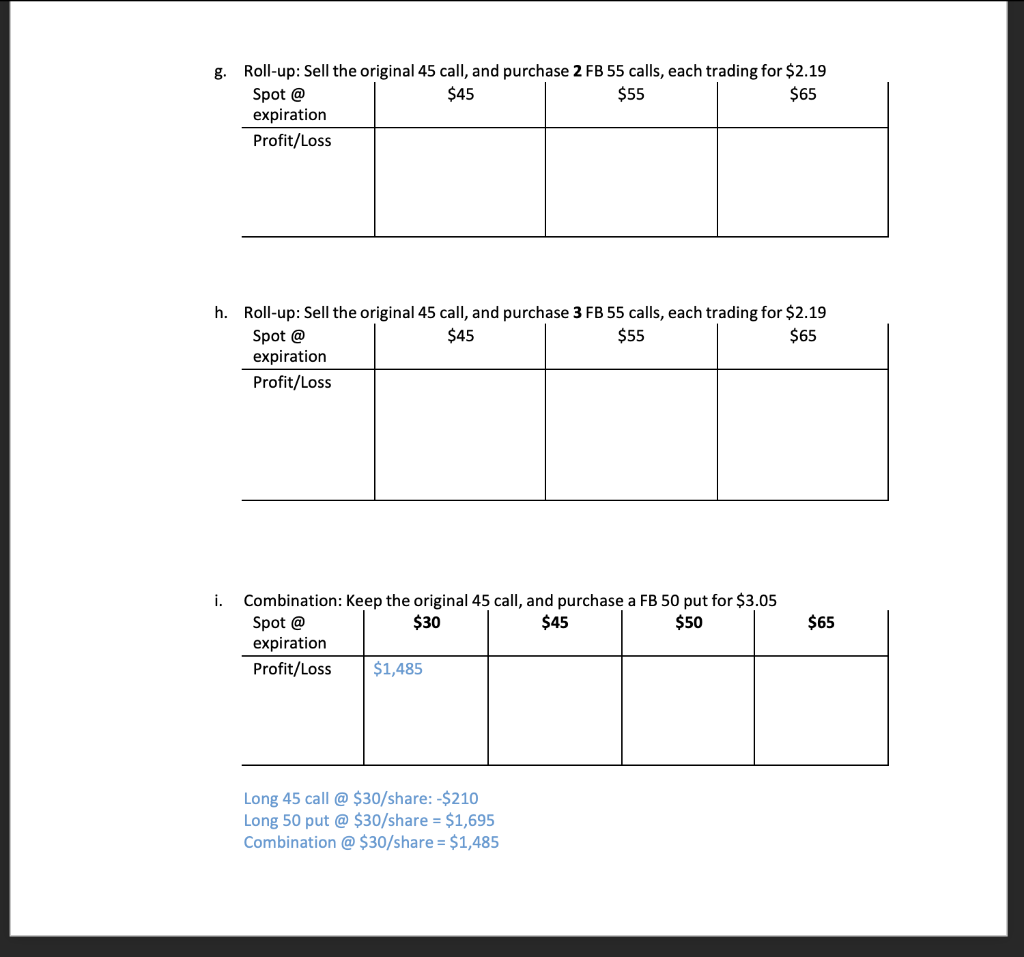

5. On September 16, Facebook (FB) was trading for $42.50/share. An investor purchased a FB 45 call option with November expiration for $2.10/share. The call contract covers 100 shares. On October 7, Facebook (FB) was trading for $50.77/share, and the premium for FB 45 call options with November expiration was $7.55/share. a. Identify the intrinsic value of the option on 9/16: Intrinsic Value 9/16: Call Option = Max(45-42.50) = $2.50 For 100 Shares = $250 b. Identify the time value premium of the option on 9/16: The Time Value Premium = $2.50-$2.10 = $0.40 For 100 shares = $40 C. Identify the intrinsic value of the option on 10/7: Intrinsic Value 10/7: Max(45-50.77) = $-5.77 d. Identify the time value premium of the option on 10/7: For the given follow-up strategies (e-i), determine the net profit/loss of the position at the potential spot prices at expiration. The follow-up strategies would be entered in to on October 7th e. Spread: keep the original 45 call, and sell a FB 50 call for $4.21 Spot @ $45 $55 $65 expiration Profit/Loss Long 45 call: -$210 Long 45 call: $790 Long 45 call: $1,790 Short 50 call: $421 Short 50 call: -$79 Short 50:-$1,079 Spread:-$210+$421 Spread: $711 Spread: $711 =$211 $45 $65 f. + Spread: keep the original 45 call, and sell a FB 55 call for $2.19 Spot @ $55 expiration Profit/Loss Long 45 call: -$210 Long 45 call: Short 55 Call: $219 Spread: -$210+219 = $9 g. Roll-up: Sell the original 45 call, and purchase 2 FB 55 calls, each trading for $2.19 Spot @ $45 $55 $65 expiration Profit/Loss h. Roll-up: Sell the original 45 call, and purchase 3 FB 55 calls, each trading for $2.19 Spot @ $45 $55 $65 expiration Profit/Loss i. $65 Combination: Keep the original 45 call, and purchase a FB 50 put for $3.05 Spot @ $30 $45 $50 expiration Profit/Loss $1,485 g. Roll-up: Sell the original 45 call, and purchase 2 FB 55 calls, each trading for $2.19 Spot @ $45 $55 $65 expiration Profit/Loss h. Roll-up: Sell the original 45 call, and purchase 3 FB 55 calls, each trading for $2.19 Spot @ $45 $55 $65 expiration Profit/Loss i. $65 Combination: Keep the original 45 call, and purchase a FB 50 put for $3.05 Spot @ $30 $45 $50 expiration Profit/Loss $1,485 Long 45 call @ $30/share: -$210 Long 50 put @ $30/share = $1,695 Combination @ $30/share = $1,485