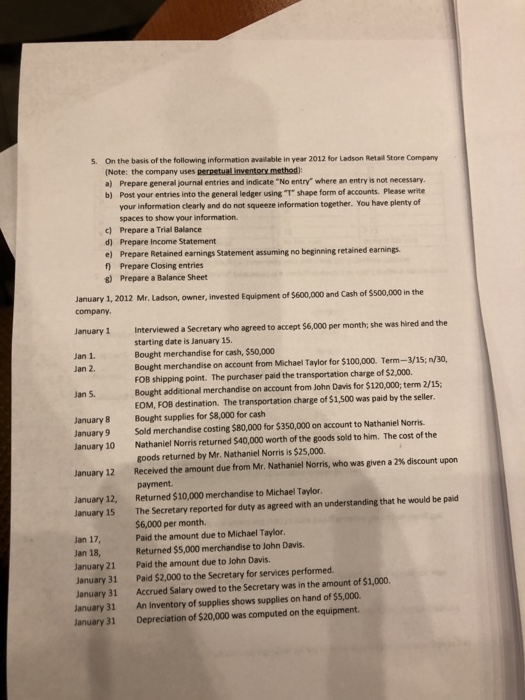

5. On the basis of the following information available in year 2012 for Ladson Retail Store Company (Note: the company uses pernstual inventory method) a) Prepare general journal entries and indicate "No entry" where an entry is not necessary b) Post your entries into the general ledger using "T" shape form of accounts. Please write your information clearly and do not squeeze information together. You have plenty of spaces to show your information. Prepare a Trial Balance c) d) Prepare Income Statement e) Prepare Retained earnings Statement assuming no beginning retained earnings f) Prepare Closing entries g) Prepare a Balance Sheet January 1, 2012 Mr. Ladson, owner, invested Equipment of $600,000 and Cash of $500,000 in the company January 1 Jan 1. Interviewed a Secretary who agreed to accept $6,000 per month; she was hired and the starting date is January 15 Bought merchandise for cash, $50,000 Bought merchandise on account from Michael Taylor for $100,000. Term-3/15; n/30, FOB shipping point. The purchaser paid the transportation charge of $2,000. Bought additional merchandise on account from John Davis for $120,000, term 2/15; EOM, FOB destination. The transportation charge of $1,500 was paid by the seller. Jan 2. Jan 5. January 8 Bought supplies for $8,000 for cash January 9 Sold merchandise costing $80,000 for $350,000 on account to Nathaniel Norris January 10 Nathaniel Norris returned $40,000 worth of the goods sold to him. The cost of the goods returned by Mr. Nathaniel Norris is $25,000. Received the amount due from Mr. Nathaniel Norris, who was given a 2% discount upon payment. Returned $10,000 merchandise to Michael Taylor. The Secretary reported for duty as agreed with an understanding that he would be paid $6,000 per month. Paid the amount due to Michael Taylor. Returned $5,000 merchandise to John Davis. Paid the amount due to John Davis Paid $2,000 to the Secretary for services performed. Accrued Salary owed to the Secretary was in the amount of $1,000. An Inventory of supplies shows supplies on hand of $5,000. Depreciation of $20,000 was computed on the equipment. January 12 January 12, January 15 Jan 17, Jan 18, January 21 January 31 January 31 January 31 January 31